By Dr. Stanislaw M. Pietruszko

Climate change caused by the carbon gas emissions is not the only problem that bothers the EU authorities and its citizens. One of major issues is also the security of energy supply, menaced by the unstable partnerships and finiteness of fossil fuel resources. Today no country can take its energy security for granted anymore. Climate change caused by the carbon gas emissions is not the only problem that bothers the EU authorities and its citizens. One of major issues is also the security of energy supply, menaced by the unstable partnerships and finiteness of fossil fuel resources. Today no country can take its energy security for granted anymore.

Moreover, there is a pending need to boost the economic development, create jobs and electrify remote areas without increasing the carbon gas emissions.

With regard to challenges mentioned above, PV represents a complex opportunity. Not only is it a source of most desired renewable energy, it boosts hi-tech industry sector, supporting competitiveness and labor market within EU. Decentralization of power generation improves national energy security of the member state. Seeming state-level, national energy security strengthens the entire EU as the recently ratified Lisbon Treaty introduced the principle of energy solidarity.

Obstacles that hamper PV sector growth do not stem from technology. The main reason of low PV deployment is a relatively high price of the systems. Yet, money spent on PV installations shall not be considered just a cost, as it is a sheer investment which scale is proportional to profits it brings. In addition, quick technological development in this field along with growing volume of PV installations triggers a decrease in PV systems’ prices. According to the European Photovoltaic Industry Association (EPIA), the prices of installations are to fall by 8% every year. Such trend is not observed in any other pricing of technologies based on Renewable Energy Sources (RES).

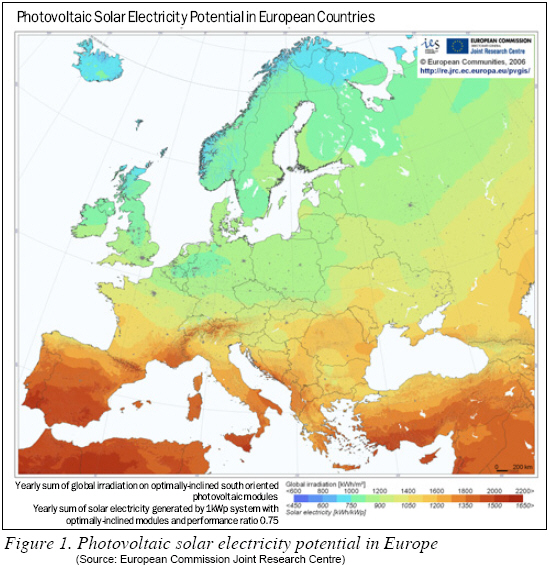

Converting sunlight into power depends strongly on irradiation of the territory. That is why many citizens of the European Union 12 New Member States (NMS) do not consider their countries as sufficiently sunny in order to utilize solar to far greater extent. Map presenting photovoltaic solar electricity potential in Europe (Figure 1) comes from the Joint Research Centre, Ispra database. As it is immediately noticeable southern parts of Europe rejoice the best irradiation which guarantees a high effectiveness of PV power installations. Five NMS (Cyprus, Malta, Bulgaria, Romania and Slovenia) and the three associated with EU partners (Croatia, Serbia and Turkey) actually have such advantageous exposure. Even with smaller PV electricity output potential, the rest of NMS benefits from sufficient irradiation to develop a successful PV market.

Briefly, PV technology is cost-effective and economically viable on all of the NMS’ territories. It is important to raise awareness about this among political decision makers and other stakeholders doubting this fact.

Photovoltaic Installed Power

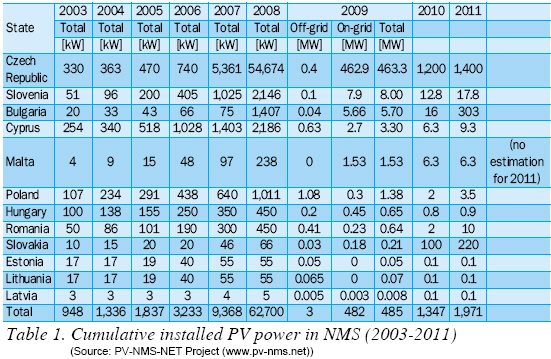

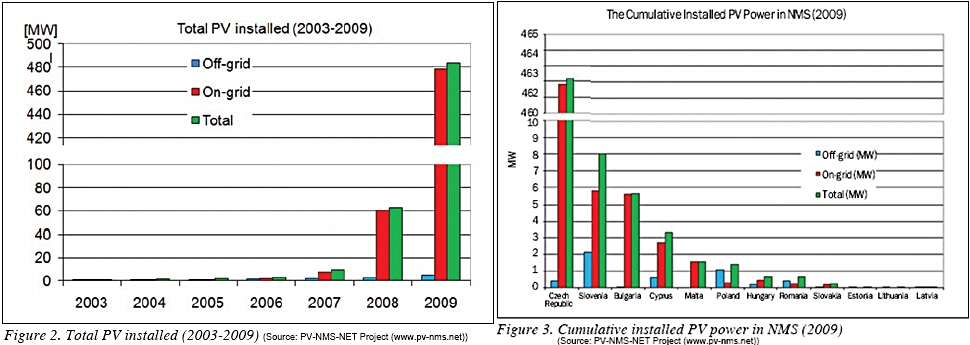

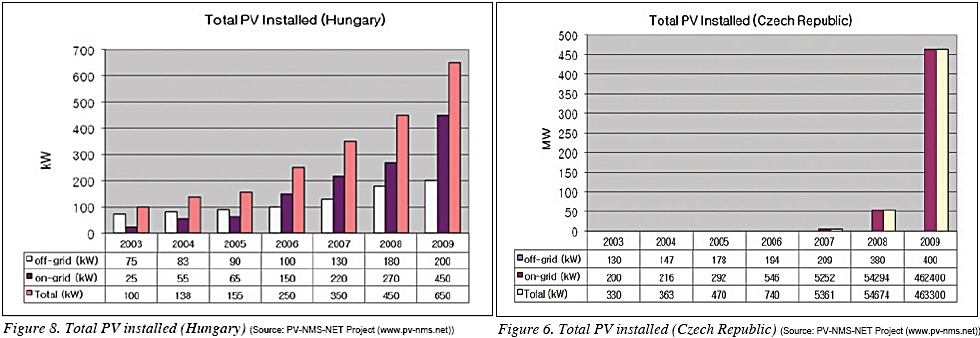

Photovoltaic market grew in NMS from 63 MWp in 2008 to 480 MWp of cumulative installed power in 2009. Although the PV NMS market is still rather small, it is growing rapidly proving its vast potential to become a considerable part of RES market in the EU. However it is necessary to note that this growth is mainly (84%) due to 408 MWp installed in the Czech Republic.

For the time being, barriers that hinder PV sector progress are still numerous. Disbelief of the general public that PV electricity can make a significant contribution to overall energy need at sensible price is one of the impediments to hamper the PV development. Lack of political support, strong nuclear and coal lobbies, improper design of support schemes, poor consumer awareness and prejudice within utility sector are only some major obstacles for PV sector advancement

Until 2006, small off-grid PV installations prevailed in NMS. Big-scale on-grid installations took over recently. The most spectacular in this matter was the Czech Republic. Such a growth of the annual PV markets is due to a successful implementation of support mechanisms. Market leaders such as Czech Republic, Slovenia, Cyprus and Bulgaria owe their growth to effective PV support mechanism, especially adequate Feed-in Tariff systems.

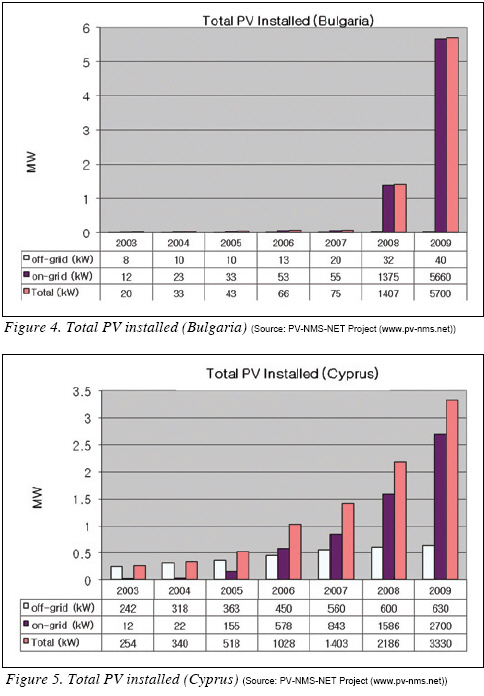

Bulgaria

PV market in Bulgaria grew by about 4.3 MW, so the total accumulated PV capacity reached about 5.7 MWp. The lion share of this number is provided by the 2 MWp solar grid-connected plant with Si modules built in village Botevo. Another installation 1 MWp solar plant (thin-film amorphous silicon) was built in Paunovo village close to the capital--Sofia, by Intersol company. In the first stage of the project ‘North-Est 1’, PV plant with installed power of 338 kWp was built in a village Jankovo, close to the town Shumen and connected to the grid in July 2009. The installed amorphous silicon modules were produced by the Bulgarian company SolarPro. The whole system ‘North-Est 1’ will have a capacity of 2,404 MW.

Cyprus

In 2009, Cyprus total installed PV capacity attained 3.3 MWp. Cyprus energy market still is dominated by the oil products. With one of the highest irradiation indicators, PV could easily supply the overall Cyprus electricity demand.

According to the unofficial expectations of the Energy Service of Cyprus, the Cyprus Institute of Energy and the PV industry representatives in Cyprus, the total PV installed power shall increase by 3 MWp annually.

Cyprus industry representatives assume that PV may have accounted for 5 MWp by 2010 and will reach 30 MWp by 2020.

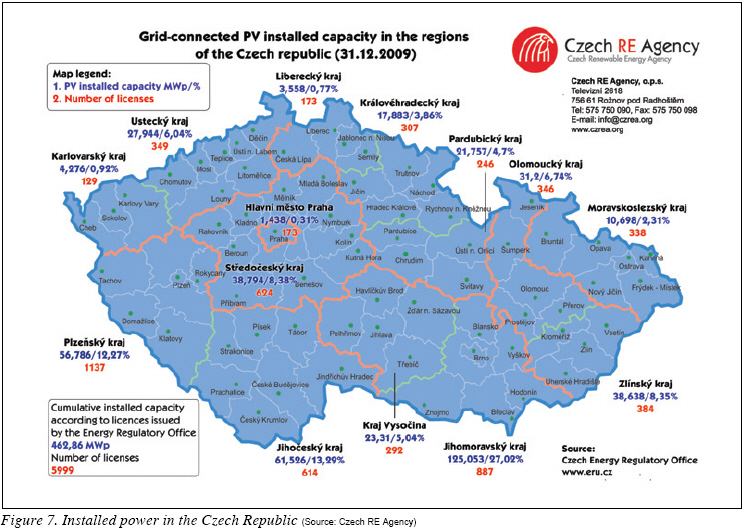

Czech Republic

With 463 MWp of cumulative installed solar capacity, Czech Republic is the leader of the region. The sector developed to the extent where the growth restriction had to be considered. Transmission and distribution grids are overloaded with new PV powers. Czech solar market owns this staggering take-up to favorable FiT with small yearly digression and stronger national currency as well as falling the price of modules. The parliament has not been able to modify the 5% yearly digression for almost a year, what has opened (in combination with above mentioned aspects) an extremely good business opportunity for those wishing to invest in the solar field.

Additionally, the overheated Czech market came as a result of speculative permits allocation for PV systems grid connection. At this time, there are some 6,000 MWp of registered systems on distribution system operators lists, mostly speculative. Nonetheless, both transmission and distribution systems operators are seriously worried about stability of the grid, even if only 20% of this figure will prove to be real power application. As a result of that, there is current moratorium on all new PV system connection applications. The Chamber of Deputies of the Parliament of the Czech Republic has already agreed on an amendment to the law supporting electricity produced from renewable sources. The amendment will introduce an additional charge of 26% on the purchasing price of electricity derived from solar radiation. The proposal is about to be cast in the Czech Senate.

The proposal discussed is exceptionally controversial as it is retroactive. It is lowering the purchasing price of electricity derived from solar radiation for photovoltaic plants installed in 2009 and 2010 for the revenues which will be perceived in the year 2011 to 2013. And these installations are given a purchase price of electricity already agreed when the investment was made.

Estonia

In 2009, Estonia did not register any growth in use of PV for energy production maintaining 15 kW of total cumulative capacity. All installed PV systems are stand-alone and mainly directed for demonstration of PV benefits to public.

Hungary

Hungarian PV sector is growing slowly but the trend is stable. Year 2009 slightly better in this matter, instead of usual 100 kW, market grew by 200 kW and reached 650 kW.

Latvia

Latvia’s PV sector, like in all of the Baltic States, is in the doldrums. Heavily affected by financial crisis Latvia noted 15% of negative economy growth. PV installed capacity at the end of year 2009 was 8 kW.

Lithuania

Although during 2009, as in the previous years, the Lithuanian PV sector experienced negligible growth and still amount to mere 10 kW, all off-grid. Significant changes in this field are expected, however. FiT and the PV market entry of several manufacturers are likely to stimulate development of this sector.

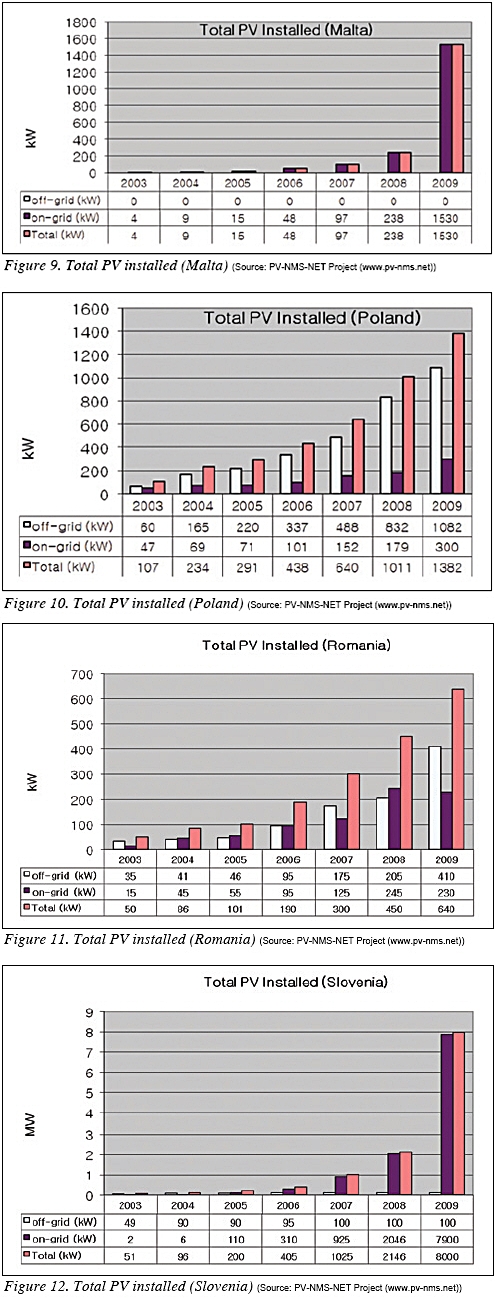

Malta

1.53 MW of installed PV capacity in 2009 is a considerable growth for Malta, a country almost entirely dependent on import for energy. Since the introduction of the on-grid PV technology, the capacity growth trend has been quite slow with a slight rise in late 2008 following the authorization of a few installations. A very sharp rise, however, in 2009 came as a result of the support instruments provided by the European Regional Development Fund scheme managed by Malta Enterprise (ME) for commercial and industrial sector. Even though residential installations in Malta still prevail and accounts for 1.7 MW of total installed PV capacity.

Poland

Year 2009 did not bring any uptake on Polish PV market. With about 300 kWp of new capacity. Currently, the total installed power amounts to 1.32 MW, mostly off-grid. The major obstacle is the lack of feed-in tariffs for PV (and other RES, too). Only this incentive can drive the strong growth of PV sector in Poland. For the time being, however, PV module prices are too high to become real alternative to cheap and abundant coal in Poland.

Romania

Moderate development of PV market in Romania pales in comparison to Bulgaria’s uptake, considering similar irradiation of the two countries. In 2009, Romania reported 635 kW of total installed PV capacity. The majority of installations are off-grid. With the aid provided by the European structural funds as well as monies from national budget several new installations will be put in place in the nearest future. According to what is already planned 300 kWp capacity systems are to be built in 2009 and up to 10 MWp by 2011.

Slovakia

180 kW of PV power capacity has been installed in Slovakia in 2009 (among others: 100 kW installed in July on the roof of Commenius University). In 2009, Slovakia introduced favorable FiT so the significant change is yet to come. It is regrettable, however, that in the same time 120 MW limit for PV have been set by Slovak authorities.

Slovenia

Slovenia learns quickly how to use the Sun to its benefit. 8 MW cumulative installed PV power (almost three-quarter of which is on-grid) in 2009 only is a remarkable upswing. In 2008, the biggest PV plant was 100 kW and in early 2009 with the capacity of 220 kW.

Main investors of PV plants are energy companies, other companies and institutions, farmers and individuals. Farmers’ interest in PV installation grows thank to the investment subsidy from regional fund for RES projects. For installation of PVS on the roof the formal procedure is quite simple, without the construction permit and without the limitation regarding installed capacity. For ground PVS installation, a construction permit, together with all related procedures is requested. Additionally, there is a cap of 5 MW per year for ground PVS installations. That means that only the first PV plants connected to the grid, up to cumulative 5 MW per year, could get the guaranteed higher FiT tariff.

Dr. Stanislaw M. Pietruszko is the Head of the Centre for Photovoltaics at the Warsaw University of Technology and the President of the Polish Society for Photovoltaics. He is also Member of the Steering Committee of the European Photovoltaic Technology Platform. His 32-year scientific career in PV is focused on research on thin-film amorphous silicon solar cells and thin-film transistors, PV modules and systems. Dr. Pietruszko has published more than 150 scientific papers. He has a broad technological expertise which covers activities in communication, management and policy.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved. |