|

By Sam Wilkinson

PV Module Costs Are Down

Given that Feed-in Tariffs (FiT) and incentive schemes in major PV markets such as Germany are set to continue decreasing, perhaps faster than some might have expected a year ago, it is not a surprise that suppliers are maintaining a strong focus on reducing costs. This is, of course, essential in order to remain competitively priced and profitable in an industry driven by a desire to gain independence from the subsidy schemes on which it currently relies. Given that Feed-in Tariffs (FiT) and incentive schemes in major PV markets such as Germany are set to continue decreasing, perhaps faster than some might have expected a year ago, it is not a surprise that suppliers are maintaining a strong focus on reducing costs. This is, of course, essential in order to remain competitively priced and profitable in an industry driven by a desire to gain independence from the subsidy schemes on which it currently relies.

First Solar has become well known for its low-cost manufacturing and did not disappoint in Q2’10, by driving its costs down 8% to US$0.74 per watt, citing improved throughput, increased efficiencies and reduced material costs as helping it achieve this.

As a result of the increased volumes and high utilizations predicted in the third quarter, IMS Research forecasts that module production costs will fall once again in Q3’10. However, as the supply of wafers remains short, crystalline cell manufacturers (particularly those that are not vertically integrated) are predicted to see increases in raw material costs, handing some advantage back to thin-film suppliers such as First Solar and making it more difficult to reduce costs further--in the short-term at least.

Are PV Module Prices Really Falling?

Another unlikely trend throughout the data that IMS Research has collected from Asian and U.S. suppliers is the decline of factory-gate selling prices--certainly unusual, given the current sky-high levels of demand and tight supply. However, although in Q2 these suppliers are reporting a decrease in the revenue generated by each PV module sold, due to exchange rate issues this has not translated into any decrease in prices to wholesalers, distributers or end-customers. So some caution needs to be taken when analyzing these companies’ Q2 results─lower reported ASPs does not necessarily mean ASPs have gotten any lower.

Although Europe accounted for some 82% of PV installations in Q2’10, the vast majority of modules were supplied by companies recognizing their revenues in currencies other than the euro. As such, currency fluctuations over the last quarter have resulted in great differences between the amount that suppliers supply their modules for, and the amount of revenues that they realize from that sale.

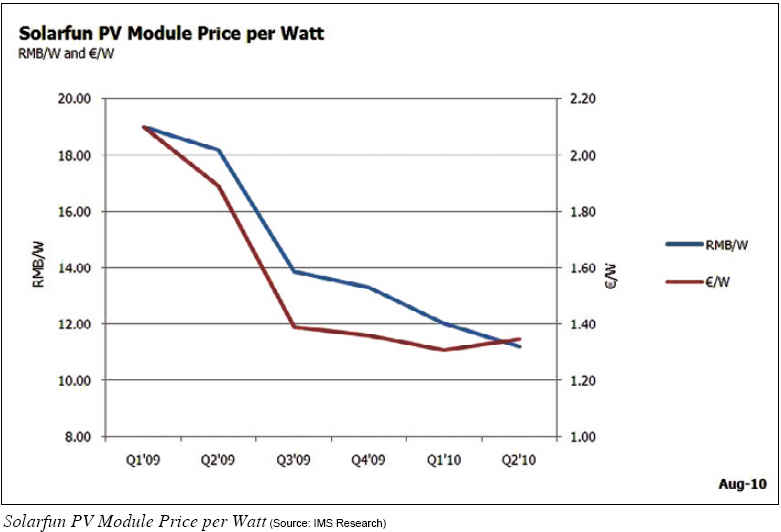

For example, Chinese crystalline cell and module manufacturer, Solarfun, announced recently that its PV module Average Selling Price (ASP) had declined by 6.8% in the second quarter to RMB 11.19/W. However, converted to euros (at the appropriate quarterly exchange rates), where the majority of its revenues are generated (Germany, Italy, Belgium and France combined accounted for over 80% of its module shipments during Q2), the truth is its prices actually rose by 3.1%.

While the depreciation of the euro (against the U.S. Dollar and the Renminbi) has negatively impacted on the margins of many module manufacturers, European suppliers will appreciate, at least temporarily, the aid in their battle to remain price competitive on their home ground against the aggressive pricing of their Asian competition.

The Second Half of 2010 and What Happens Next?

There is almost no uncertainty surrounding demand for PV in the second half of this year and 2010 will certainly prove to be another remarkable year for the industry. PV module shipments are forecast to increase by an incredible 60% over 2009 to reach 15.6 GW.

System integrators and project developers continue to rush to realize installations right through to the end of the year, particularly in Germany--despite the recent reductions in the EEG--driven by further cuts which will take place on October 1st and January 1st 2011. As a result, module shipments are forecast to increase to more than 4 GW in Q3’10 in order to complete and connect systems to the grid by the end of the year. Crystalline module prices are predicted to remain relatively unaffected by additional FiT reductions in Germany and are forecast to increase slightly (in euros) in Q3, due to this strong demand.

Beyond 2010 the situation is less clear and questions remain over how the industry will respond to multiple FiT reductions in the largest European markets heading into 2011. A strong consensus is apparent in the market today that we will see another unhealthy drop in demand (similar to that experienced early in 2009 following the demise of the Spanish market) and the return of seasonality.

IMS Research forecasts that installations in EMEA will decline by 80% Q-o-Q in Q1’10. This, coupled with capacities that have been ramped to their maximum in order to serve the strong demand of H2’10, is forecast to quickly reverse the current imbalance between supply and demand and average PV module prices are forecast to commence their downward trend once again.

One supplier with a more optimistic outlook for the New Year is First Solar. The thin-film supplier recently announced that it planned to construct 500-700 MW of systems in 2011 and boasted a ‘captive pipeline’ of utility-scale business that would buffer any fluctuations in demand. Following its acquisition of project developer NextLight, First Solar plans to begin the construction of a massive 290 MW power plant before the end of 2010 and install modules there throughout 2011.

One thing is for certain: most agree that 2011 demand cannot remain as strong as 2010, and if this is the case, not all suppliers can afford to be as optimistic as First Solar.

Sam Wilkinson is PV Research Analyst at IMS Research (www.pvmarketresearch.com).

Solarfun PV Module Price per Watt (Source: IMS Research)

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved.

|