Reported by Jeanny H. Lim (swied@infothe.com)

.jpg)

To help our readers understand you better, please give us a brief account on how OSUNG LST entered the solar photovoltaic business. To help our readers understand you better, please give us a brief account on how OSUNG LST entered the solar photovoltaic business.

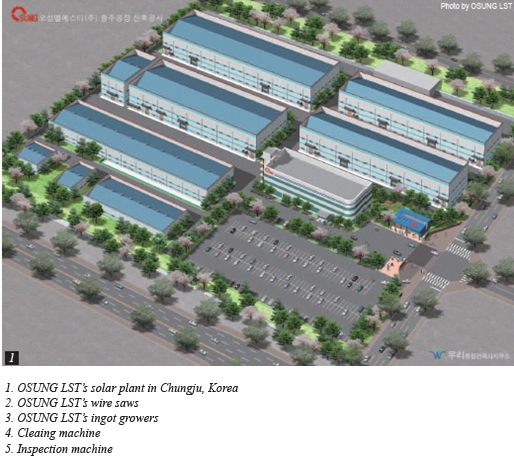

After selling our subsidiary ACE Digitec in 2007, we searched for a new business item to grow our company, and renewable energy came up on our radar. Among many renewable energy sectors, we chose photovoltaics because OSUNG LST is specialized in designing and manufacturing semiconductor equipment and we thought this experience and know-how could help us gain price competitiveness in the highly competitive photovoltaic marketplace.

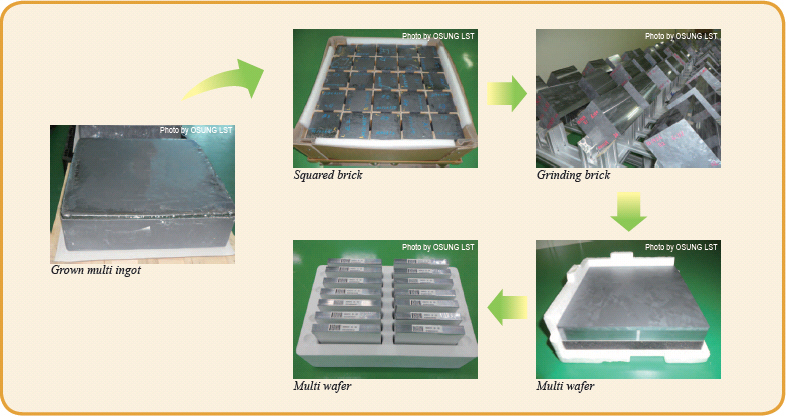

OSUNG LST currently has three businesses: solar, equipment and materials. The solar division produces ingots and wafers. The equipment division manufactures semiconductor and solar equipment. The material division offers back sheets, which gives us a footing in the module market for our future module business. The three businesses are closely linked and generating synergy for our journey to the top of the solar market.

Could you tell us some of the competitive edges that differentiate you from your competitors in the solar market?

In the photovoltaic market, OSUNG LST provides ingots, wafers and manufacturing equipment. OSUNG LST has more than 20 years of experience in developing semiconductor and LCD manufacturing equipment and has sound know-how in localizing the equipment. OSUNG LST’s ingot and wafer manufacturing equipment is particularly optimized for mass-production. It can outperform that of European makers and be provided at half the price of the European equipment.

After establishing HK Silicon, we began to produce polysilicon for ingots and wafers, and successfully completed vertical integration of the value chain. Thanks to this vertical integration, we, now, can secure stable supply of polysilicon, which is key for an ingot and wafer producer, and be flexible to the changing market conditions, thus getting the upper hand in price battle.

Our Q1’11 operating income increased by nearly 600% over the same period last year and this is thanks to the growth of our solar business.

What will be the growth strategy of Osung LST in the solar market?

OSUNG LST will make further investment to produce not only multicrystalline wafers but also monocrystalline wafers and increase wafer production capacity to 1 GW.

We have 300 MW of production capacity for multicrystalline wafers now and plan to have production capacity of 200 MW for monocrystalline wafers in the second half of this year. So, by the end of this year, we will reach 500 MW of production capacity for wafers.

By 2013, we will reach the gigawatt-scale production capacity with 600 MW in multicrystalline wafers and 500 MW in monocrystalline wafers.

For that, our subsidiary HK Silicon will also invest in facility expansion to increase its production capacity from the current 3,500 MT per year to 12,000 MT by the first half of 2012, to 45,000 MT by the end of 2013.

We haven’t materialized it yet, but we are considering entering into the module business. Recently, we’ve acquired a company which is Korea’s largest producer of films for LCD equipment. If we use the technology to produce back sheets for solar, we believe we’ll have a strong vertically integrated business model.

We are aiming to become one of the top 10 players in the global photovoltaic industry and we will invest in facility expansion more aggressively and focus on localizing the relevant equipment.

.jpg)

How much growth do you expect for this year? What’s your production volume and sales target for your wafers this year?

If all goes as planned, we expect to grow by 500% this year and accomplish 250 billion KRW in revenues. By 2013 when we reach 1 GW production capacity, we estimate our revenues will be between 800 billion KRW and 1 trillion KRW.

How is your solar manufacturing equipment business shaping up?

With our know-how in building semiconductor manufacturing equipment for more than 20 years, we have been developing the two key equipment for solar manufacturing: growers and wire saws.

Currently, we are increasing the capacity of multicrystalline ingot growers. We’ve already exported the growers to a Taiwanese client and are ready to mass-produce them. When it comes to monocrystalline ingot growers, we thought that building the same equipment with the same technology as other companies’ would not give us any competitive edges, so we decided to build it with our own newly developed technology. The monocrystalline ingot growers we developed show 20% better performance than the existing ones on the market.

And the wire saw we developed has already been installed, and performs better and costs less than the existing equipment on the market.

Moreover, we are now localizing the equipment used at our polysilicon subsidiary HK Silicon, so we can save half the cost of expanding the polysilicon plant. With foreign equipment, it costs about 100 million KRW per ton to build a polysilicon plant, but with our own equipment, it costs 50% less, meaning we can build a polysilicon plant at 50 million KRW per ton.

As a company headquartered in Korea, what are your expectations for the development of the PV market in Korea in the coming year?

The Korean government has set a goal of increasing renewable energy export to 15% by 2015 and put in place a variety of support programs. We believe the Korean photovoltaic industry will continue to grow and the scale will reach competitive levels.

What about your company’s strategy outside Korea? Is it different than in Korea?

We have marketing programs tailored for the global photovoltaic market. Our target markets are Taiwan, Japan, India and the U.S.A. We are executing direct business models in those markets with different products for different markets.

Jeanny H. Lim is Editor-in-Chief of InterPV. Send your comments to swied@infothe.com.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2011 www.interpv.net All rights reserved. |