BY Brent Harris

Thin-film Technologies

Introduced into the market 32 years after silicon crystalline--thin film photovoltaics were the product of industry driven research aiming to improve processing, decrease silicon demand (or explore the use of new photovoltaic materials) while increasing efficiencies and decreasing costs.

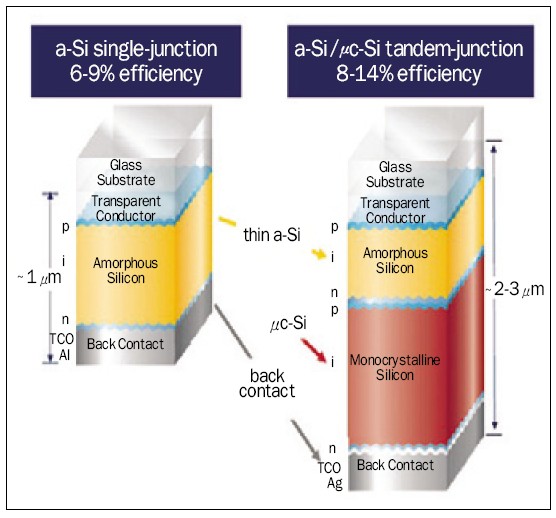

The first of the three thin-film technologies common today was amorphous silicon. Then, through the exploration of alternative photovoltaic materials, Cadmium Telluride and CIGS (Copper Indium Gallium Selenide) were invented. Each of these materials requires anywhere from tens of micrometers to nanometers of photovoltaic material--using significantly less resources to create one module. The process of manufacturing a thin-film solar module is very similar to that of manufacturing an LCD projection television--one product converts light into energy and the other converts energy into light.

Solar Investment

So, if thin film uses less material, a more efficient manufacturing process and offers new customer benefits, why has the technology seen such a slow market uptake?

One reason--investment; or rather lack thereof.

In the 1980’s both technologies were around, thin film was brand new and crystalline had already been used in many satellite and space applications. It was decided then by the U.S. Department of Energy to focus their efforts and resources on developing the crystalline technology for terrestrial applications and many thought at the time that it was the end of the road for thin film. This decision was largely responsible for allowing crystalline to take a giant lead over other photovoltaic technologies resulting in products available for general commercial applications by the late 1980’s, and ultimately for helping the technology get to where it is today.

Challenges to Thin-film Manufacturers

Despite this setback, thin-film technology continued to progress, focusing on niche portable and flexible applications and has recently gained greater acceptance as a viable photovoltaic technology for the mass market. This late start has made it difficult for thin-film manufacturers that are now trying to gain a foothold in the mainstream PV market. These manufacturers are faced with three basic challenges:

● Lower efficiency. Due in part to the lack of research and development investment thin-film technologies suffer from significantly lower efficiencies than that of crystalline--requiring as much as double the space to deliver the same power. This can be a problem in space constrained installations, but also increases the relative cost of racking, wiring and installation, forcing thin-film manufacturers to sell their modules at a lower price per watt than their crystalline counterparts. While some of the technologies will likely never be on par with crystalline technology in terms of efficiency, others show promise and are likely to catch up as production volumes increase. For example, CIS technology is already delivering commercial product with efficiencies between 10-12%. Most recently, in Germany on May 4 2010, researchers at the Centre for Solar Energy and Hydrogen Research created a CIS cell which was 20.1% efficient and could produce a market ready product with 15% efficiency within the next few years (Photovoltaics World, 2010).

● Near term cost competitiveness. Much of the recent investment in thin-film manufacturing technology was driven by the high market prices in recent years. As these new thin-film factories came online, the market dynamics had changed and module prices plummeted. With much lower margins available to support their ambitious growth plans, some thin-film companies are closing their doors. However, most are pressing on with a focus on sustainable growth supported by R&D to improve efficiency in order to be able to reach their potential.

First Solar, the thin-film success story, is the exception to this rule and has achieved production costs which are half of that of crystalline at US$0.90 with efficiencies of between 10-11%. While the characteristics of its technology certainly contributed to this achievement, First Solar has also had the benefit of steady investment into the development of its proprietary technology and its manufacturing capacity over the past decade.

● Bankability. Although it has been around for over 20 years, thin film is seen as a ‘new’ technology. This creates difficulty in getting project financing. Again, the dropping prices on crystalline technology, and an oversupply situation exacerbate the problem for thin film since proven alternatives are available. Thin-film manufacturers are overcoming this barrier through intensive reliability testing and through support from large insurance companies who will stand behind the warranties.

Thin-film Outperforms

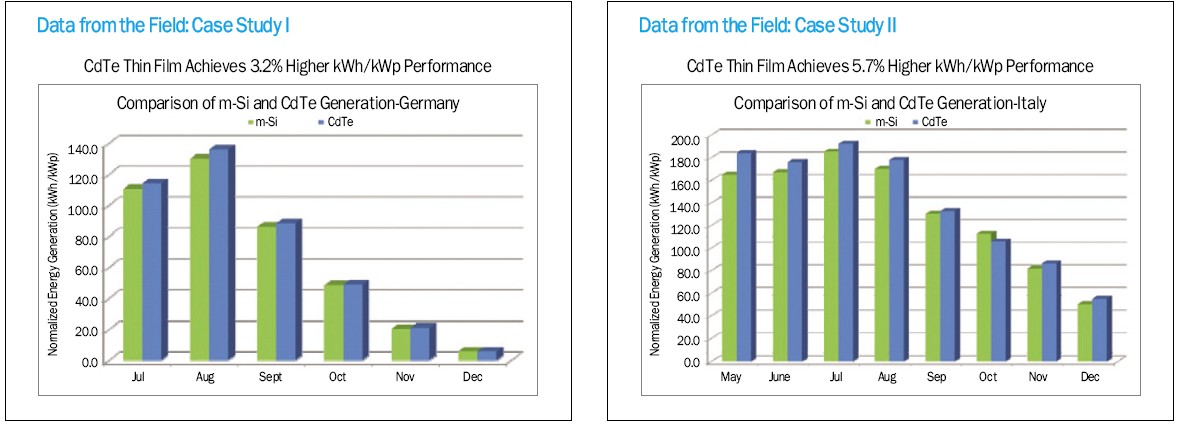

However, new research results are showing thin-film modules outperforming crystalline modules in non-ideal (i.e., real-world) conditions--better performance data in lower light levels such as diffused light, as well as in direct sunlight with high temperatures. For example, in two case studies presented by Forrest Collins of juwi Solar at a recent thin-film solar conference in California, their cadmium telluride installation showed a 3.2%-5.7% higher performance than crystalline at the same location.

While this higher output relative to rated power is a clear benefit on its own, there is a deeper benefit--especially when it comes to commercial installations: The performance of thin-film modules suffers less than that of crystalline when they are not installed at the ideal orientation. This becomes a more important factor as photovoltaic systems move from highly engineered showcase installations to more practical installations where the system is treated more as a building appliance. In these cases, the goal is to keep the upfront engineering and custom design costs as low as possible. This results in a ‘structurally optimized’ installation, meaning an installation aligned with the building structure and at relatively low tilt. The superior performance of thin film under such conditions will help the technology to establish itself in the mainstream commercial rooftop market, and will eventually lead to its dominance of BIPV applications--the ultimate ‘structurally optimized’ installation.

Separating the Wheat from the Chaff

There have been many media reports recently which discuss what a risky industry the thin-film industry is, citing large companies who are backing out of the market. Simply put, this is probably better understood as an example of separating the wheat from the chaff. The companies who are staying in the market are serious about the technology and are working hard to not only raise the profile of thin film but to prove the viability of the technology in today’s marketplace.

It is important to remember that crystalline had almost a 3-decade head start on thin film and has not had the level of sustained technology investment that crystalline photovoltaics have enjoyed. It has only been truly commercial in the latter part of the past decade, and market shares are already projected to grow to 31% by 2013 (iSuppli Corporation, 2009). Investors and customers are starting to see the potential in thin film--and believe that in a just a few more years it could become the predominant technology in the photovoltaic industry.

These projections show the bright future ahead for thin film--but it is not without its challenges. Thin-film companies saw anywhere from ½ billion to a 2 billion dollar loss for the 2009-2010 year and in order to counter those losses they will need to begin to turn a profit.

Increasing Competiveness

In order to really make their modules viable, thin-film companies must achieve higher conversion efficiencies, which is imperative for increasing thin film’s competiveness against crystalline and increasing sales. They should also explore offering a differentiated product or service such as offering optimized materials and installations. This way they will be able to profit from selling the BOS components and can entice customers with their ‘total package’ offerings in order to mitigate some of the challenges of selling thin-film modules on a component basis.

Last, thin-film manufacturers need to continue to drive down the cost per watt of their products. This is also imperative to obtaining a competitive edge of crystalline--particularly while module efficiencies remain significantly lower than crystalline.

Crystalline silicon has been the only real player in the solar PV game for a long time. The technology is tried trusted and true. With new technologies such as thin film stepping onto the court--the question is not about which technology is better or more advanced--but rather where can the second generation of solar PV technology fit in? As thin-film technologies grow, and begin to rival crystalline in cost and efficiency, an ability to identify to which application either technology is best suited will help both the manufacturers and the customers make a more informed choice for their project; all of which will help to push the solar PV industry to new heights.

Brent Harris is Vice President at Sustainable Energy Technologies (http://www.sustainableenergy.%20com/).

For more information, please send your e-mails to pved@infothe.com.

ⓒ www.interpv.net All rights reserved

|