By Jack Calderon, Chaim Lubin

.jpg)

.jpg)

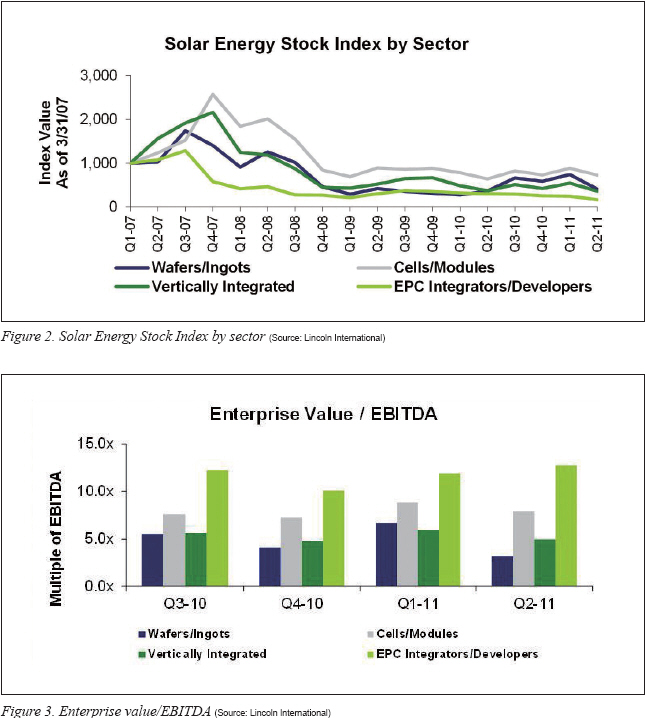

Increased competition and continued economic uncertainty around the globe, and particularly in Europe, severely impacted the solar industry as evidenced by stocks declining beyond the S&P 500 during the second quarter of 2011. Cell and module manufacturers were impacted significantly as increased competition drove down module prices and reduced the overall profitability to these firms. However, companies at the front of the supply chain, as well as those that have established a vertically integrated model, have exhibited improved profitability and, in effect, some strength in the industry.

In the second quarter of 2011, the index of solar companies tracked by Lincoln International (the ‘Solar Stock Index’) underperformed the S&P 500 with the Solar Stock Index declining 24% while the S&P remained flat. Cells/Modules companies’ stocks declined the least, decreasing 18%. However, as noted by current stock prices, this trend may continue and could look far worse in the third quarter of this year. Vertically Integrated companies and EPC Integrators/Developers declined 33% and 34%, respectively, while the Wafers/Ingots companies at the front of the solar industry value chain declined the most at 45%.

Valuation multiples declined in all sectors except for EPC Integrators/Developer companies, which highlights the industry trend of organizations looking toward these companies as driving value through pipeline access and ownership. The EPC Integrators/Developer companies are currently viewed as attractive throughout the value chain providing the valuable link between cells, which have become more of a commodity, and the ultimate customer. This has driven EBITDA multiples for EPC Integrators/Developers to an average of 12.8x, which is higher than any of the other sectors in the solar industry and the highest level for this sector in more than a year. The Cells/Modules sector exhibited EBITDA multiples at 8.0x on average, which is half a turn lower than last quarter and could potentially drop even further due to the increased competition in the market. Vertically Integrated companies declined slightly, exhibiting EBITDA multiples of 5.0x on average and Wafers/Ingots were the most severely impacted with valuations dropping in half, resulting in EBITDA multiples of only 3.2x on average.

As previously mentioned, the operating performance of Cells/Modules companies has been severely impacted by increased competition and lower solar cell prices. The revenue softness among these companies caused the three year CAGR of the Cell/Module sector to decline from 37% in the first quarter of 2011 to only 29% by the end of the second quarter of 2011. Vertically integrated companies saw some revenue softness with their three year CAGR decreasing four percent, while both Wafers/Ingots companies and EPC Integrators/Developers showed revenue strength with their three year CAGRs increasing slightly. Vertically Integrated companies still maintained the highest EBITDA margins across the value chain at 23% and Wafers/Ingots companies also exhibiting profitability strength at 22% EBITDA margins. Cells/Modules companies’ EBITDA margins declined only slightly from 13% in the first quarter of 2011 to 12% by the end of the second quarter of 2011. However, as noted Cells/Modules companies will face continued pricing pressure, which could severely impact these margins by the end of the third quarter of 2011. EPC Integrators/Developers again exhibited declining EBITDA margins, which dropped from 7% on average to only 5% on average. The EPC Integrators/Developer is still significantly fragmented and, therefore, it has been difficult for these firms to exhibit significant profitability due to competitive pressures. However, the value of the pipeline that these companies have access to or own outright has shown up in valuation multiples and M&A activity within the sector. There continues to be valuable opportunities for acquisitions, especially among the EPC Integrator/Developer group. As previously mentioned, the operating performance of Cells/Modules companies has been severely impacted by increased competition and lower solar cell prices. The revenue softness among these companies caused the three year CAGR of the Cell/Module sector to decline from 37% in the first quarter of 2011 to only 29% by the end of the second quarter of 2011. Vertically integrated companies saw some revenue softness with their three year CAGR decreasing four percent, while both Wafers/Ingots companies and EPC Integrators/Developers showed revenue strength with their three year CAGRs increasing slightly. Vertically Integrated companies still maintained the highest EBITDA margins across the value chain at 23% and Wafers/Ingots companies also exhibiting profitability strength at 22% EBITDA margins. Cells/Modules companies’ EBITDA margins declined only slightly from 13% in the first quarter of 2011 to 12% by the end of the second quarter of 2011. However, as noted Cells/Modules companies will face continued pricing pressure, which could severely impact these margins by the end of the third quarter of 2011. EPC Integrators/Developers again exhibited declining EBITDA margins, which dropped from 7% on average to only 5% on average. The EPC Integrators/Developer is still significantly fragmented and, therefore, it has been difficult for these firms to exhibit significant profitability due to competitive pressures. However, the value of the pipeline that these companies have access to or own outright has shown up in valuation multiples and M&A activity within the sector. There continues to be valuable opportunities for acquisitions, especially among the EPC Integrator/Developer group.

The solar industry is currently facing a very difficult environment. Cell pricing declines have caused substantial pressure across the value chain and are causing some consolidation and shakeout to occur. This pressure has, and may continue to cause some firms to get pushed out or require companies to merge or access additional resources to continue operations. On the positive side, there continues to be a strong pipeline of solar projects around the globe and an expectation for many geographies to exhibit continued growth for solar. The firms that can weather the competitive pressure and strategically use this turbulent period to their advantage will be better positioned and could emerge even more successful than they were previously.

Jack Calderon is Managing Director at Lincoln International (www.lincolninternational.com) and co-heads the firm’s Renewable Energy Group.

Chaim Lubin is an associate at Lincoln International and a part of the Renewable Energy Group.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2011 www.interpv.net All rights reserved. |