By Dr. Ashish Pandey

.jpg)

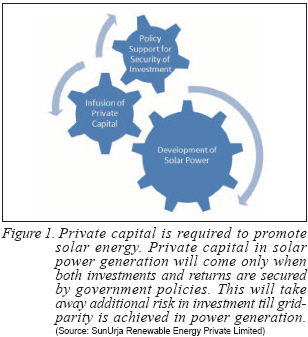

.jpg) The policy makers have put in place a secure mechanism to meet the challenge of meeting India¡¯s exponentially growing energy need by public-private partnerships. Excellent policy framework secures investments and returns and enables infusion of private capital in the sector to support a burgeoning demand for sustainable energy. The policy makers have put in place a secure mechanism to meet the challenge of meeting India¡¯s exponentially growing energy need by public-private partnerships. Excellent policy framework secures investments and returns and enables infusion of private capital in the sector to support a burgeoning demand for sustainable energy.

Strategic compulsions and an inevitable growth has put in place all the ingredients to make India a perfect market for solar¦¡an ever increasing gap in supply and demand for energy, unsustainable to meet the demand conventionally and a right policy framework in a stable democracy.

A stable photovoltaic market and its immense growth prospects make India a destination of choice for players across the value chain. The article explores the growth trajectory as it traverses very exciting times. It puts forwards the key drivers and policy insights to help analyze the market¦¡its potential and risks. It provides an update on the current situation as it unfolds to capture the underlying challenges and the opportunities that lie hidden underneath.

The Demand for Energy and the Need for Renewables

Within a span of few years, the per capita energy consumption in India increased from meager 450 units in the year 2004 to 650 units some time back and is projected to be 1,000 units the year 2011-12. Even today when our per capita consumption is close to 1,000 units a year, similar figure for nations with much higher human development index runs into thousands of units per year. For example, the figure for the U.S.A. is 13,250 units a year. Within a span of few years, the per capita energy consumption in India increased from meager 450 units in the year 2004 to 650 units some time back and is projected to be 1,000 units the year 2011-12. Even today when our per capita consumption is close to 1,000 units a year, similar figure for nations with much higher human development index runs into thousands of units per year. For example, the figure for the U.S.A. is 13,250 units a year.

To meet the aspirations of our billions, even the conservative estimate for energy production should be 7,500 billion units¦¡in line with estimated consumption of 5,000 units of annual per capita consumption.

This works out to be more than ten fold increase in consumption between now and 2030. And, this estimate takes into account the state of the art in energy conservation by the year 2030 and conservative approach towards consumption in general. The conventional approach towards meeting this challenge by ¡®burning more¡¯ will not work as energy security concerns will define how Indian decides to meet the challenge.

Energy Security

The big question may not be whether India will consume, then, as much as its more developed counterparts in the West are consuming now. The question is how India is going to produce that much of energy.

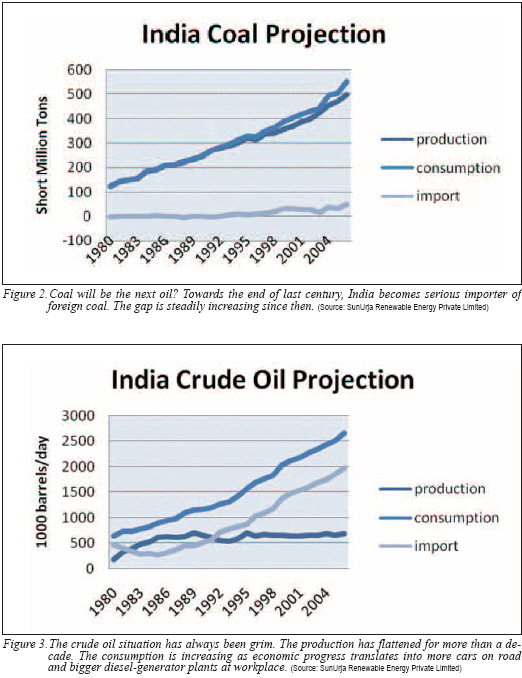

The chances are remote that burning coal will be an answer. The coal situation in one word is bad and future is not promising either. Recently, India became net importers of foreign coal. And very soon several super thermal power plants will start firing imported coal to make the situation even worse.

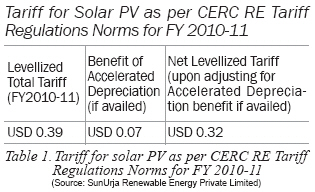

Oil is less said the better. India will need oil to drive its cars and also fuel world¡¯s largest diesel driven captive power generation capacity. A look at the oil situation shows that Indian oil production is flattening. Consumption is increasing and long term price projection talks of unacceptable risks.

It¡¯s not just climate change but prospects of stunted economic growth that is a long-term worry. Indian economy cannot sustain conventional energy production of the scale that will be required in the next 20 years. The climate change sideshow will only help to project the solar alternative.

The Policy Framework¦¡The Basis

It is clear that the energy has to be produced in close public-private partnership. It is imperative that to enable such a partnership, a strong policy framework has to be in place.

To meet the demand on energy in the coming decades as India embarks on unprecedented growth, the legal framework in India recognizes the need of renewable energy in overall energy mix to ensure sustainable development of India¡¯s energy sector. The Electricity Act 2003, has paved the path for creation of central and state electricity commissions with the responsibility of promoting generation of electricity from renewable energy sources of energy in their domain. The act stipulates formation of central electricity commission under clauses (a) and (b) of Section 79 of the Electricity Act, 2003. The central electricity commission will formulate tariff for central entities and matters pertaining to multiple states. The act also empowers the state electricity commission under section 181 of the Electricity Act, 2003 to formulate tariff in the respective state.

Section 61 (h) of the act stipulates that the commission must take measures to stimulate investment in renewable energy area by taking suitable measures:

¡°The Appropriate Commission shall, subject to the provisions of this Act, specify the terms and conditions for the determination of tariff, and in doing so, shall be guided by the following, namely: the promotion of co-generation and generation of electricity from renewable sources.¡±

Section 86(1) (e) of Electricity Act 2003 mandates the State Electricity Regulatory Commission to:

¡°Promote Co-generation and generation from Renewable sources of energy by providing suitable measures for connectivity to Grid and sale of electricity to any person, and also specify, for purchase of electricity from such sources, a percentage of total consumption of electricity in the area of distribution licensee.¡±

The tariff policy is designed to bridge the viability gap as the solar energy evolves to compete with conventional sources of energy. The tariff is designed to procure energy from solar at preferential tariffs to be determined by the Commissions using a transparent process in close collaboration with all the stakeholders.

The Policy Framework¦¡The Tariff

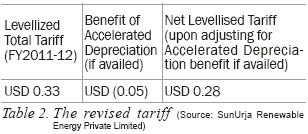

The Tariff designed by The Central Electricity Regulatory Commission and is published as Terms and Conditions for Tariff determination from renewable Energy Sources Regulations, 2010

¡°the generic tariff determined for Solar PV projects based on the capital cost and other norms applicable for the year 2010-11 shall also apply for such projects during the year 2011-12;

provided that

(i) the Power Purchase Agreements in respect of the Solar PV projects as mentioned in this clause are signed on or before 31st March, 2011

(ii) the entire capacity covered by the Power Purchase Agreements is commissioned on or before 31st March, 2012 in respect of Solar PV projects.

Tariff Design

Clause (1) of Regulation 9 of the RE Regulations stipulates that the tariff for RE projects shall be single part tariff consisting of the following fixed cost components:

(a) Return on equity;

(b) Interest on loan capital;

(c) Depreciation;

(d) Interest on working capital;

(e) Operation and maintenance expenses

Fixed Cost Components for Solar PV

-Benchmark capital cost for solar PV power shall be US$3.6Million/MW for the FY 2010-11.

-Useful life of solar PV plant is 25 years.

-Capacity utilization factor 19%

Further for Calculation of Tariff

(a) Return on equity;

Pre-tax 19% per annum for the first 10 years, and

Pre-tax 24% per annum from the 11th year onwards.

Weighted average RoE 22%

(b) Interest on loan capital;

Debt Equity Ratio 70:30

Period of Loan 10 years

Interest rate 13.39%

(c) Depreciation;

The Salvage value of the asset shall be considered as 10% and depreciation shall be allowed up to maximum of 90% of the Capital Cost of the asset.

¡®Differential Depreciation Approach¡¯ over loan tenure and period beyond loan tenure over useful life computed on ¡®Straight Line Method¡¯. The depreciation rate for the first 10 years of the tariff period shall be 7% per annum and the remaining depreciation shall be spread over the remaining useful life of the project from 11th year onwards.

Depreciation shall be chargeable from the first year of commercial operation.

(d) Operation and maintenance expenses;

Normative O&M expense of US$0.02 million/MW for FY 2010-11 has been considered along with escalation factor of 5.72% p.a.

Revised Tariff Policy 2011-2012

Power Purchase Agreement (PPA) signed after March 2011 will follow revised tariff structure. The change is essentially due to reduction in benchmark capital cost to US$3.13 million. The Revised tariff now stands at:

Inside the Indian Market

Currently the main driver for solar market is the Jawaharlal Nehru National Solar Mission¦¡a policy initiative by Government of India to stimulate the market by providing funds for bridging the viability gap till the grid parity is achieved. The mission envisages 20 GW of solar installation in India in a phased manner by year 2022. This will be divided into equal parts for Solar PV and Solar thermal. India will therefore see 10 GWp of off-grid and on-grid solar PV installation. Initiatives by states will add another 5-10 GWp of capacity especially in sunny Gujarat and Rajasthan states of India. Assuming that no grid parity is achieved and entire solar industry remains policy driven it is expected that India will see 20 GWp of solar installation in the next ten years. It is expected that about 15GWp will be grid tie¦¡11kV and above and about 5 GWp will be off-grid and stand-alone systems including large area street lightening projects and village power systems.

All this will be achieved from existing cumulative installation of less than 20 MWp today.

The Implementation Trajectory FY 2010-11

A phased implementation path is envisaged by policy designers to allow capability building. In the first phase upto 2012-13, the projects are to be implemented by two agencies.

Rooftop PV & Small Solar Generation Programme(RPSSGP) is implemented by Indian Renewable Energy Development Agency (IREDA) jointly with State Nodal Agencies. In the first phase small ground based and roof-top projects from 100 kWp to 2 MWp capacity upto a total capacity of 90 MWp are implemented. These projects will connect to below 33kV bus bar.

The projects were selected online on first come-first-serve basis and the project was oversubscribed in three minutes. The PPA is signed as per the tariff designed by Electricity Commission. The funds for paying higher tariff are provided by the budgetary allocation of the Mission.

NVVN¦¡A Public Sector Power Trading Company was designated nodal agency for development of large project of 5 MWp capacity each to be connected to 33 kV or above voltage level. The first phase will see 150 MWp synchronizing with grid if all the 30 selected projects go online.

The projects were registered using a two tier selection process. Initially projects which met the standard criteria or land, net-worth etc. were shortlisted.

The final selection required reverse bidding and developers were selected based on discount offered on the CERC specified tariff. The 30 projects that made it to the list offered energy at US$0.23 to 0.27/kWhr.

To make it viable for NVVN the government has allocated equal amount of capacity of coal fired plants for every MW of solar project capacity for which PPA will be signed by NVVN to balance the higher rates to be offered to developers.

The policy mandates use of indigenous solar panels and ensures compliance by demanding bank guarantee for setting up project and reverse bids.

Overall we see opening of a serious market with strong fundamentals. The first steps have been taken. Aggressive pricing, notwithstanding developer¡¯s lack of expertise to fully define project variables has exposed the projects to cash flow risks. The next part of the article will look deeper by opening up the EPC quotes floating in the market and will discussall the variables of interest in Indian context to carry out a detailed techno-economics.

Dr. Ashish Pandey is Director of SunUrja Renewable Energy Private Limited, New Delhi, India. The company develops electronics and systems for solar power processing and also advises several corporate houses on entry into solar space.

For more information, please send your e-mails to pved@infothe.com.

¨Ï2011 www.interpv.net All rights reserved. |