By Tobias Rothacher

.jpg)

The EEG--Germany’s Market Driver for Over a Decade

.jpg) 2010 marked the ten-year anniversary of the landmark Renewable Energies Act (EEG), the masterpiece of Germany’s ambitious green policymaking. The law guarantees owners of Photovoltaic (PV) installations a fixed Feed-in Tariff (FiT) payout for 20 years, subject to size and system type (rooftop/field). Currently this rate is between 21.11 and 28.74 EUR cents/kWh if the installation is connected in the first six months of 2011. The enormous success of the EEG in Germany has led to the implementation of similar legislation in more than 50 countries worldwide. 2010 marked the ten-year anniversary of the landmark Renewable Energies Act (EEG), the masterpiece of Germany’s ambitious green policymaking. The law guarantees owners of Photovoltaic (PV) installations a fixed Feed-in Tariff (FiT) payout for 20 years, subject to size and system type (rooftop/field). Currently this rate is between 21.11 and 28.74 EUR cents/kWh if the installation is connected in the first six months of 2011. The enormous success of the EEG in Germany has led to the implementation of similar legislation in more than 50 countries worldwide.

The success of the EEG has a unique flipside. Over the past 10 years, it has helped create the world’s most highly sophisticated PV infrastructure in Germany. In turn, this has led to falling system prices and made it possible to decrease FiTs earlier than expected. This means that a functional renewable energy law essentially sets the mechanism for its own phase-out by accelerating the attainment of the ultimate goal--grid parity. This ‘holy grail’ of the PV industry simply indicates an innovative and competitive PV market that works without relying on government incentives.

Over the past decade, the law has provided a necessary springboard, allowing the German PV industry to develop in a budding field. Banks specialized in solar power, thousands of system installers nationwide, and effective regulation guarantee smooth project development, qualified installation and rapid grid connection. In this market environment, end customers benefit from access to these ideal conditions through a number of consulting and support agencies providing the necessary expertise, while readily available financing and healthy competition among suppliers and installers ensure the lowest PV system prices worldwide.

Germany’s PV Market Going Forward

According to latest surveys, 84% of German citizens are in favor of using solar energy. More than 840,000 PV systems have already been installed in Germany, while conservative estimates assume that there are over 2 billion square meters of suitable rooftop space across the country. Depending on the efficiency of individual modules and the angle of rooftops, this leaves a potential PV market capacity of at least 120 GWp in the rooftop segment alone.

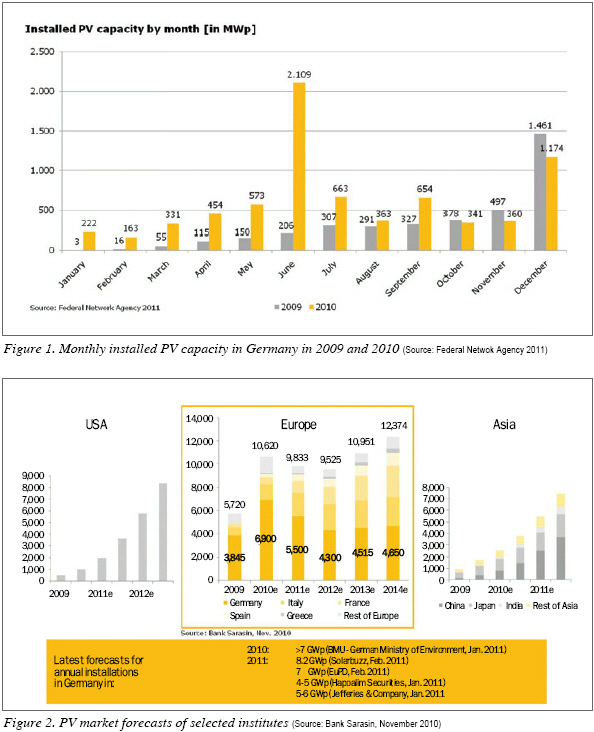

The latest market analyses indicate that Germany doubled its 2009 installation volume of 3.8 GWp and added more than 7 GWp of new PV capacity in 2010. As illustrated in Figure 1, the governmental PV register recorded preliminary figures of 7.4 GWp for new installations in 2010, once again more than any other country worldwide. From the register we can also learn that PV systems smaller than 10 kWp accounted for around 10% of the installed capacity and 43% of the number of systems installed in 2010. Today, Germany has a cumulative installed PV capacity of around 17 GWp, which makes it the world’s top solar energy generator.

Looking at the next three years, Figure 2 illustrates that most analysts forecast a reduction of the annual installation volume--compared to the record year in 2010--and predict annual installations between 4 and 6 GWp. The European Photovoltaic Industry Association (EPIA) has forecast a PV capacity in Germany of around 5 GWp annually for the years ahead, which would further consolidate Germany’s position as the world’s largest PV market.

By 2020, the German government targets an accumulated PV capacity of 42 GWp and expects grid parity in the private consumer segment by 2013. The estimated share of total electricity consumption from PV sources is expected to rise from the 2010 level of 2% to 10% in 2020.

Grid Parity and Coming Changes

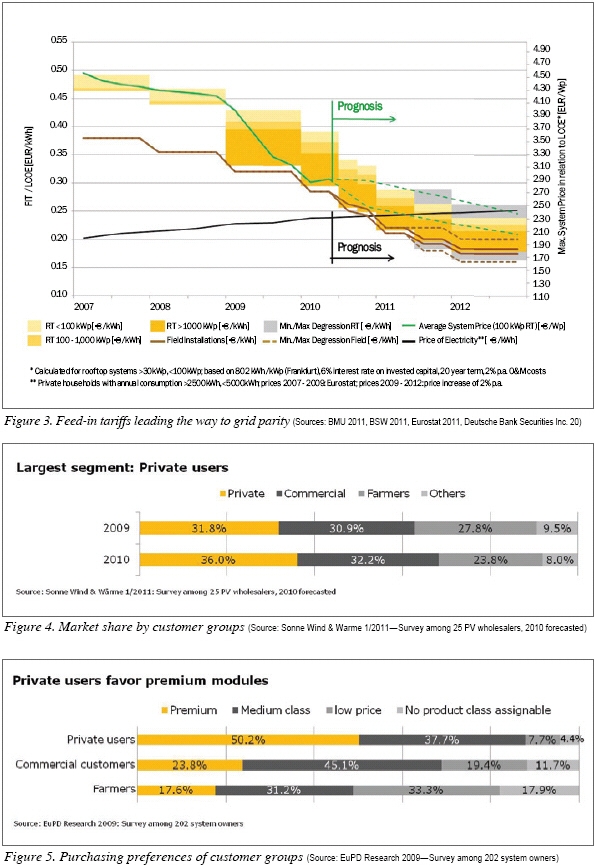

In the very near future, FiT payments will be at the same level as electricity prices for private households. As Figure 3 illustrates, a system price in the range of 2.10 EUR/Wp would enable the production of PV electricity at about 22 EUR-cent/kWh, including a 6% annual return on the invested capital. Also shown in Figure 3 (based on the example of a 100kWp rooftop system), the historical development of system prices indicates that this price range is within foreseeable reach. Several companies are already targeting system prices even further below this mark within the next three years. This would not only make PV systems more competitive with conventional grid prices, but it would also allow for storage technologies in the system to be included while still producing energy at costs below grid prices. Further decreasing system prices would also open the market to additional players, such as commercial electricity consumers who would now enjoy new electricity options at the same, if not eventually lower and more stable, prices.

In order to prepare end customers, banks and installers for a market environment at grid parity, the EEG now provides added incentives for consuming one’s own produced PV electricity. Every kilowatt hour consumed where it is generated receives between 6 and 10 EUR cent of additional income compared to energy fed into the grid. The regulation is optional for rooftop systems equal to or smaller than 500 kWp and still allows unused excess electricity to be fed into the grid at normal FiT rates. It, therefore, puts an incentive in place to gradually implement storage solutions and to develop innovative smart-home and smart-grid technologies.

The Private Consumer Market--A Key to Success in the Grid Parity Era

Achieving price competitiveness will provide a boost to the entire German PV market, as the first group to enjoy grid parity benefits will be private electricity customers. As shown in Figure 4, this group represents the largest share of the market at 36% in 2010. This segment is currently also the fastest growing, posting the strongest recent year-over-year growth figures.

Figure 5 shows what makes this segment unique: Private users typically prefer premium quality rather than following a race to the bottom in system pricing. As a result, growth of this segment could also imply a boost in demand for manufacturers based in Germany, as ‘Made in Germany’ modules enjoy a reputation for high quality. And as manufacturers seek to compete successfully in an increasingly globalized PV market, local supply and service chains are critical. Customers will have increasing choice and tend to seek providers with a local presence, reliable services and trustworthy long-term warranty arrangements.

With overall growth expected to be sustained, the PV industry made net investments in production capacities in Germany of around EUR 1.8 billion in 2009. A further investment of EUR 1 billion in R&D is planned for the period from 2009 to 2013. This amounts to twice as much as the sum invested over the past four years. Apart from the traditional major research areas consisting of high-efficiency silicon cells and modules, thin-film technologies, and the nascent organic PV segment, new research areas were defined that will be important for the era of grid parity. These include system optimization and grid integration as well as new inverter technologies and energy storage technologies.

Grid Parity Shifts Market Incentives

With the market rapidly approaching grid parity and consumption increasingly likely to be where renewable electricity is generated, fundamental changes to market incentives could occur. With FiT levels above electricity prices--as has been the case up to now--PV installations are mainly regarded as a financial investment in order to earn money by feeding in as much electricity as possible. With future FiT levels below electricity prices, PV will be used to save money on electricity bills. This means that as much electricity as possible will be used on location rather than being fed into the grid. With the market rapidly approaching grid parity and consumption increasingly likely to be where renewable electricity is generated, fundamental changes to market incentives could occur. With FiT levels above electricity prices--as has been the case up to now--PV installations are mainly regarded as a financial investment in order to earn money by feeding in as much electricity as possible. With future FiT levels below electricity prices, PV will be used to save money on electricity bills. This means that as much electricity as possible will be used on location rather than being fed into the grid.

From this perspective, some analysts and market experts expect a change in the average system size. Up to now, the size of a PV rooftop system has mainly been adapted and limited to the size of the roof, meaning that the whole rooftop area is used. In a near-term grid parity environment, system sizes could be adapted and limited to the amount of electricity consumption of the customer and therefore lead to smaller and more standardized systems. From a long-term perspective however, with rising costs of fossil resources and decreasing costs of PV electricity, the spectrum of electricity usage could be broadened by substituting fossil heating with electric heating and the use of electric vehicles. Taken as multiple parts of one vision, this will increase the share of electricity in the final energy consumption mix and, therefore, also increase the average system size for rooftop systems for own consumption in the long run.

As the market is expected to be increasingly independent from government incentives, the buying behavior of customers could also change accordingly. The volatility of demand may decrease due to the lack of demand spikes preceding FiT reductions. At the same time, demand could become less predictable and therefore manufacturers will need to establish more flexible logistics and distribution channels. This can be done by increasing the proximity to the end customers through local sales offices, warehouses and manufacturing facilities.

Customers will need to analyze their individual electricity needs in order to determine their optimal individual system size. At the same time they will no longer have the time pressure to install before FiT reduction dates, meaning that customer pitches could become more time intensive for the system integrators. As a result, visibility to the end customer, innovative and cost-effective sales channels, individual consulting combined with standardized engineering and fast installation will become more and more important for system integrators acting in a highly competitive market.

Another aspect of the increase in on-site consumption is the addition of new players and business models to the PV market. Financing and leasing concepts, new technologies and services but also innovative business models by utilities will play an increasingly important role. For international PV enterprises or PV start-ups, Germany’s approach is not limited to offering attractive incentives and expertise through agencies like Germany Trade & Invest (GTAI) that support market entry. Germany is also prepared to be the test market for the grid parity environment and provides the opportunity to design and implement new industry standards for PV solutions beyond subsidies.

Tobias Rothacher, Manager for Renewable Energy & Resources at Germany Trade and Invest (GTAI) has a special focus on the Photovoltaic Industry (www.gtai.com). Prior to his position at GTAI, Rothacher worked as a Business Development and Project Development Manager at the Conergy group. He has an academic background in Business Administration and Engineering and received his higher education in Germany and Canada.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2011 www.interpv.net All rights reserved. |