By Tom Key

.jpg)

.jpg) With today’s growing environmental concerns, ongoing PV technology improvements and cost reductions, solar PV appears to be entering an era in which it will play an increasingly important role in meeting the world’s energy needs. In fact, deployment growth of solar power today exceeds wind power and it is the fastest growing form of electricity generation on a percentage basis. With today’s growing environmental concerns, ongoing PV technology improvements and cost reductions, solar PV appears to be entering an era in which it will play an increasingly important role in meeting the world’s energy needs. In fact, deployment growth of solar power today exceeds wind power and it is the fastest growing form of electricity generation on a percentage basis.

A solar cell’s power output depends on several factors, including design and materials, the intensity of solar radiation incidence, and temperature. Mono-or polycrystalline silicon cells are the most widely used PV technologies today. The cost of the highly purified silicon required for these cell types has fallen, but cost remains a barrier to mass deployment. Additionally, manufacturing processes for silicon-based PV are slower and more difficult to automate than their thin film cousins. Thin-film solar modules are not as efficient but are significantly less expensive and easier to scale to larger sizes and production volumes, thus are gaining market share.

Photovoltaic Cell Type

.jpg) Crystalline silicon is the traditional cell material for solar modules, and has maintained at least 80% market share of worldwide production for nearly all of the past 30 years; and, over 90% for much of the past decade, as shown in Figure 1. To date, crystalline silicon cells have achieved the greatest flat-plate module efficiency when illuminated at standard test conditions. In addition, crystalline silicon cells have the most highly-developed manufacturing processes. Typical commercial monocrystalline silicon modules achieve solar-to-electric efficiencies of approximately 16-18%. The best commercially available silicon modules exceed 20% efficiency. Polycrystalline silicon modules are slightly less expensive, but also a few percentage points less efficient. The emergence of very large 830 mm x 830 mm ingots of super poly (Photo 1) represents a new entry into the market as ribbon makes its exit and is currently not available in the market. Crystalline silicon is the traditional cell material for solar modules, and has maintained at least 80% market share of worldwide production for nearly all of the past 30 years; and, over 90% for much of the past decade, as shown in Figure 1. To date, crystalline silicon cells have achieved the greatest flat-plate module efficiency when illuminated at standard test conditions. In addition, crystalline silicon cells have the most highly-developed manufacturing processes. Typical commercial monocrystalline silicon modules achieve solar-to-electric efficiencies of approximately 16-18%. The best commercially available silicon modules exceed 20% efficiency. Polycrystalline silicon modules are slightly less expensive, but also a few percentage points less efficient. The emergence of very large 830 mm x 830 mm ingots of super poly (Photo 1) represents a new entry into the market as ribbon makes its exit and is currently not available in the market.

.jpg)

.jpg)

Thin-film solar cells are made from layers of semiconductor materials only a few micrometers thick that are deposited on a low-cost substrate such as plastic, glass, or metal foil, as seen in Figure 2. They use considerably less semiconductor material and their manufacturing techniques are well suited for mass production. In additional to reducing material costs, thin films make applications more flexible, as thin-film PV can be integrated into roofing tiles, windows, or even tent roofs, as seen in Figure 3. Thin-film cells significantly reduce cost per unit area, but also result in lower efficiency cells, such that their costs per watt of output are similar to crystalline silicon’s. Amorphous silicon is the most common type of thin film and has the longest operating history, but is loosing market share because of relatively low efficiency can cost competition from other technologies. Other materials that are gaining market share include Cadmium Telluride (CdTe) Copper Indium DiSelenide (CIS), and Copper Indium Gallium DiSelenide (CIGS). Other technologies include Dye Sensitized Solar Cells (DSSC) and organic polymer solar cells, but these are used in Building Integrated Photovoltaic (BIPV) applications and not yet close to commercialization for power generation.

Technology Status and Outlook

Given the recently rapid growth of both CdTe and amorphous silicon commercial sales, it is tempting to forecast a turnaround in the long-time market dominance of crystalline silicon. However, the underlying cost structure of both thin-film and crystalline silicon manufacturing has been rapidly evolving and neither camp appears to be approaching any absolute limits in cost reductions. Therefore, the PV market is destined to remain a vigorously contested horse race for a decade or two at least. In the much longer term there also are likely to be other entrants in that race, but the extreme difficulties involved in bringing brand-new PV technologies from the laboratory to the factory floor suggests that the leaders for the next few years will continue to include crystalline silicon, CdTe, and CIGS.

In many ways, PV technology is continuing to evolve and has not yet reached mature commercial status in most market segments. Without subsidies, PV is currently best suited economically for small, off-grid installations and other applications where PV can often provide a service at the lowest cost. However, the presently predominant PV markets are driven by significant subsidies across the PV supply chain designed to spur this immature industry. One such market is that for residential and commercial rooftop retrofit installations of 1 to 500 kW each, driven also by growing public interest in sustainable-resource based ‘green power’. The ‘green’ market motive also helps to stimulate the growth of building-integrated and building applied PV (BIPV and BAPV), such as roofing materials and building facades, generally installed during new construction.

Large-scale bulk-power PV facilities are now cost competitive in specific markets, generally those with high DNI, that also provide some degree of subsidy. The ITC and the 1603 cash grant in the U.S.A. facilitated a large number of multi-MW projects in the Southwestern U.S. Additional subsidy driven growth has been seen in Germany, Italy, Greece, and spreading to Asia in the likes of India and China. Also, the adoption of state-based Renewable Portfolio Standard (RPS) requirements in the U.S., together with extension of the Federal 30% solar investment tax credit to utilities, has fueled interest, particularly in central-station PV where cost gains are realized due to scale.

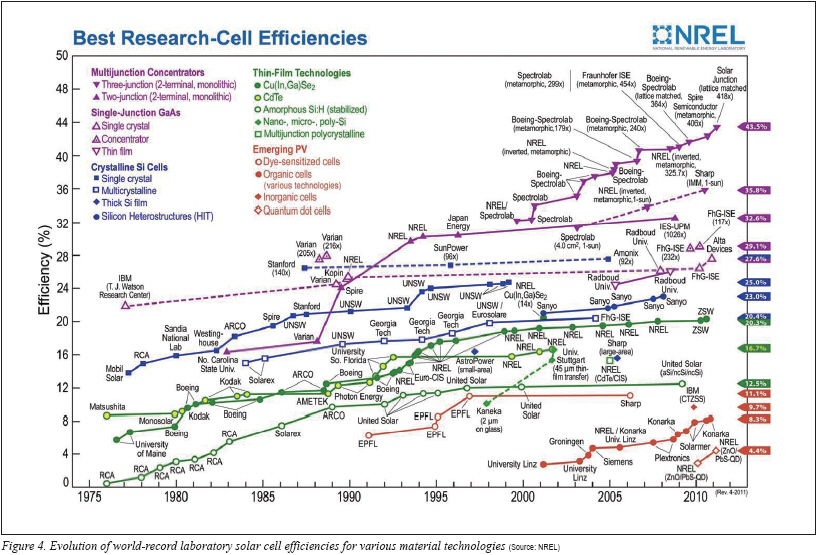

The evolution of most of the principal PV cell technologies shown in Figure 4 suggests two important conclusions about the future of the industry. First, there is a substantial time lag of about 20 years between laboratory efficiency achievements and their appearance in flat-plate commercial products. This underscores the difficulty of scaling up square-centimeter laboratory cells to square-meter products. Notably, this observation does not apply to the high-efficiency multijunction cells now used in concentrating PV applications, where such enormous scale-up in cell dimensions is not required for commercial production.

The second conclusion from Figure 4 is that nearly all thin-film technologies have substantial room for performance improvement, given the current difference of roughly 100% between commercial modules and the record cells compared to about 25% in the corresponding crystalline silicon cases. This is clearly a consequence of the relative immaturity of thin-film PV manufacturing.

Looking to the future, a number of concepts show promise for advancing the performance of PV devices by a factor of two or three from those in present-day commercial modules. Collectively, these advanced devices are known as ‘Third Generation Photovoltaics’1). Figure 5 illustrates the performance and cost relationships between these third-generation concepts and current thin-film and crystalline silicon technologies. Although most of the third-generation concepts have not even reached the stage of laboratory demonstration, the ‘multijunction cell’ can be found in some of today’s commercial amorphous silicon modules and specialized cells made for concentrating PV systems.

Cost and Economics

As solar PV technologies continue to evolve, significant cost reductions are expected to continue as a result of improving power conversion efficiencies, development of low-cost cell fabrication processes, and increasing cell production volume with attendant economies of scale.

The fundamental PV technology is the same for distributed and central-station PV systems, but costs and economic considerations differ between them. In the former case, some or all of the cost may be borne by customers interested in benefiting from on-site distributed generation or in supporting clean renewable technology. Depending on local electricity prices and available rebates, subsidies, or incentives, the payback period for a typical residential-scale PV system varies widely. One model that has made PV more accessible to homeowners is third-party leasing that covers financing, installation and longer-term maintenance as well as reducing electricity bills. A distributed PV system may also be owned by an energy company interested in providing grid support in critical areas, exploiting new business opportunities, or complying with policy demands such as renewable portfolio standards. Because PV is highly modular, distribution companies can precisely deploy it in optimal locations and capacities or work with customer-owners to do so. Research into PV grid integration optimization has been advancing in recent years to create tools that help utilities understand where PV will best fit in their power systems. Other innovative purchasing or leasing products may provide added benefits to customers, utilities, or both parties.

To accurately evaluate the costs and benefits of a possible distributed PV project, the consumer should:

-Obtain detailed cost and performance data from the PV system or module manufacturer;

-Acquire meteorological data from a representative ground station;

-Simulate the production of the PV system, taking into account sun angles and module orientation;

-Determine hourly impacts on consumption from the electric utility and related electricity cost;

-Calculate monthly energy and/or demand savings using their specific utility tariff structure;

-Calculate the financial impacts and applicability of various buy-down programs, tax credits, and financing terms.

Distributed PV production models and financial calculations are complex and the factors involved, vary widely. It is impractical to attempt to construct a single example representative of all distributed PV systems. There are many computer models available to assist in these calculations, with the U.S. Department of Energy’s Solar Advisor Model perhaps having the best combination of ease-of-use and comprehensiveness2). A general observation that can be made is that there are today significant markets where the subsidized cost to the PV end- user appears increasingly attractive compared to local utility rates.

Photovoltaic power plants have long been designed as distributed-generation resources at the watt to tens-of-kilowatt scale for the residential and small commercial markets. However, PV systems are now also appearing more frequently in central-station configurations in the tens-of-megawatt range. Even larger plants have been planned and constructed in locations of optimal solar resource or in markets with available capital (China’s 2 GW First Solar farm in Mongolia is a great example). Fixed costs, such as engineering, applying for subsidies, and project management can make up a smaller percentage of larger systems. In addition, equipment such as inverters can be less expensive in larger sizes. Economies of scale are not linear, however, as the main cost element of the system─the solar panel─tends not to drop significantly with scale for systems in the MW range. Thin-film modules are generally less costly than crystalline but their lower efficiencies likely increase the balance of system cost per watt.Tracking systems maximize the power output of a particular PV array, but also add to its cost and mechanical complexity.

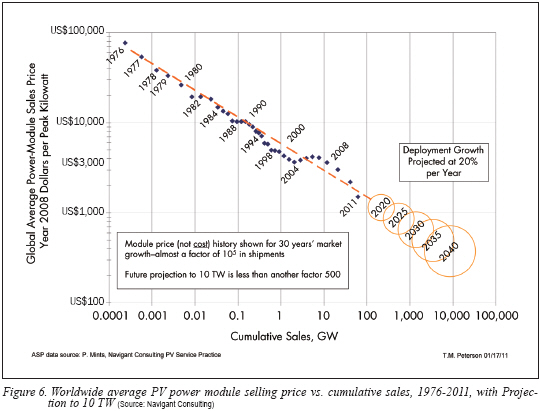

In the past, a rule of thumb was that modules typically constitute half of the cost of PV systems however in the last few years the BOS is more than half. Figure 6 shows the evolution of worldwide PV module average selling prices. The figure presents these data in the form of an ‘experience curve’, where the average sales price is plotted versus cumulative sales volume. This format was chosen to show the clear power-law behavior of historical module prices, where the average selling price has declined by about 20% with each doubling of sales.

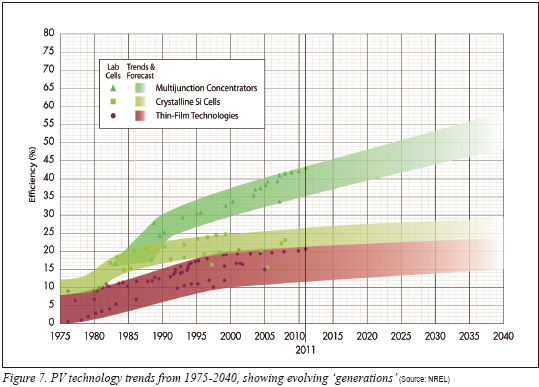

The widening circles in Figure 6, projecting PV deployments to 2040, are based on an assumed demand growth averaging 20% per year, together with ongoing ‘learning’ that enables prices to continue their historic decline. This envisions a simple continuation of silicon’s past price-setting role as the dominant player in the PV market. This projection is, of course, speculative, but it is commensurate with PV’s 30-year historic market growth and conservative compared with the last 10 years of PV market and technology developments that have averaged about 40% growth per year. From the point of view of likely technology advancements, given the recent emergence of multiple commercial thin-film PV products and the prospects for efficiency gains with multijunction concentrating PV, suggested in Figure 7, the extrapolation may well prove to be even pessimistic.

Future deployment of solar photovoltaic systems is expected to challenge the utility industry in several ways. The first will be enabling the electric grid to effectively integrate and distribute PV energy to electricity users. The second is to realize the full value of the electric grid and the PV power systems by developing new business models for these distributed resources. EPRI has researched different approaches to meeting both integration and business model challenges in various publications.

Related to these challenges, a number of utility leaders, particularly in the Hawaii, California and New Jersey markets, are being challenged to consider if they are ready for higher levels of PV deployment and are subsequently reviewing their strategies and plans. In one EPRI case, the following ‘Top 10’ check list items were identified:

1. Developing an overall strategy for orderly PV adoption and rollout;

2. Designing a business plan to maximize company and ratepayer PV benefits;

3. Assigning necessary internal resources to address new infrastructure demands;

4. Arranging PV industry partners to stay on the leading edge of applications;

5. Selecting a solar applications menu to assist in orderly business expansions;

6. Discovering grid-integration issues and opportunities to avoid costly oversights;

7. Designing PV energy rates and incentives to speed implementation and ensure equitable earnings;

8. Filing for rate recovery to avoid costly implementation delays;

9. Planning technology and application demos for internal and external learning;

10. Reaching out to educate and engage customers to enhance relationships and raise corporate image.

Worldwide installation of PV systems has been growing at a rapid pace in recent years, driven by a combination of government incentives and popular support for clean energy particularly in Germany and other European markets. A key goal of the incentive programs has been to drive down costs by increasing production volume. PV costs have indeed declined substantially over the long term, for both module and non-module costs, and they show no signs of slackening the pace beyond short periods of infrastructure regroupings, such as the previous shortage of high-purity silicon feedstock and the current oversupply of PV modules. Even the global recession has hit the PV industry relatively mildly, softening demand in the first half of the year but showing many signs for resumption of vigorous growth in coming years. Existing regional variations in average installed costs suggest that there is much to be gained globally from learning best practices in system installation and interconnection.

Many experts are predicting a blossoming of the U.S. market over the next few years, as installed prices reach grid parity with conventional alternatives and the potential of the U.S. domestic solar resource is better appreciated. Large-scale commercial PV and central-station utility-scale PV will most likely become the dominant growth market; however, the relatively high value of displaced retail kWh will probably stimulate growth of the residential and commercial markets as well.

Tom Key has over 30 years of experience in energy related R&D with the U.S. Navy, Sandia National Laboratory, and Electric Power Research Institute (EPRI, www.epri.com). He currently manages EPRI’s program to enable integration of distributed renewable resources. His experience in power electronics includes UPS with storage, inverters for PV and electronics applied for grid support. Key is a fellow of the IEEE and a nationally recognized leader in power system compatibility research, power quality engineering, integration of distributed and renewable energy resources and the power electronics needed for these applications.

REFERENCES

1) Green, M.A. Third Generation Photovoltaics: Advanced Solar Energy Conversion. Springer-Verlag, Berlin, Germany: 2003.

2) U.S. DOE Solar Advisor Model, www.nrel.gov/analysis/sam/

For more information, please send your e-mails to pved@infothe.com.

ⓒ2011 www.interpv.net All rights reserved.

|