By Cassidy Deline

Europe PV Market Environment and Development Trends

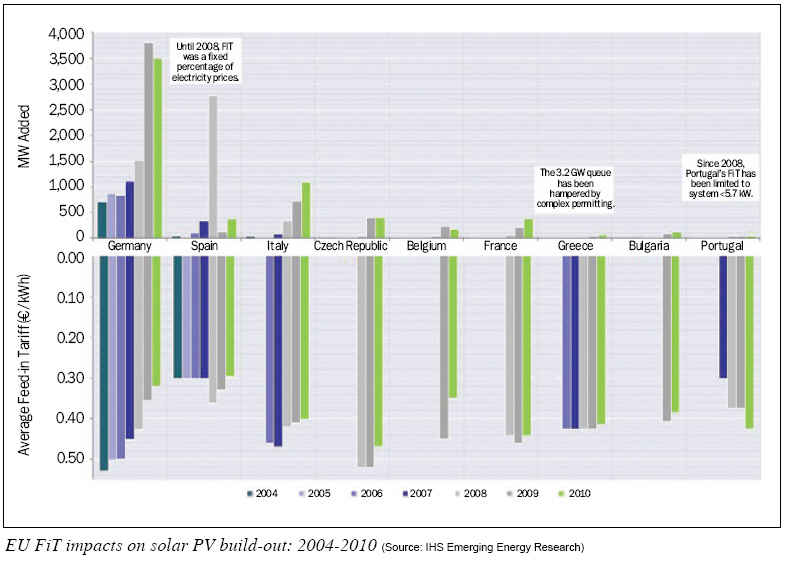

European concerns have escalated toward securing long-term energy supply at the lowest cost possible. At the same time, the solidifying scientific consensus over the realities of climate change has fueled the drive to transition toward a low-carbon-emissions electricity generation portfolio. As a result, European countries have implemented a mix of Feed-in Tariff (FIT) and Green Certificate (GC) mechanisms and permitting processes to enable the greater build-out of renewables, including solar PV. While regulators continue to dial back government incentives, a host of factors impacting PV in the long term will be critical in facilitating its growth.

-Tariff rates underlie near-term PV volatility.

-Cost declines improve cost position against other renewables.

-Siting flexibility begets broader audience.

-Risk profile of fossil-fuel generation.

Unstable Incentive Environment Creates Volatile Market

As PV development experience and economic dynamics evolve, regulators are altering incentive schemes to keep pace. In step with the precipitous decline in module prices over the course of 2009, regulators are slashing incentive rates across Europe. Near-term uncertainty about incentive duration, rate cuts, and anticipated regulator intervention underpin the mercurial PV development landscape. The three top markets in 2009--Germany, Italy, and the Czech Republic--have provided developers with less than one year of viability into incentive rates, resulting in a scramble to capture tariff rates prior to cuts or degressions. As the best indication of future FiT stability is past precedence, rates are expected to continue dropping subject to regulators¡¯s impulses. The result of low visibility into the longevity of tariff rates drives periods of rapid growth as the market swells in anticipation of incentive reductions.

While recent tariff reductions have created market volatility, these shifts also signal positive developments in the PV industry. Intended to encourage industry growth and keep pace with installed system costs, legislated tariff reductions across Europe are largely a result of improved technology costs and significant demand. As regulators attempt to keep pace in the near term, incentives and technology cost imbalances are expected to continue.

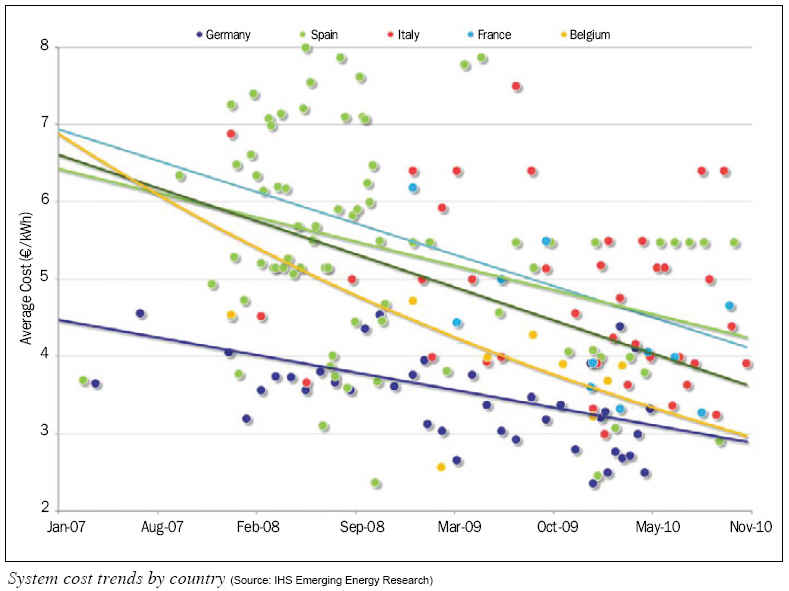

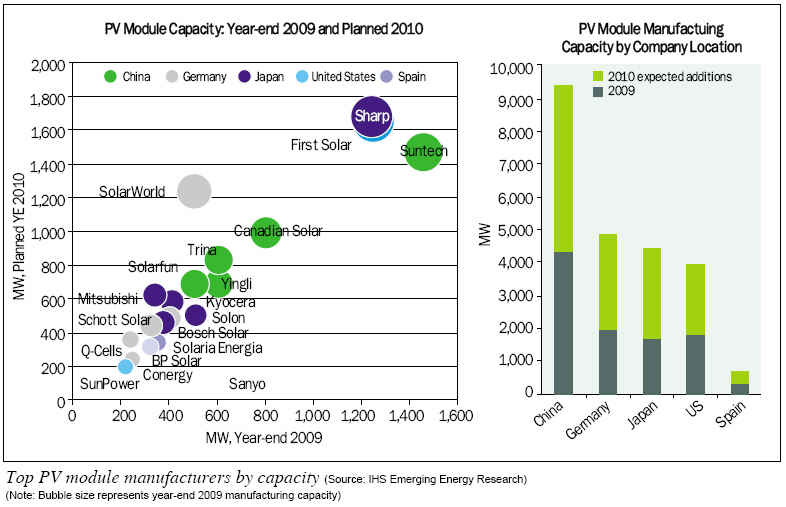

PV System Costs Tied to Incentives

While PV technology has made significant inroads into cost reductions, it is under mounting pressure to improve its economic competitiveness among conventional and other renewable technologies. PV module Average Selling Price (ASP) fell approximately 35% to 40% in 2009, and further cost reductions (up to an additional 20%) are expected in 2010. As the PV module accounts for roughly 50% of system costs, this has driven down total costs. These downward cost trends are expected to continue in the near term, but PV will remain more expensive than wind or geothermal.

Permitting Driving Sustainable Commercial Rooftop Market

Nine European countries are pushing rooftop system deployment through their regulatory structure. Further, as regulators across Europe cut incentive rates, rooftop tariffs are being revised less drastically than those for ground-based systems. This trend reflects governments¡¯s belief in PV¡¯s long-term suitability as a rooftop and, potentially, a distributed energy application. Rooftop installations are seen as an effective way to generate electricity without new construction or space requirements.

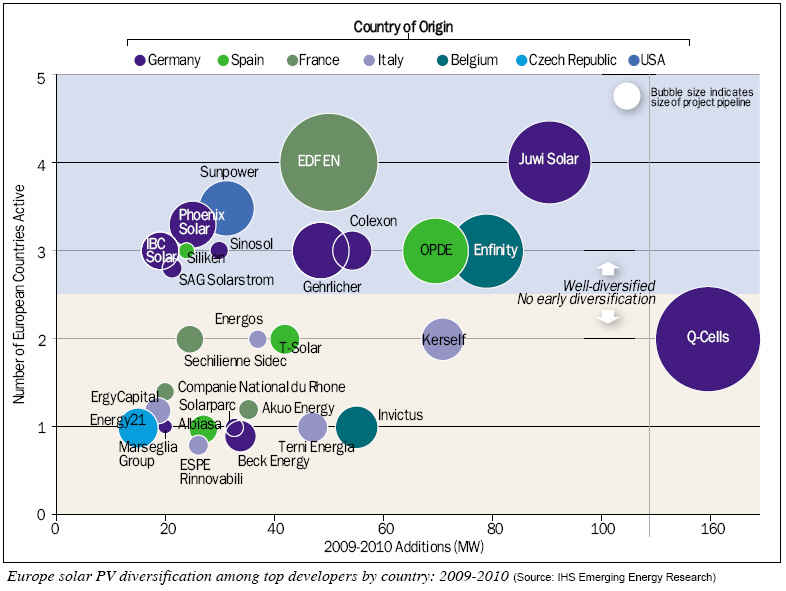

Europe PV Developer Landscape

To date, the patchwork of local and national regulatory agencies, land availability, and capital requirements demonstrate the importance of local development experience in scaling solar markets. As a result, Europe PV developers are employing a variety of deployment strategies as they adapt to quickly shifting PV markets. More experienced German system integrators have flourished, but their singular impact on future growth is eroding in a more competitive landscape. The scaling activity of Italian, French, Spanish, Belgian, and Czech players has propelled a new group of companies into the industry forefront. As these companies leverage their domestic success and experience, many are positioned for broader international competition.

PV Developer Rankings: Leading Positions in Transition

Reflecting the quickly changing market conditions across Europe, the top developer positions in 2009 were marked with fluidity. While Spanish players continued to fall out of the top 30 rankings, a surge of new Italian and French developers have risen to the top. German developers continued to defend their leading positions, leveraging their experience and existing relationships to penetrate Europe¡¯s more stable PV market.

While system integrators account for 16 of the top 30 developers, technology promoters carved out a larger stake in the post-2008 PV landscape. Three of the top developers are classified as technology promoters. Meanwhile, utilities¡¯s announced plans in the PV sphere have yet to materialize for the most part, as only EDF EN makes the utility ranks.

Europe PV Capacity Forecasts

PV development is gaining momentum across Europe, with 5.7 GW installed in 2009, and is forecasted to maintain its growth trajectory as the PV sector progresses toward 101 GW of installed capacity by 2025. Initially bolstered by Germany¡¯s leading market role, the Europe PV sector is finding increasing opportunities in scaling markets such as Italy, France, Spain, the Czech Republic, and Belgium. PV support is manifesting itself largely through FiTs, but equally important to the growth has been the expanded site-specific tariff incentives (e.g., rooftop, BIPV).

Cassidy Deline is with IHS Emerging Energy Research (www.emerging-energy.com), the leading provider of research-based analysis, advice, and support to the global renewable power industry.

For more information, please send your e-mails to pved@infothe.com.

¨Ï2010 www.interpv.net All rights reserved.

|