By Jack Calderon, Chaim Lubin

The most significant change in the market in the third quarter of 2010 is the improvement of companies at the front of the solar industry value chain. In particular, companies providing the raw wafers and ingots used to produce solar panels have benefited from the increased demand and higher prices, directly benefiting their bottom line. The increased demand has trickled through the value chain further as solar cell and module companies are also exhibiting improved financial performance, and the market is recognizing them for it. In addition, the vertically integrated model (companies with capabilities crossing many sectors of the overall value chain) seems to be paying dividends, with these vertically integrated companies exhibiting higher margins on average than in any recent prior period. However, it seems that due to the longer lead times on completing solar projects, integrators and developers are still experiencing difficulties that have impeded their ability to capitalize on the improved market conditions. The most significant change in the market in the third quarter of 2010 is the improvement of companies at the front of the solar industry value chain. In particular, companies providing the raw wafers and ingots used to produce solar panels have benefited from the increased demand and higher prices, directly benefiting their bottom line. The increased demand has trickled through the value chain further as solar cell and module companies are also exhibiting improved financial performance, and the market is recognizing them for it. In addition, the vertically integrated model (companies with capabilities crossing many sectors of the overall value chain) seems to be paying dividends, with these vertically integrated companies exhibiting higher margins on average than in any recent prior period. However, it seems that due to the longer lead times on completing solar projects, integrators and developers are still experiencing difficulties that have impeded their ability to capitalize on the improved market conditions.

.jpg)

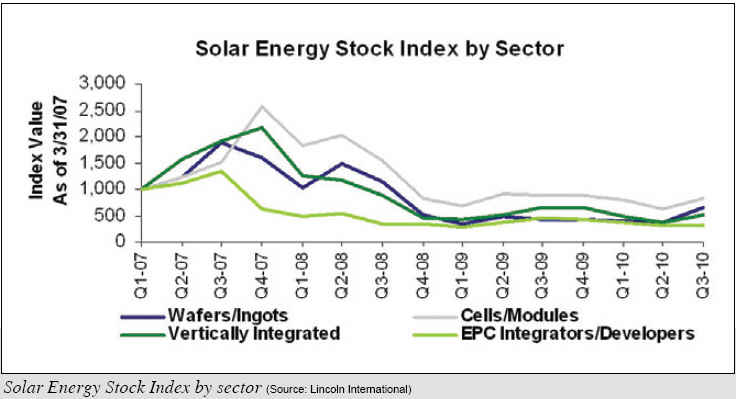

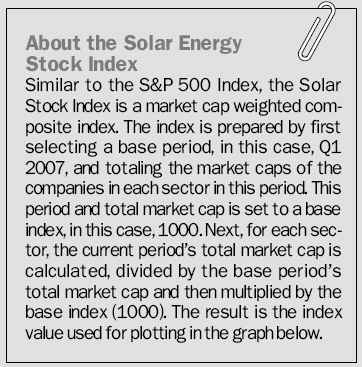

In the third quarter of 2010 the index of solar companies tracked by Lincoln International (the ‘Solar Stock Index’) well outperformed the S&P 500 with the Solar Stock Index gaining 34% while the S&P increased approximately 11%. The Solar Stock Index covers four main sectors within the solar industry including: Wafers and Ingots Producers (Wafers/Ingots), Cells and Modules Manufacturers (Cells/Modules), Solar Engineering, Procurement, and Construction Integrators and Developers (EPC Integrators/ Developers), and Vertically Integrated Companies (Vertically Integrated). Each of these sectors captures a specific aspect of the overall solar energy value chain and each is an integral part of the industry as a whole. All but one sector increased during the third quarter of 2010. The Wafers/Ingots sector continued its leading trend of outperforming the other three sectors, increasing over 78% on average. Cells/Modules and Vertically Integrated companies increased 30% and 40%, respectively, while the EPC Integrators/ Developers were the only sector showing a decline of approximately 1% on average.

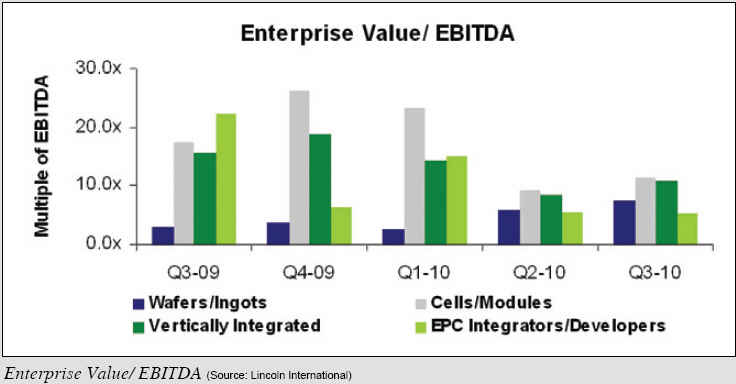

As we saw in the second quarter, the increases in the stock prices of the companies within the Solar Stock Index have improved industry valuation multiples. The Cells/Modules sector continues to exhibit the highest EBITDA multiples at 11.3x on average, while EPC Integrators/Developers are trading lower than any other sector in the solar industry at an average of 5.3x. Wafers/Ingots and Vertically Integrated companies are exhibiting EBITDA multiples of 7.4x and 10.9x on average, respectively.

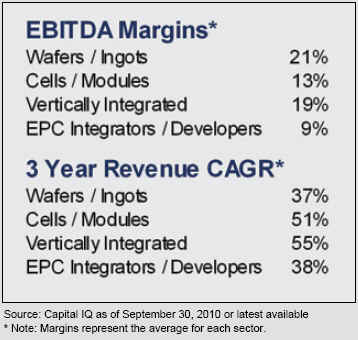

It is evident that the positive valuations and stock performance exhibited by the solar industry are driven by the continued positive financial attributes exhibited within the industry. In particular, the growth of companies across the industry during the last three years has been quite significant with Compound Annual Growth Rates (CAGR) of all four sectors exceeding 30% for this time period. In addition, profitability continues to improve across most of the industry, as exhibited through increased average EBITDA margins in all sectors except for EPC Integrators/Developers, as compared to their averages in the previous quarter. At the front of the supply chain, the EBITDA margins of Wafers/ Ingots and Cells/Modules companies increased slightly, averaging 20% and 12%, respectively at the end of the second quarter of 2010 to approximately 21% and 13% on average, respectively by the end of the third quarter of 2010. The EBITDA margins of Vertically Integrated companies exhibited the greatest improvement, increasing from an average of 14% at the end of the second quarter of 2010 to the current average of approximately 19% at the end of the third quarter of 2010. EPC Integrators/ Developers remained relatively flat with EBITDA margins continuing to average approximately 9%. It is evident that the positive valuations and stock performance exhibited by the solar industry are driven by the continued positive financial attributes exhibited within the industry. In particular, the growth of companies across the industry during the last three years has been quite significant with Compound Annual Growth Rates (CAGR) of all four sectors exceeding 30% for this time period. In addition, profitability continues to improve across most of the industry, as exhibited through increased average EBITDA margins in all sectors except for EPC Integrators/Developers, as compared to their averages in the previous quarter. At the front of the supply chain, the EBITDA margins of Wafers/ Ingots and Cells/Modules companies increased slightly, averaging 20% and 12%, respectively at the end of the second quarter of 2010 to approximately 21% and 13% on average, respectively by the end of the third quarter of 2010. The EBITDA margins of Vertically Integrated companies exhibited the greatest improvement, increasing from an average of 14% at the end of the second quarter of 2010 to the current average of approximately 19% at the end of the third quarter of 2010. EPC Integrators/ Developers remained relatively flat with EBITDA margins continuing to average approximately 9%.

Overall, the increased demand for solar, and correspondingly, the improved financial performance throughout the solar industry are resulting in an increase in stock prices and valuations that hasn’t occurred since the fourth quarter of 2009. Only time will tell if this trend is sustainable and will continue through the new year. Overall, the increased demand for solar, and correspondingly, the improved financial performance throughout the solar industry are resulting in an increase in stock prices and valuations that hasn’t occurred since the fourth quarter of 2009. Only time will tell if this trend is sustainable and will continue through the new year.

Jack Calderon is Managing Director at Lincoln International (http://www.lincolninternational.com/) and co-heads the firm’s Renewable Energy Group.

Chaim Lubin is an associate at Lincoln International and a part of the Renewable Energy Group.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved. |