|

By Mortenson

.jpg)

.jpg) The surface of the sun is interspersed with brilliant flairs of brightness and areas of relative inactivity. The same might be said of the utility-scale solar market. A recent burst of activity has tripled installations in just two years, but areas of doubt and uncertainty remain. The surface of the sun is interspersed with brilliant flairs of brightness and areas of relative inactivity. The same might be said of the utility-scale solar market. A recent burst of activity has tripled installations in just two years, but areas of doubt and uncertainty remain.

Continued enthusiasm for solar energy was underscored by attendance of over 30,000 stakeholders at last Fall¡¯s 2011 Solar Power International (SPI) Conference. Mortenson gathered feedback from 265 professionals at the show to conduct a study and shares the result in this article. Respondents represented a broad array of organizations, including utilities, developers, Independent Power Producers (IPPs), financiers, and module and equipment suppliers.

The majority were very optimistic, convinced that solar would outpace other renewable alternatives, and reach cost parity with coal and gas within 10 years. This optimism is natural given recent growth, as well as technological and manufacturing advancements and decreasing solar energy costs.

However, the solar industry is also at a moment of uncertainty.

Respondents acknowledged vulnerability to government policy and continuing budget deficits. The industry continues to face significant structural challenges in areas such as transmission infrastructure and energy storage. Utilities were less optimistic about growth and new technologies than many of the suppliers and developers.

In the Sweet Spot

.jpg) Solar energy has entered an expansion phase of high growth driven by technological advancements and falling module prices. Solar energy has entered an expansion phase of high growth driven by technological advancements and falling module prices.

67% of professionals surveyed said their organizations have experienced significant growth in their solar business over the last year. The growth of solar is attracting many new participants. The average respondent in our survey has worked in renewable energy only 4.4 years. Those who have worked in renewables for at least 10 years have worked for an average of 3.6 renewables companies, reflecting the high degree of transition that exists across many companies.

The near-term growth expectations of utility company respondents was lower than expectations of other players. For example, a full 93% of developers and IPPs expect their firm¡¯s solar business to grow in 2012, while only 40% of utility companies expect the same. This suggests that the numerous solar projects being planned by developers and IPPs may be chasing a more limited number of utilities looking to expand solar purchases¦¡perpetuating the highly competitive environment that exists for new projects.

We asked utilities to list the most important criteria they use to choose developer and IPP partners from which to purchase energy. 35% of participants mentioned low cost. 20% of participants mentioned experience and/or technical ability, and 20% also mentioned a firm¡¯s ability to deliver the project as promised and on time. Financial strength and location were mentioned by 10% of respondents.

Optimism for the Future

.jpg) The solar industry faces significant hurdles in both the short-term and long-term. Short-term challenges include competition from cheap and abundant natural gas as well as the expiration of important federal renewable energy grants. Participants who took our survey expressed solid optimism that solar would overcome these challenges. The solar industry faces significant hurdles in both the short-term and long-term. Short-term challenges include competition from cheap and abundant natural gas as well as the expiration of important federal renewable energy grants. Participants who took our survey expressed solid optimism that solar would overcome these challenges.

Only 10% of respondents felt that natural gas will have a significant negative impact on solar, and nearly half did not believe natural gas poses any risk.

When we asked why, many participants felt solar energy will continue to experience significant cost reductions that will counter potential impacts from natural gas. Many also felt that U.S. and state governments will continue to support a broad portfolio of energy sources that includes renewables. Others pointed out that natural gas production brings pollution concerns that have yet to be addressed.

.jpg)

The ability to qualify for the federal government¡¯s 1603 Treasury Grant Program, which provided cash grants for renewable energy projects, expired at the end of 2011. Although 30% believed the expiration of this grant would have a large negative impact on the solar industry, 56% felt the expiration would have only a modest negative impact on solar, and 14% believed the impact would be insignificant.

Ultimate Parity

In the long-term, attaining grid parity against other energy sources is the challenge facing solar. In this regard, participants who took our survey were also optimistic that solar will meet the challenge and outgrow other energy options.

71% of participants felt solar will surpass wind energy in annual generating capacity additions, even though current new wind capacity is 5-6 times greater.

Perhaps more surprising, well over half of participants felt solar will achieve grid parity with fossil fuels within the next 10 years¦¡ and only 12% felt that solar would never reach competitiveness.

Optimism in solar competitiveness is understandable given historical trends. The per watt price of solar modules has dropped from US$22 in 1980 to under US$3 today, and has fallen 40% in the last year alone.

Still, the kilowatt-hour cost of solar electricity is about 3-4 times that of coal or natural gas today. It remains to be seen whether technological advancements can bridge this gap, but there is no doubt participants who took our survey believe solar will accomplish this.

Current Day Challenges

.jpg) Optimism in the future of solar does not mean market participants are unconcerned about current day issues surrounding their industry. Optimism in the future of solar does not mean market participants are unconcerned about current day issues surrounding their industry.

Participants wrote in the one or two greatest obstacles that they saw facing solar today. Their grouped responses can be seen in Q6.

The responses of participants to Q6 reflect an industry experiencing pricing pressures from other energy sources and fearful of inadequate government incentives and policy support.

Some participants are also worried that political developments or powerful fossil fuel lobbyists would erode government support for renewables.

Several ¡®on the ground¡¯ participants such as utilities and developers also mentioned transmission infrastructure concerns and interconnection issues. Although mentioned less frequently, some participants were also concerned about the lack of public education regarding solar and felt it important to maintain a positive reputation for solar in the face of failures such as the recent bankruptcy of Solyndra.

We also asked participants to select current industry challenges from a pre-created list. The selections participants chose showed consistency with their written comments. ¡°Lack of strong federal and state renewable energy standards¡± received the most votes, followed by ¡°Uncertainty of economic competitiveness of solar.¡±

Infrastructure and technological issues such as transmission and storage did not rise to the top in participant responses. Although important issues, participants are more worried about competitiveness and government support.

¡°Questionable viability of module suppliers¡± was not chosen as an issue by participants. Although the module supplier industry remains in flux with fierce international competition, this dynamic was not seen as threating the progress of solar energy¦¡and in fact has helped the industry by driving down module prices. ¡°Questionable viability of module suppliers¡± was not chosen as an issue by participants. Although the module supplier industry remains in flux with fierce international competition, this dynamic was not seen as threating the progress of solar energy¦¡and in fact has helped the industry by driving down module prices.

(Note: The survey was conducted shortly before SolarWorld Industries filed an anti-dumping lawsuit against Chinese module manufacturers, which likely raised concerns among solar professions regarding dynamics in the module industry.)

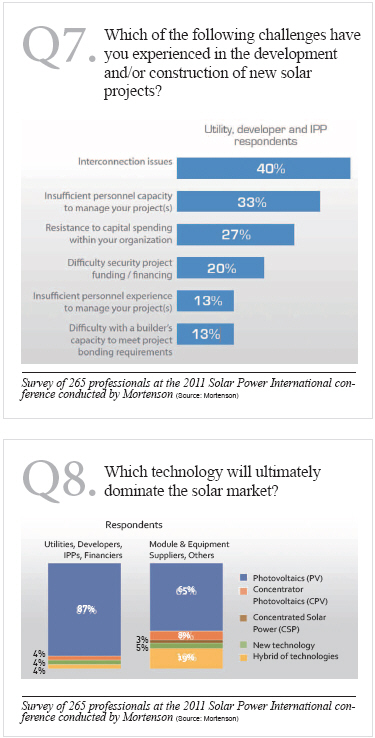

A full 4 out of 10 utilities, developers and IPPs have experienced interconnection issues related to new solar projects, and 1 out of 3 have struggled with having enough personnel to manage their projects.

Uniform, simplified interconnection procedures to connect solar projects to utility grids do not exist, and this results in technical and contractual issues that can significantly delay projects.

Future State

Participants were asked which solar technology will ultimately dominate the market (see Q8). Photovoltaics (PV) was the clear winner. ¡°The technology of the future is the same technology that has been bankable for 25 years, crystalline PV modules,¡± said one respondent.

87% of on the ground participants (utilities and developers) felt photovoltaics will dominate, but only 65% of supplier and other participants felt the same way and saw greater potential in Concentrated Photovoltaics (CPV) and hybrid technologies.

We also asked participants what emerging solar technologies they felt had the greatest chance of reaching commercial viability. New types of thin-film module technologies were mentioned most often. Examples of these include Cadmium Telluride Photovoltaics (CdTe), Copper Indium Gallium Selenide (CIGS), and Organic Photovoltaics (OPV). A smaller number of participants mentioned emerging concentrator technologies such as Highly Concentrated Photovoltaics (HCPV).

Participants also named the states they felt offered the best overall environment (regulatory, incentives, weather, etc.) for the development of solar projects. California was the clear winner, followed by Texas.

¡°California remains the leader in creating a market for solar,¡± one developer told us. ¡°Having a renewable portfolio standard signed into law is a big driver in that.¡±

California law requires utilities to generate 33% of their electricity from renewables by 2020¦¡the most ambitious target established by any state. Several participants pointed out that solar enjoys solid popular and political support in California as well.

.jpg)

Solar and Society

We asked solar professionals to share their opinions regarding what drives public interest in renewable energy, and the potential of renewables to help solve environmental issues.

Only 19% of professionals believe greenhouse gas concerns are the primary driver of public interest in renewable energy.

When asked a follow-up question regarding whether global warming concerns provide meaningful support to the renewables today, only 26% of professionals agreed. Energy independence¦¡not global warming¦¡is seen as the main driver of public renewables support, followed by interest in the jobs renewables can bring to our economy.

Regardless of current opinions regarding global warming, beliefs of solar professionals paint an ominous picture of what the future may hold.

Survey participants believe scientists are in strong agreement that fossil fuels are heating up the planet and that unchecked global warming will bring substantial calamity to our planet.

At the same time, 4 out of 10 participants believe human intervention can do little to alter the trend of global warming, which highlights the skepticism many people have regarding actions to eff ectively reverse global warming. Still, 60% believe proactive measures can make an impact, and nearly all participants agreed that countries should work in concert to try to address global warming.

Preferences Regarding Contractors

The execution of new solar projects is often fraught with technological, construction and performance risks for developers, utilities, and IPPs. Careful selection of a solar contractor can help mitigate these risks and ensure a successful project.

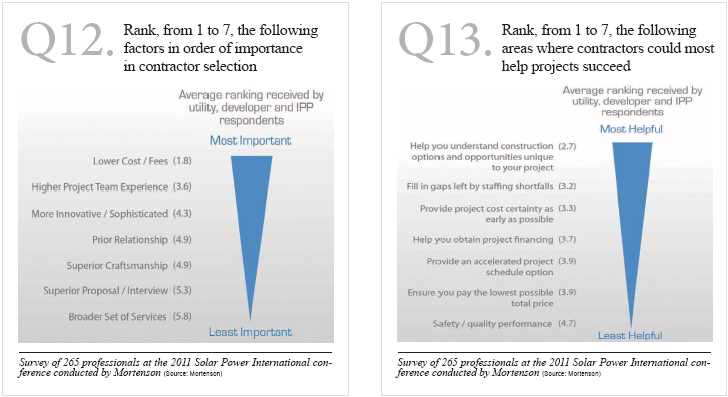

We asked utility, developer, and IPP participants to think back to their last solar project and rank factors in order of their importance in the contractor selection process (see Q12).

Participants felt the most important factor that drives contractor selection is lower costs. The other top factors speak to the importance for a contractor to bring experience, ideas, and certainty to new solar projects.

It is important for a contractor to not only have a deep understanding of technologies, but also possess the capability to find new and innovative ways to streamline designs and processes to deliver maximum value.

In fact, when we asked participants to name the single most important area builders could improve upon, nearly a third mentioned innovation and value engineering. Only better pricing received more mentions.

Where Can Contractors Help?

To explore even further areas where builders can help, we asked participants to rank potential builder activities in terms of the ones they felt would most help projects succeed. In order of importance, the areas that received the highest rankings are shown in Q13.

The #1 factor again speaks to the desire of utilities and developers to fully explore innovative options that can maximize the success and value of their projects. The other top factors illustrate the difficult budget, cost, and financing environment within which projects are developed, and the importance placed on contractors that can help solve these issues and bring cost certainty to a project. The #1 factor again speaks to the desire of utilities and developers to fully explore innovative options that can maximize the success and value of their projects. The other top factors illustrate the difficult budget, cost, and financing environment within which projects are developed, and the importance placed on contractors that can help solve these issues and bring cost certainty to a project.

¡°Ensure that you pay the lowest possible total price¡± was not selected as a top area, suggesting that single-minded focus on price alone is not recipe for success when executing complex solar projects.

We also asked utilities, developers, and IPPs which aspects of the construction process they feel contractors are least competent. Their top three answers illustrate the potential challenges in providing cost and process certainty during the construction process, and the value of partners that can address these challenges (see Q14).

Mortenson Construction (www.mortenson.com) is a leading builder of renewable power facilities in North America, constructing more than 100 solar and wind projects generating more than 11,000 megawatts of renewable power across the U.S. and Canada. With 100% of Mortenson¡¯s business in the power sector coming from renewable energy, Engineering News-Record ranked Mortenson the 11th largest power contractor in the U.S. A U.S.-based, family-owned business, Mortenson Construction is a leading builder in North America and one of the only domestic builders with capabilities in Asia. With services in general contracting, construction management, design-build, EPC/BOP and project development, Mortenson is capable of delivering projects of any scope and size, in North America and abroad. From cutting-edge stadiums and state-of-the-art, LEED-certified mission-critical projects to some of the most innovative renewable energy projects on the planet, Mortenson is building structures and facilities for the advancement of modern society.

For more information, please send your e-mails to pved@infothe.com.

¨Ï2011 www.interpv.net All rights reserved. |