By Jack Calderon, Chaim Lubin

.jpg)

Photovoltaic installations more than doubled last year reaching above 15 GW globally and many solar companies saw revenue, profit, and subsequently, stock prices increase as a result. With the credit market returning, companies are looking to access capital to build projects, increase capacity and make acquisitions that will build stronger platforms for future success. As a result, Merger and Acquisition (M&A) activity in the solar industry was higher than any year in recorded history and is showing no sign of slowing down.

There were 165 completed solar M&A transactions in 2010, a 37.5% increase as compared to the 120 recorded in 2009. This is nearly three times the total deals recorded in 2008 and more than 15 times the number of deals completed in 2005.

These significant increases in transaction activity continue to highlight the immaturity of the solar industry relative to other global markets. The high level of consolidations is something that most industries exhibit in their early stages, and considering the majority of the solar industry value chain is still highly fragmented, more consolidation is expected.

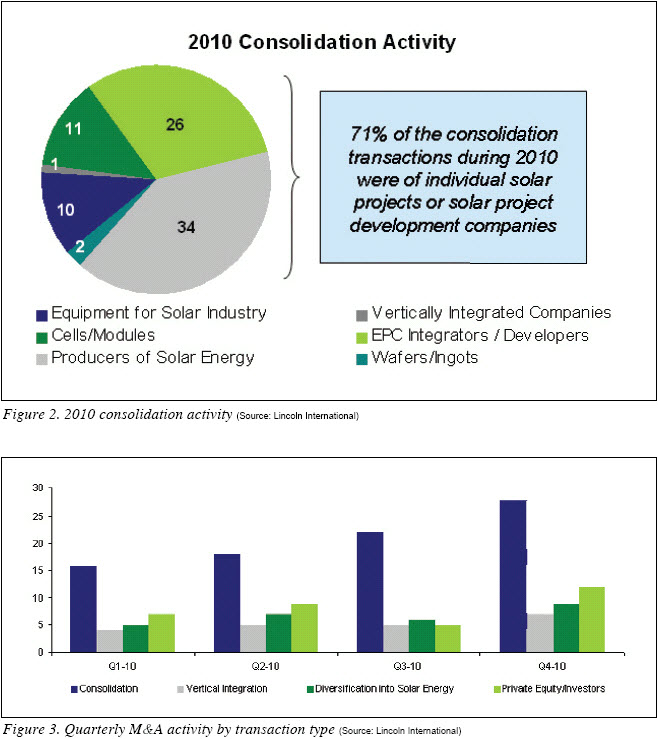

Consolidations Leading Transaction Rationale

The most significant area of transaction activity in 2010 was consolidation, with 84 deals completed or 51% of the total deal activity. The amount of consolidation is somewhat misleading as typically an industry experiencing this level of activity would start to see some contraction in the amount of fragmentation of companies in the value chain. However, consolidations have been mainly relegated to the end of the value chain with the acquisitions of solar projects and project developers representing 71% of all consolidation activity experienced during 2010. Much of the value chain, especially among cell/module and equipment companies, remains extremely fragmented.

In 2010, and especially during the last six months, the credit market has returned significantly. This has allowed private equity groups and other investors that rely on debt leverage to resurge and complete transactions. With 33 transactions completed during 2010, or 30% of the total, private equity and other investors accounted for the second largest amount of deals completed. This level of activity is a 27% increase over the 26 deals completed by private equity or other investors in 2009. Of those 33 transactions, 12 were completed during the last quarter of 2010. This trend could continue to gain momentum with more private investors looking to solar for opportunities as long as credit remains strong.

With 27 and 21 transactions during 2010 or 16% and 13% respectively, diversification into solar and vertical integration rounded out the yearly activity. While diversification into solar remained relatively flat as compared to the 26 transactions exhibited in 2009, vertical integration saw a significant 45% decrease from the 31 transactions of this type completed last year. It is possible that some companies are currently shying away from the vertically integrated model in order to focus on only core activities rather than remaining active in all areas of the value chain. This may be highlighted by the depressed earnings that some vertically integrated companies announced during the course of 2010. It remains unclear whether the vertically integrated model will be a path to success in the solar industry, but for the time being it seems to have slowed.

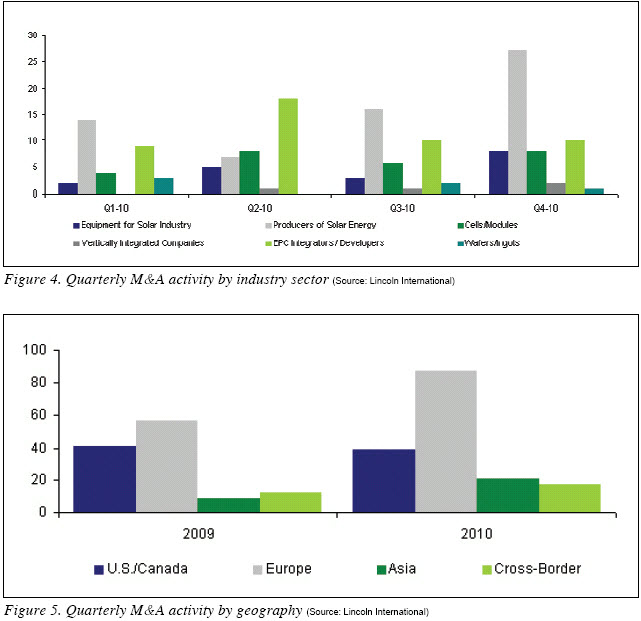

Heavy Transactions in Solar Project Sectors

The most active sectors in the solar industry for 2010 M&A activity were producers of solar energy and EPC integrators/developers. Most of the activity was driven by companies and investors looking to build project portfolios, as illustrated by the acquisition of more than 2 GW of solar power through M&A during 2010. This activity is expected to continue for the foreseeable future as many owners and developers are transferring ownership of solar projects once constructed. However, an interesting phenomenon is that less than 5% of the solar projects sold in 2010 were considered ‘cross border’ transactions, with the buyer and seller in different geographic regions. This highlights how sellers of solar projects are not optimizing their chances to sell projects at maximum valuations by accessing a global set of buyers. There exists a significant opportunity for owners of projects to maximize value through a truly global sale process.

It is important to note, however, that companies need to carefully execute these transactions, because in order to maximize the value received from the sale of a project, they need to be able to reach the global set of potential buyers. Without having relationships in multiple geographies, and, therefore, divergent risk profiles, a company might not find the party willing to pay a premium for a project. The valuations of projects will differ significantly by region as some companies may value entry into a new market far greater than those that already have a foothold, and vice versa. Recognizing this phenomenon will lead to further transaction activity on a global scale.

The next largest sector category of acquisitions was for companies categorized as cells/modules producers with 26 transactions, or 16% of the 2010 total. This is slightly ahead of the 23 transactions recorded in this sector during 2009. Similarly, solar equipment companies exhibited 18 transactions, or 8% of the 2010 total, which was also relatively flat compared to the 16 transactions exhibited in this sector during 2009. Given that PV installations more than doubled year over year from 2009 to 2010, it is not surprising that transaction activity in these sectors have not increased significantly. Companies have focused on meeting the significant demand for solar, resulting in fewer consolidations or other M&A transactions in these sectors.

Companies categorized as vertically integrated or wafers/ingots represented only 4 and 6 transactions, respectively. The activity in these sectors is lower due to varying technologies and different business models at the manufacturing level. This leads to more differentiation between firms and lowers desire for consolidation or integration. However, to the extent that companies have a proven technology or platform, they can garner significant value through a sale given the desire for entry into the solar market.

The Solar Industry Is Truly Global

M&A activity has been spread across various geographies with Europe continuing to remain the leader in transaction activity. In 2010, 87 transactions, or 53% of the total, were recorded coming from Europe, which was a 52% increase from the 57 recorded in the region a year ago. Germany and Italy were also large drivers of this activity given their more favorable tariff structures.

The U.S. and Canada saw only 39 deals completed, or 24% of the total in 2010. This is a slight decrease from the 41 transactions that were completed in this region in 2009. Asia exhibited the most significant increase from a transaction perspective with 21 deals completed or 13% of the 2010 total, which is more than double the nine transactions completed in this region a year ago.

Cross-border transactions increased slightly, with 18 transactions completed or 11% of the 2010 total, which is ahead of the 13 cross-border transactions completed in 2009. A significant untapped opportunity for cross-border transactions still exists, but it is necessary for companies to access a global network that facilitates the completion of such transactions. Companies need to be able to approach the appropriate contacts in multiple geographies while being cognizant of cultural biases and norms that can make or break the ability to complete a transaction. In order to maximize value for the sale of a business or to find the best acquisition target, having global reach is critical.

The transaction landscape of 2010 mirrored the overall positive dynamics in the solar industry exhibited during the year. Transactions in 2010 highlighted the focus in the solar industry to increase and consolidate project portfolios through acquisitions, a trend that is expected to continue. In addition, the return of credit has brought private equity and other investors back in the transaction mix, which is a positive sign that can further the solar industry’s rapid growth.

2011 Outlook for the Solar Industry

After a year like 2010, it is difficult to speculate what will occur in the solar industry during the course of the next year. It is unlikely that an industry would maintain the same growth that is currently doubling on itself. Many industry experts are already speculating some pullback in major markets like Germany and Italy due to governmental uncertainty on tariff structures. In addition, it is unclear when markets such as the U.S., China and India will begin to reach the PV installation quantities that are within their capabilities. With industry growth expected to level off, it is clear that the amount of fragmentation throughout the supply chain is not sustainable. This will eventually lead to a shakeout in the solar industry through both consolidation and companies being pushed out.

While we may still be more than a year away from these types of significant changes in the structure of the solar industry, we have reached an important milestone for all industry players. Companies, now more than ever, need to determine whether they have the market position and scale to grow organically or whether they need to access acquisition growth avenues. Without the appropriate resources, solar players may risk losing the attractive positioning they warrant today. As such, it is necessary to consider whether being acquired is the best alternative to access these resources and succeed in the changing market.

Jack Calderon is Managing Director at Lincoln International (www.lincolninternational.com) and co-heads the firm’s Renewable Energy Group.

Chaim Lubin is an associate at Lincoln International and a part of the Renewable Energy Group.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2011 www.interpv.net All rights reserved. |