By PV LEGAL

.jpg)

Greece

Despite its favorable conditions, Greece being one of the sunniest countries in Europe, the Greek market has so far failed to achieve its actual potential. The reasons for this slow take-off lie mainly in bureaucracy and a difficult financing environment, nevertheless, the situation could rapidly evolve positively.

.jpg)

Summary of Market Segments

Residential rooftop systems: The new legislation in place since mid-2010 has removed most of the barriers and the authorization process has been simplified. Though the residential segment is still relatively small, it is expected to grow dynamically as banks are now offering up to 100% financing for this sector.

Commercial rooftop systems: The market development of the commercial segment, which is still small, is expected to gain importance as most of the barriers have been lifted. Before the changes the authorization process was very time consuming, but has improved considerably with the exception of waiting time for the connection to the grid.

Ground-mounted systems: The same advantageous uplifting of barriers occurred for ground mounted segment. Simplified procedures, removal of requirements for special permission and production licenses for systems up to 1 MW will further help to develop this segment, although waiting times for getting an offer for connection to the grid should decrease considerably.

.jpg)

.jpg)

.jpg)

Results and Future Developments

Since the beginning of the PV LEGAL project, significant progress has been observed in Greece─in particular regarding the residential rooftop segment and larger systems up to a certain extent. In autumn 2010, a series of Ministerial Decisions helped simplify the authorization process. More specifically the progress includes:

-New applications for large PV systems are no longer frozen; they can now be filed to the Regulatory Authority for Energy.

-Production licenses are no longer needed for systems smaller than 1 MW.

-Rooftop systems of any size no longer require environmental permitting, while procedures have become easier for ground-mounted systems.

-Residential systems can now be installed in all regions (previous regulations excluded the autonomous island grids).

-Applications previously excluded (such as facades, louvers, warehouses, carports, etc.) are now feasible in the residential sector.

-Installation of PV systems on prime agricultural land is now allowed with certain limitations.

-A 150 €/kW bank guarantee is needed for ground-mounted systems up to 1 MW before the signing of a grid connection contract.

In April 2011, a new ministerial decision was adopted which further simplifies authorization procedures for PV systems. It clarifies issues related to permits needed by Urban Planning authorities. This new decision, however, has re-introduced further barriers for systems installed on historic buildings and heritage areas thus blocking installation of small rooftop systems in those cases. Since the end of 2010, following the positive changes introduced, there has been a new wave of applications, creating a grid-connection bottleneck. Getting an offer for grid-connection is now the major barrier for investors.

In addition, the difficult access to capital due to the financial crisis is currently constraining the development of PV. Although the situation has largely improved some barriers in the administrative and grid integration process remain to be lifted.

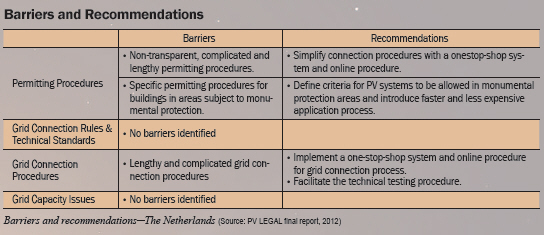

The Netherlands

Until today, the Dutch market has been developing moderately. The Feed-in Tariff scheme was cancelled for PV systems up to 15 kW at the end of 2010. Today, these small-size PV systems are being developed thanks to the net-metering scheme in place.

A FiT still exists for systems larger than 15 kW. In the Netherlands, so far only two segments have been present: residential rooftop systems and medium-sized PV systems on commercial and industrial buildings.

Ground-mounted systems are expected to develop as from 2012.

.jpg)

Summary of Market Segments

Residential rooftop systems: This is the most common application: the building permission procedure is relatively simple and often requires no permit. An exception is made for listed buildings in areas with protected city views, where a building permit is still required. No national quality system exists for PV systems, hindering further development of the market.

Commercial rooftop systems: Connection to the grid requires a series of procedural steps with different authorities. This results in unnecessary cost and extra waiting time.

Ground-mounted systems: The uncertainties regarding financial feasibility for ground-mounted projects, high legal and administrative barriers, in particular for building and grid connection procedures, make the development of the segment very difficult.

.jpg)

.jpg)

Results and Future Developments

Since the beginning of the PV LEGAL project there have been several changes in the Netherlands. The existing Feed-in tariff was changed in 2011 by the new government. The previous scheme was capped by an annual budget and caused serious legal/administrative barriers. The new scheme facilitates the development of large-scale systems (larger than 15 kW) and ground-mounted applications. Thanks to a net-metering scheme small-scale (up to 15 kW) systems can develop in the residential rooftop segment. In 2011, about 15 MW should be installed thanks to this new scheme, potentially increasing quickly in the years thereafter.

Regarding grid connection procedures, in 2010 some improvements regarding the technical specifications for grid connection across the country were achieved. The specifications are now the same for all regions. This progress has resulted in an improvement for PV investors and thus reduced costs and grid connection time.

At the end of 2011 more progress was made with regard to the certification of installers. A national quality assurance program for PV systems and installers is being set up for the beginning of 2012, made up of representatives from the government, the standardization body, the association of installers, and the national association for the solar energy industry.

A ‘Green Deal’ was signed beginning of October 2011 between the solar sector and the Dutch government aiming at the introduction of quality certification and better streamlining of the practical application of PV systems.

This agreement foresees simplifying procedures for the implementation of solar energy by citizens and businesses.

Through this agreement Holland Solar will work with the grid operators on:

-Making information more accessible.

-Working out the process of offsetting generated energy against own energy consumption (net-metering).

Part of the green deal also foresees the removal of bottlenecks in the authorization procedure for systems installed on listed buildings and for city areas with a protected view. Today’s procedure often causes complications for the applicants on a municipal level. The state government will work on a uniform directive for municipalities.

This open, closer collaboration between the sector association and the government should help to find adequate solutions fulfilling interests for both parties. These recent improvements are providing some hope for a future long-term development of PV in the Netherlands.

Poland

Currently there is no PV market in Poland apart from a few installations for demonstration purposes. The reason is that the support scheme through the green certificate system is still too low to attract PV investors.

.jpg)

Summary of Market Segments

The market for PV in Poland is relatively new. Therefore, only a few PV systems are installed on residential and commercial buildings. The ground-mounted segment is still emerging.

In general, the legal-administrative procedures in the three market segments are very similar thus often inappropriate to the system size. The connection procedure is very complex and non-transparent as the owner must deal with non-standardized requirements from DSOs. Another obstacle is the burdensome administrative process for the licence for renewable electricity production.

Additionally, the installation of PV systems is linked to very rigorous construction law. The production activities such as generating electricity are prohibited on residential buildings standing on areas of the local development plan and may hinder PV development further.

.jpg)

.jpg)

.jpg)

Results and Future Developments

The Polish market has not emerged yet. Nevertheless the potential is there. It is expected that with the adoption of the new RES act, support for PV could increase and a growing interest for PV on buildings and rooftops is starting to appear among policy makers.

In terms of legal administrative barriers, some improvements have been observed since the beginning of the project.

A very clear description of the application process for obtaining a license for the production of electricity from renewable energy system has been available since 2010 on the website of the Energy Regulation Office (URE). This information increases the transparency in the legal-administrative process. Lead times are expected to be reduced accordingly. A differentiated approach among large and smaller systems seems to be considered now by the URE.

Since December 2010 significant progress has been made regarding grid connection procedures:

-Deposit payments for the connection of RES systems to the grid have been introduced. A maximum amount for this deposit which can be requested by the grid operator has been defined (up to 30,000 PLN per MW). Such regulation should secure the investor from excessive level of advance and accelerate the process of grid connection. On the other hand, the necessity to obtain financial resources for the advance may constitute a great difficulty for the investor to accomplish the project.

-A copy of the Local Land Development Plan must be submitted to the grid operator together with the grid connection request. In case no such plan exists, the grid operator must be provided with a ‘decision for area development conditions’ by the local authority for the site where the PV system is to be installed (if such a decision is required on the basis of the law on spatial planning).

-Grid operators must publish the information on connected projects and available grid connection capacity on their website.

The latest discussions on a potential improvement of the market support to PV offers hope that a PV market in Poland can develop in the future. This support should be in all cases accompanied by streamlined administrative and grid connection processes if the market is to develop.

Italy

Italy has experienced an important development in recent years since the adoption of a favorable support framework. However, the level of Feed-in Tariffs (FiT) often indirectly finances the cost of complex and long administrative procedures. A real simplification and streamlining of procedures would allow the FiTs to finance the actual cost of the system.

.jpg)

Summary of Market Segments

Residential rooftop systems: For the residential sector, the authorization process is relatively simple, requiring the filling out of a Simplified Administrative Procedure (PAS) or, in some cases, a simple communication addressed to the Municipality.

Commercial rooftop systems: The IVth Conto Energia provides important simplifications for the segment, allowing the installation of systems up to 1 MW with a PAS. Regional differences still represent potential barriers at legal-administrative level.

On the other hand, the instability of the legal framework has negatively influenced the whole PV market sector, investors are more diffident while credit is more difficult to get.

Ground-mounted systems: The IVth Conto Energia introduced strong limitations for ground-mounted systems and set up a registry procedure with monetary hard cap to limit the installed power and the related expense. A significant reduction of this segment is foreseen in coming years.

.jpg)

.jpg)

.jpg)

Results and Future Developments

Since the beginning of the PV LEGAL project, some significant progress has been observed in Italy regarding administrative processes and connection of systems to the grid. In 2010, National Guidelines for Unique Authorization (“Autorizzazione Unica”: the centralised procedure for the authorisation of PV Systems) were published. In 2011, two decrees changed once more the reference framework introducing new norms that also affect the Guidelines, particularly concerning ground-mounted systems. In addition, the Gestore dei Servizi Energitici (GSE) is, since 2010, responsible for setting up an online process for Feed-in Tariff requests, which is today operational. Some problems have been reported, particularly with regard to the online application for the registration of ‘big systems’.

As regards grid connection permitting, several improvements have been observed:

A revised Unified Text for Active Connections (TICA) was also published in 2010, aiming at introducing swifter connection procedures. It provides for more transparency in the communications between the grid operators and project developers and introduces provisions concerning reduction of speculative connection requests. However it has created another concern over the payment of guarantees for systems falling into ‘critical areas’ or ‘critical lines’.This point and the relevant articles of the TICA are suspended and new solutions are being proposed by the Authority (AEEG).

Italy is currently experiencing significant market growth rates. There is a risk that new hurdles will slow PV’s development; financial support should be adapted to regulate the overflow of new projects. The definition of a National Energy Strategy and of a National Energy Plan is urgent and necessary to define new targets for RES on the longer term.

The stabilization of the photovoltaic legal-administrative framework is fundamental for any future development.

The PV LEGAL project (http://www.pvlegal.eu/), funded by the European Commission’s Intelligent Energy Europe program, aims at reducing bureaucratic barriers holding back the development of Photovoltaic (PV) energy installations throughout Europe. It gathers a group of 13 national PV industry associations together with the European Photovoltaic Industry Association (EPIA) and the Management Consultants eclareon.

Partners include BSW-Solar (German Solar Industry Association: Coordinator), ASIF(Spanish Photovoltaic Industry Association), Assosolare (Italian Photovoltaic Industry Association), ENERPLAN (French Solar professional association), HELAPCO (Hellenic Association of Photovoltaic Companies), PTPV (Polish Society for Photovoltaics), MPC (Micropower Council, United Kingdom), SER (French Renewable Energy Industry Association), ZSFI (Slovenian Photovoltaic Industry Association), EPIA (European Photovoltaic Industry Association), eclareon Management Consultants.

Collaborating organizations are Holland Solar (Dutch Solar Industry Association), CZREA (Czech Renewable Energy Agency), APESF (Portuguese Photovoltaic Industry Association), BPVA (Bulgarian Photovoltaic Association).

For more information, please send your e-mails to pved@infothe.com.

ⓒ2011 www.interpv.net All rights reserved. |