By Dr. Stanislaw M. Pietruszko

.jpg)

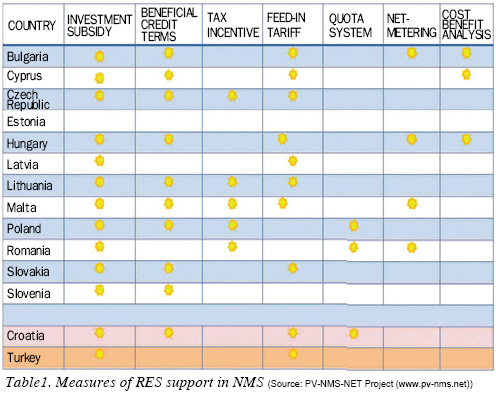

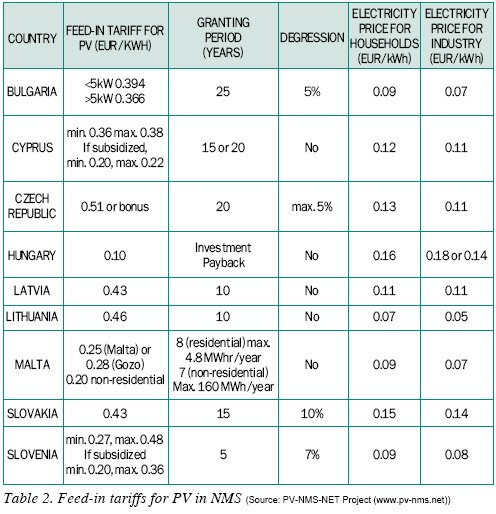

.jpg) As shown in Table 1, almost every NMS incentivizes the PV investment costs either with the investment subsidy or favorable loans conditions. Moreover, two thirds of the NMS introduced FiT to support the PV generation. As shown in Table 1, almost every NMS incentivizes the PV investment costs either with the investment subsidy or favorable loans conditions. Moreover, two thirds of the NMS introduced FiT to support the PV generation.

Estonia, however, did not assign any FiT for PV power whereas the FiT in Hungary occurred to be ineffective. Poland and Romania staked the most important part of PV support on quota system and associated to it--green certificates.

Multiple factors decide whether incentive is considered as well-designed. Not only should it be sufficient in size and scope, but also self-correcting and sustainable. Czech FiT is an example of ill-engineered incentives that got beyond control, overheating the market.

Bulgaria

PV investors in Bulgaria are eligible for investment subsidies, preferential loans and FiT. This last incentive is particularly interesting for PV producers. Every year (before the 31st of March) the State Energy and Water Regulatory Committee determines the FiT based on the following: The FiT rate is derived from 80% of the average electricity price in the previous year. A variable surcharge is added that cannot be less than 95% of the previous year’s level. That means the PV FiT could also increase as electricity prices have raised sharply in Bulgaria in the past years.

.jpg)

Contracts on PV are guaranteed for 25 years, which is more than the period of obligatory purchase for the electricity from almost all the other RES (only geothermal sources benefit from the same guarantee period).

Energy suppliers in Bulgaria must collect all of the energy that is fed into the grid by RES producers. Failure to comply with this obligation is subject to heavy fines up to 75,000.

Smaller systems (<5 MW) are connected to the low and medium voltage grids operated by small energy suppliers, who pay the corresponding FiT to the system operators. Bigger systems (>5 MW) are connected to the high voltage grid, provided they got approval of the National Electricity Company. Utilities have two weeks to respond to the motions tendered by investors willing to get a connection point to the grid. If it is accepted, connecting of such installation shall not last longer than 90 days. Any delay is subject to another fine of about 25,000. Bulgarian investors are well protected indeed. Even the grid extension cost is covered by the utility.

In November 2008, the duration of FiT payments was changed from 12 to 25 years. From April 1st, 2009, only systems of a maximum 10 MW capacity are eligible for FiT.

Apart from FiT, the Bulgarian PV sector is supported with preferential soft loans allocated by private banks.

Renewable and Alternative Energy Sources and Biofuels Act came into force in November 2008. Its main objective is to promote RES generation technology development and implementation. By virtue of this act, public national information system will be created, research and development in the field of RES will be supported mechanisms for promoting the production and use of clean energy will be introduced. Moreover, obligations and competences of executive authorities and local governments have been clearly described to allow efficient implementation of the state policy measures.

In Bulgaria, 20% of the project investment can be financed with financial resources from a reduced interest loan offered by the Bulgarian Energy Efficiency and Renewable Energy Credit.

Cypprus

The Grant Scheme for the Promotion of Energy Conservation and the use of Renewable Energy Sources is the core document regulating incentive mechanism in Cyprus.

Small systems (up to 20 kW) installed by households or non-profit organizations are eligible for the maximum of 65,000 of subsidy. For same installations managed by organizations engaged in economic activities, amount of 48,000 is the maximum. Investors who want to install systems with power greater than 20 kWp must obtain a permit from the Cyprus Energy Regulations Authority (CERA). If the installation’s capacity is greater than 150 kW no subsidy is allocated. Despite this, electric power can still be sold for a normal price and fed into the grid (price in 2009 was about 0.09 per kWh). Obviously, it is not enough for such investment to bring profits.

The application period for the existing RES grant scheme is 2009-2013. Adjustments to the Grant Scheme may occur on a yearly basis with relation to the current situation and available budget.

The feed-in tariffs are paid from a Special Fund for the promotion of RES and Energy Conservation and the Electricity Authority of Cyprus.

In Cyprus, the use of the electric energy produced in one’s own appliances is not profitable. In order to take full advantage of electricity generation, investors should feed it to the grid.

Czech Republic

PV investors in Czech Republic do not receive subsidies under the European Structural Funds nor within any national program any more. RES scheme of support was introduced in 2005 by the Act on Promotion of Use of Renewable Sources. Feed-in tariff has existed in Czech Republic since 2002. The new RES Act brought up another measure of support, a green bonus--extra payment on top of the market price. PV electric energy producers can choose between FiT and green bonus, both paid by the distribution system operator. The prices may not be lower than 95% of the value of the year before. According to debated regulations, however, by 1st January 2011, it will be possible to reduce FiT more than 5% (probably up to 40%). The Energy Regulatory Office determines the FiT and the green bonus rates every year. Digression may change on a yearly basis, too. FiT is guaranteed over 20-year period.

Green bonus scheme brings a bigger risk factor for the producer, as free market is unpredictable, and the green bonus rate can change substantially every year. This risk is compensated by higher potential revenues. In Czech Republic, no income tax is levied on the incomes from RES related activities for 5 years since the connection year plus the year in which the system has been connected.

Czech RES support mechanisms occurred to be so efficient that the market got overheated. However, since that situation was caused mostly by speculators, it may well be that Czech system of incentives was not well designed. In order to preserve PV sector’s sustainability, the law on FiT should be amended so that digression rate for FiT would slow the booming. FiT for 2009 has already been decreased by 5% in accordance to the maximum allowed by law. At the same time the Czech crown value went down. Even though, PV investment is still considered very profitable, especially for foreign investors. Compared to Germany, where FiT has been decreased by some 11%, Czech FiT is almost 40% higher. For these reasons, many foreign investors, especially from Germany and Spain started PV projects in 2009 in the Czech Republic. It is, therefore, expectable that the installed PV capacity in this country will exceed 1,000 MWp by the end of 2010, or even 1,500 MWp considered the previous year experience. From January 2011, only systems below 30 kW will be eligible for FiT.

Estonia

Nordic geographical location, not favorable radiation situation and lack of FiT for PV make Estonia not beneficial country for investors willing to start up PV energy production business. Currently, there are awareness raising activities in place aiming at Estonian governmental administration to understand the benefits of PV power generation and a need for FiT. This persuasion process, however, takes time before the outcome becomes tangible.

Hungary

Hungarian PV investors can benefit from subsidies, preferential loans and slender FiT. Moreover, net-metering is applied to about 60% of PV systems measuring the surplus of power production for households in Hungary. Net-metering system favors only the 2/3 of the entire volume of the electric energy that is consumed by the producers.

Subsidies for private investments are granted in the frame of National Energy-saving Program and does not exceed 35% of eligible cost (about 5,200). This program is coordinated by the Ministry of Transportation Telecommunication and Energy. Another PV relevant scheme is the Environment and Energy Operating Programme (coordinated by the Ministry of Environment and Water) from which up to 70% of investment expenses can be covered (max. 3.6 million). In 2009 only one PV project received the subsidy 106,000.

Small FiT rates change every year, but they are not profitable for the potential investors.

Latvia

Year 2009 is considered to be revolutionary when it comes to Latvian’s policy and approach towards solar energy. New regulations on RES were adopted in February 2009. Due to these laws, transmission grid operator is obliged to pay the FiT to PV electricity producers.

Purchase price of solar power is 0.427 /kWh and the payments will continue for the guarantee period of 20 years. The expenses of such procurement shall be covered by all electricity end users in Latvia in proportion to their electricity consumption by purchasing from the public trader a definite part of RES electricity, or by compensating the expenses of the public trader.

The licences for electricity production from RES (with 614 MWh quota for solar stations in 2010) were issued in December 2009 for two private companies. Quota system for electricity produced from RES exists already in Latvia. The new ‘Law on Renewable Energy Resources’ is currently under preparation.

Lithuania

Eventually, at the end of 2009, Lithuania introduced FiT for the electricity produced from PV. For the 10 year period, FiT for the PV plants smaller than 100 kW is 0.47 EUR/kWh, for the plants with the installed power in the range from 100 kW to 1 MW is 0.45 EUR/kWh, and for the larger than 1 MW installations--0.44 EUR/kWh.

These tariffs are much higher than the present electricity price for the consumers (about 0.13 EUR/kWh); therefore, FiT introduction has significantly contributed to the rise of the awareness of PV positive aspects both among the Lithuanian business representatives and the general public. The first licences for grid-connected PV facilities have already been issued.

Malta

Since November 2008, the Government of Malta through its own and EU funding has repeatedly issued grant schemes for the promotion of photovoltaics, besides the installation of systems on public roofs as to set example and introduce the technology to the population. There have been various schemes and government intends to keep on supporting such grant schemes. The initial two schemes of support for PV in Malta were oriented to roof-top residential installations and industrial installations. The former scheme is still being re-launched annually and oriented to residential buildings consisting of up to 50% grant coverage of the capital costs, but limited to 3,000. The latter scheme which has been concluded last year supported enterprises with also up to 50% grant on capital investment costs but addressed both energy efficiency and renewable sources projects of capital investment within 25,000 and 100,000.

Other schemes have been also launched in the meantime addressing the agricultural sector, and local councils. Other schemes may be in the pipeline for sectors not yet addressed. So far the promotion has been through the provision of a grant complemented by a feed-in tariff introduced on September of 2010. FiT for 2010 for residential domestic premises was 25 (Malta) or 28 (Gozo) cEUR/kWh, guaranteed for 8 years with max 4.8 MWhr/year. For non-residential & institutional premises: 20 cEUR/kWh, guaranteed for 7 years with max. 160 MWh/year. All systems would need to be registered with the local regulator, the Malta Resources Authority.

Poland

Lack of FiT for PV keeps Poland, the biggest country of the region, far behind its neighbors. Except from abovementioned FiT, PV investors in Poland are encouraged with several investment subsidies, Green Certificates, preferential loans and a tax waiver.

The National Fund for Environmental Protection and Water Management (NFOSiGW) with the Voivodeship Funds for Environmental Protection (WFO) are the major instruments of financing RES projects on the state-level. The National Fund grants come from its own budget and from external sources.

In 2005, Poland introduced a tradable green certificates mechanism in order to comply with obligations set in the Directive 2001/77/EC. Polish companies dealing with production, supply and sale of electricity have a duty to obtain and submit to termination a mandatory number of GC. Thus, there is a constant demand for these certificates on the energy market. The certificates represent property rights and as such are traded on the Polish Power Exchange.

Power plants, utilities and grid operators have to prove the RES origin of certain percentage of the electric energy they sell. This renewable sources portfolio imposes 10.4% by 2010, but there are no specific provisions for PV. This target, however, is unlikely to be achieved without revolutionary take-up on RES market in Poland. To render the system more flexible, there is a choice: Instead of purchasing a GC, it is possible to pay the replacement fee.

The strategic document ‘Energy Policy of Poland until 2030’ hardly mentions photovoltaics giving prospect of 2 MW in 2010 and 32 MW by 2030 of PV installed capacity.

Polish PV investors are eligible also for grants financed through the Green Investment Scheme (GIS).

The National Fund’s sources of income are fees paid for use of the environment for economic activity; penalties paid for violation of the ecological law.

The two major RES incentivizing European level funds are: the Cohesion Fund, European Regional Development Fund. The second one functions in form of Operational Programmes co-financed from EU and Polish budget. This is the most important source of RES investment financing in Poland, it is highly regrettable that PV is excluded from this support scheme. Only heat production from solar power is eligible for these grants.

Switzerland supports Poland with a total amount of 304 million over the five years from 2008 to 2012. These funds are part of the Swiss contribution to the ten states that joined the EU on 1st of May, 2004. Swiss contribution is likely to be a considerable source of funding for PV investments in Poland.

RES investments in Poland have been promoted through EEA and Norway grants, last financing period being 2004-2009.

Sixteen Provincial Funds for Environmental Protection and Water Management award soft-loans for small and medium PV investments. Only new plant construction projects submitted by legal entities or natural persons are eligible for the loan.

The Environment Protection Bank with the support of the National Fund for Environmental Protection and Water Management gives credits for the projects in line with one of the priority programs set by the Fund (max. granting period is 10 years). Unfortunately, PV is not mentioned as one of the prioritized electric power generation source.

The Environment Protection Bank with the support of the Provincial Funds for Environmental Protection and Water Management act locally, supporting regional investments with preferential loans. The Environment Protection Bank’s credit facilities can be utilized by entrepreneurs, local government units, and retail clients.

The same bank in cooperation with the National Property Bank (BGK) gives 5-year soft loan (usually at a half of the commercial rate), covering up to 25% of the investment cost on energy efficiency upgrading using RES. The form of preference apart from a lowered rate of interest in comparison to commercial credits is a chance to obtain a grace period in the repayment of the principal. During the first six months of the year 2008, more than 2,700 loans have been granted (total amount > 580 mio PLN), but none on PV. There are also some preferential loans from other commercial banks.

Polish scheme of state support for foreign and domestic investors includes initial investment support (material and non-material assets) and subsidy for, the parallel to this investment, jobs creation. Only investments within regions where GDP rate is lower than the average GDP in EU countries. Initial investment support consists on tax exemptions or governmental money grants.

Romania

Main axis of RES support policy in Romania is the Operational Programme ‘Competitiveness and Economic Growth’ supported from Structural and Cohesion funds. From all of the 5 main priorities of this program, the 4th is relevant for the purpose of this article. Called ‘Growth of energetic efficiency in the context of fighting against the climatic changes’ provides a few subsidies destined to foster RES investments. Within the 4th priority, there are three sub-domains, the second one being called ‘increase exploitation of RES,’ which refers to investments in the modernization and building of new plants to produce thermal and electrical energy from biomass, hydro power units (installed capacity <10 MW), solar, wind, geo-thermal resources and other renewables.

Small companies are eligible for subsidies covering up to 70% of the succumbed costs, medium size companies can get 60%, and large ones are offered the subsidy covering half of their eligible costs. The only exception to these payments are the investments realized within the capital city--Bucharest, where subsidies are slightly lower than anywhere else (60% instead of 70%, etc.). Up to 98% of costs can be covered if the investor represents local authorities.

The overall budget in 2008 was about 70 milllion, the minimum single subsidy was 100,000 and the maximum 150 million. There was a single project in the field of PV application approved for financing in 2009 (PV power plant of around 250 kWp owned by the Municipality of Alba Iulia).

The second call deadline was April 30, 2010 and the list of approved project will be announced by the end of 2010. VAT is not an eligible cost nor is a purchase of second-hand photovoltaic modules. Main obstacle is the inertia of evaluation team not able to examine all of the applications in due time.

In Romania, there is a mandatory quota system accompanied by Green Certificates (GC) system. In 2008, the mandatory quota of RES in national gross electricity consumption was 5.26%. In 2010, the quota is 8.3%. Over 2008-2014 period, the GC value will range between 27 and 55. In November, 2008 GC value reached 38.87 EUR/MWh. In December 2009, the value of GC was 55. The solar electricity producers get 4 Green Certificates for every MWh (more than for any other RES). Distributors who would fail to meet the quota are subject to a 70 fine per each missing GC.

Another incentive is the Romanian government’s guaranty for 50% of the total loan amount on long term. Investors benefit also from the income tax waiver in the first 3 years of RES plant operation. Favorable tax discount is provided for private investors producing more than 20% of their energy consumption from RES. In their case, the total annual income used for tax evaluation is reduced by 50% of the value of the RES system components. Net metering applies to less than 50% of PVs with installed power smaller than 1 MWp.

The producers are also not obliged to pay some fees for the unbalance of electrical parameters they induce in the electrical energy transport system if the peak power of the installation is lower than 250 kWp.

Existing system promoting RES is roots in the Law No 220/2008. New legislation act amending this legal background is under preparation.

Slovakia

Effective since 2009, generous FiT rates have been warmly welcomed by PV investors. FiT in Slovakia vary among the sources, PV payments are divided in dichotomous way. One is for systems whose capacities do not exceed 100 kW. The FiT for such installations is 0.43 EUR/kWh. The second group of beneficiaries are producers utilizing systems bigger than100 kW who get 0.425 EUR/kWh. FiT are guaranteed over 15-year period decreasing by the maximum of 10% each year. Nevertheless, there is one black cloud on this new PV-friendly horizon. In 2009, the Slovak Electricity Transmission System office introduced the limit of 120 MW for PV installations. As a consequence, all investors willing to install over 1 MW must register their projects in this office and only a few of them will be authorized.

Except from FiT, RES investment in Slovakia can be supported by the European Structural funds. Especially under the scheme 2.1. Increase of energy efficiency in production and consumption and setting up new progressive technologies in power engineering. Maximum support 6 million varies upon geographical region (max. 40-50% of the eligible costs in less developed regions--e.g., eastern and central part of Slovakia).

Subsidies are earmarked for private companies that do not employ more than 1,000 people and which yearly turnover does not exceed 49.8 million. Noteworthy, these subsidies are not available for projects in autonomous region--Bratislava.

Slovakia, just like in many other NMS, there is no PV specific investment subsidy although general RES support scheme exists. The background law of this scheme is the Act on Investment Support, focused on regional development and creation of new employment opportunities in general.

Slovenia

Slovenia already introduced the FiT as the main fiscal measure of RES support, with guaranteed minimum prices and premiums in 2001. From 2004, the tariffs for electricity from PV plants were adequately high, so the development of the sector started to grow fast and stable.

Following the request of the DG Competition, the FiT had to be reorganized according to the rules for state aids. As a result, new regulations entered into force bringing considerable changes for PV market stakeholders. First of all, the time of support has been prolonged from 10 to 15 years, the collection of the money for the FiT scheme has been changed from the fee to kWh consumption to lump sum on connection and the whole system is managed by an independent institution Centre for State Aids.

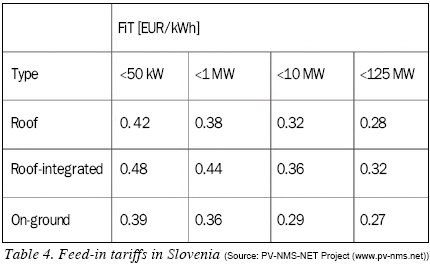

The Centre is obliged to purchase all the RES electricity and sell it on the market. For plants with nominal power of up to 5 MW, the producers have the choice to select between fixed purchase prices or fixed operating support. Above 5 MW, the producers have the right to get the operating support and have to sell the produced electricity on the market themselves. The tariffs are calculated for 15 year pay-back period divided in size classes: Up to 50 kW, 1 MW, 10 MW and 125 MW.

Investors benefiting from investment subsidy get lower guaranteed price or operational support. The actual rates of support PV plants entered in operation in 2009 or before in Slovenia are shown in the Table 4.

Subsidies for RES including PV are granted by the Ministry of Agriculture. Its regional fund is through Agency for Agricultural Markets and Regional Development (AKTRP), grants subsidies for RES, including PV. Such a subsidy amounts to 50% of the investment cost (without VAT). The investment must be implemented out of defined urbanized localities. Maximum investment of the plant is 480,000 and subsidy is limited to 200,000. The subsidy scheme applies for the period 2007-2013.

Apart from subsidies, PV investors can apply also for a preferential loan provided by The Environmental Fund of the Republic of Slovenia (Ekosklad). Ekosklad grants low-interest loans to RES projects covering up to 90% of investment expenses (2 million) at annual fixed nominal interest rate of 3.9% for individuals and 1% for companies. Loan has to be redeemed in 10 years. Eligible projects must be put forward by public or private legal entities or individual persons. In 2009, the PV plants represented the far biggest share of the loans given by this found. In 2009, also a few commercial banks started to open special loan lines for RES and especially for PV projects.

Main obstacle identified by the PV investors in Slovenia is the long average lead time for obtaining Support Scheme Contract, without this document investors cannot perceive FiT payments. Another diagnosed problem occurs while building bigger on-ground systems requiring a building permit. The FiT for on-ground systems is limited to first 5 MW installed plants yearly. Since 2009, Slovenia does not support RES with tax incentives any longer.

Dr. Stanislaw M. Pietruszko is the Head of the Centre for Photovoltaics at the Warsaw University of Technology and the President of the Polish Society for Photovoltaics. He is also Member of the Steering Committee of the European Photovoltaic Technology Platform. His 32-year scientific career in PV is focused on research on thin-film amorphous silicon solar cells and thin-film transistors, PV modules and systems. Dr. Pietruszko has published more than 150 scientific papers. He has a broad technological expertise which covers activities in communication, management and policy.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved.

|