.jpg)

The front of the solar industry value chain continues to exhibit strong performance as the market has high expectations for the future of the solar industry. The global increases in oil prices as well as the nuclear disaster in Japan have caused ripple effects that have the world re-evaluating its overall energy portfolio. Solar is viewed as relatively safe and is gaining traction as a cost effective alternative for future electricity generation. However, with softness in various tariff markets such as Spain and Italy, there is concern regarding the completion of the number of solar projects that are slotted to be installed. This has inhibited companies at the end of the value chain, such as EPC Integrators/Developers, from fully benefiting from the renewed market momentum.

.jpg)

The First Quarter Performance

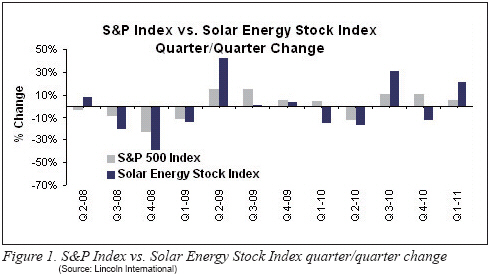

In the first quarter of 2011, the index of solar companies tracked by Lincoln International (the ‘Solar Stock Index’) well outperformed the S&P 500 with the Solar Stock Index gaining 21% while the S&P increased only 5%. The Wafers/Ingots sector at the very front of the solar industry value chain and Vertically Integrated companies were the two sectors exhibiting the strongest gains, both increasing approximately 25% on average. Cells/Modules companies followed closely increasing more than 20%, while EPC Integrators/Developer companies were the only sector to experience a decline of approximately 8% on average, highlighting the difficulties that continue in the solar project market.

High Trading Multiples

The increasing stock prices of companies within the Solar Stock Index have improved industry valuation multiples to some of their highest levels in a year. The Cells/Modules sector continues to exhibit strong EBITDA multiples at 8.5x on average, with Wafers/Ingots and Vertically Integrated companies both exhibiting slightly lower EBITDA multiples of 6.8x on average. Interestingly, EPC Integrators/Developers are currently trading at the highest valuation multiples of any of the other sectors in the solar industry at an average of 10.4x. It is certainly possible that the market is indicating that the positive dynamics occurring within the other sectors will indeed trickle down to the solar project level, and therefore, improve the overall performance of EPC Integrators/Developer companies. In addition, these high trading multiples could also indicate a potential consolidation phase within the fragmented EPC Integrators/Developer sector.

Margin Gowth

The operating performance of solar companies has varied with revenue growth slowing as compared to the last few quarters, but still remaining robust with CAGRs of all four sectors exceeding 30% for the last three years. At the front of the supply chain, the EBITDA margins of Wafers/Ingots remain strong at approximately 20%, which compares to the margins exhibited in this sector for the last few quarters. Cells/Modules companies’ EBITDA margins have also remained consistent with previous quarters and have held steady at 13%. Vertically Integrated companies experienced the most significant increase in margins growing to more than 23% by the end of the first quarter of 2011. The Vertically Integrated model may be gaining some traction as this sector has experienced improving margins for the last two quarters. The only sector showing a declining margin profile was that of EPC Integrators/Developers with EBITDA margins declining to approximately 7% on average. The EPC Integrators/Developer sector will need some relief in the form of better tariff certainty in the global market, improved Power Purchase Agreement (PPA) rates, or the removal of other impediments slowing down project installations in order to curb the continued margin decline. Otherwise these companies will need to rethink their models in order to drive profitability through efficiency improvements, identify new areas of revenue generation or consider a merger or acquisition to enhance their overall strategy.

Risks & Positives

The current global energy environment certainly has characteristics that provide positive benefits to the solar industry, whether through increased oil prices or the uncertainty of nuclear as part of a larger energy portfolio. The attractiveness of solar companies and the market’s future growth expectations are driving improved financial performance resulting in increased stock prices and valuations. However, there is a risk of oversupply in the market with solar projects being delayed and the uncertainty that exists with overall tariff structures worldwide. While these risks exist, there are many potential positives that could help the continued growth and success of the industry, including markets such as China and India displaying significant potential to take over as major geographies for solar, decreases in solar system costs which brings the industry closer to grid parity and increasing pressure in the U.S. and abroad to improve and solidify incentive structures. 2011 started off strong, yet how each of these areas play out will ultimately dictate the progression of all companies within the solar industry.

Jack Calderon is Managing Director at Lincoln International (www.lincolninternational.com) and co-heads the firm’s Renewable Energy Group. Chaim Lubin is an associate at Lincoln International and a part of the Renewable Energy Group.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2011 www.interpv.net All rights reserved.

|