By Vladimir Budyansky

A Key for Market Development: Regulation & Monitoring

In 2008, when the first cap was released the topic of PV in terms of regulation, permits, system integration into the national grid was totally new for all. Therefore, the only right decision was to allow the market players to start their activity, while constantly adjusting and simplifying the regulatory issues. Great amount of work was done by all relevant institutions such as Ministry of National Infrastructures, Public Utility Authority, Israeli Electric Corporation, Ministry of Interior and Local Authorities. In 2008, when the first cap was released the topic of PV in terms of regulation, permits, system integration into the national grid was totally new for all. Therefore, the only right decision was to allow the market players to start their activity, while constantly adjusting and simplifying the regulatory issues. Great amount of work was done by all relevant institutions such as Ministry of National Infrastructures, Public Utility Authority, Israeli Electric Corporation, Ministry of Interior and Local Authorities.

During the installation and integration of PV systems of the first quota, many administrative barriers were eliminated. Today, in some cases, it is possible to get all the permits within only a month.

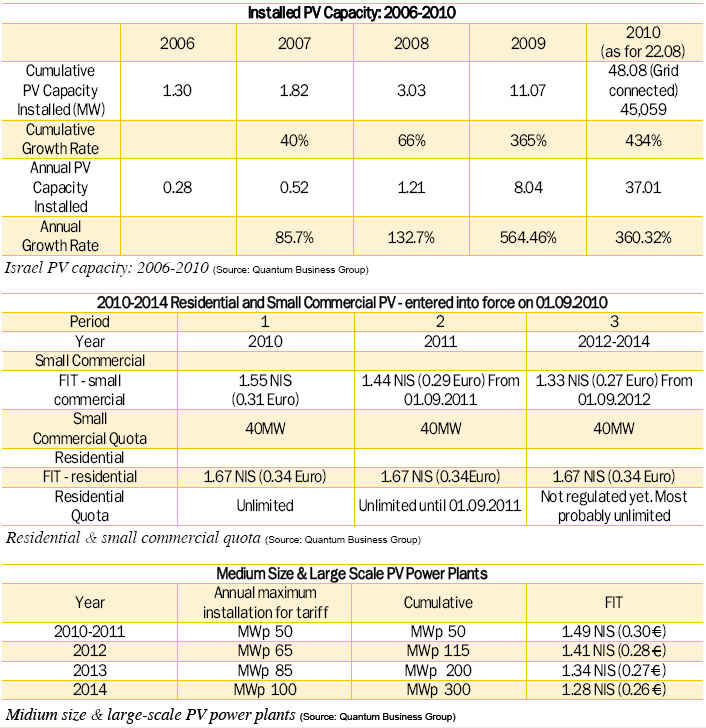

Israeli Installed Capacity, PV Quotas and Incentives

In the following tables, market growth can be tracked easily. Cumulative growth of the installed cap is 434% with 45 MW installed. To this new applications of 20 MW from September 1st should be added.

Market Segmentation

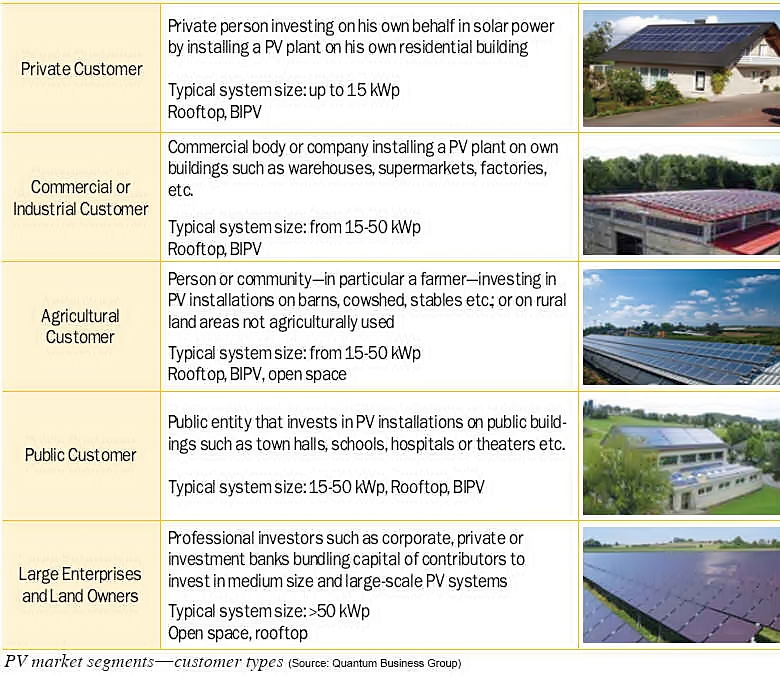

Israeli PV market segmentation is very rich, thus allowing to the companies to develop their marketing strategies. The segments of the Israeli markets can be divided into 5 main classes: Private (residential) Customer, Commercial or Industrial, Agricultural customer, Public customer and Large Enterprises or Land owners operating in the segment of the medium-size and large-scale PV power plants.

Gross Poential of the Residential Segment of the Israeli PV Market is at Least 3 Bilion Euros

On July 28th, Israeli Public Utility Authority released the continued regulation for residential and small commercial grid-connected rooftop PV systems. As in the first quota, the regulatory framework limits maximal installation capacity per system: for the residential facilities it is allowed to install PV rooftop systems up to 15 KWp; and for the small commercial up to 50 KWp. The quota entered into force on September 1st, 2010. The interesting fact is that PUA decided not to limit the quota of the residential plants. On July 28th, Israeli Public Utility Authority released the continued regulation for residential and small commercial grid-connected rooftop PV systems. As in the first quota, the regulatory framework limits maximal installation capacity per system: for the residential facilities it is allowed to install PV rooftop systems up to 15 KWp; and for the small commercial up to 50 KWp. The quota entered into force on September 1st, 2010. The interesting fact is that PUA decided not to limit the quota of the residential plants.

This regulatory decision opens a unique window of opportunity for module, inverter and other components manufacturers as well as for dozens of the Israeli system integrators. For instance, according to the Israeli Statistical Bureau, in Israel just in the period between 1995 and 2008 were built more than 200,000 private houses. Thus, relying on this data, even with the minimal installation of only 4 KWp on private roofs, the gross market potential could be measured as least as 800 MWp.

With an average cost of 4 KWp PV system (16,000), companies’ profits from sales of only the necessary equipment (modules, inverters) are reaching, by the most modest calculations, 3 billion. This is only partial, very minimalistic counting, but if we’ll try to calculate the total amounts of financial capital that should be involved (and will be involved) in Israeli solar market after the implementation of new regulation, the numbers will be much higher.

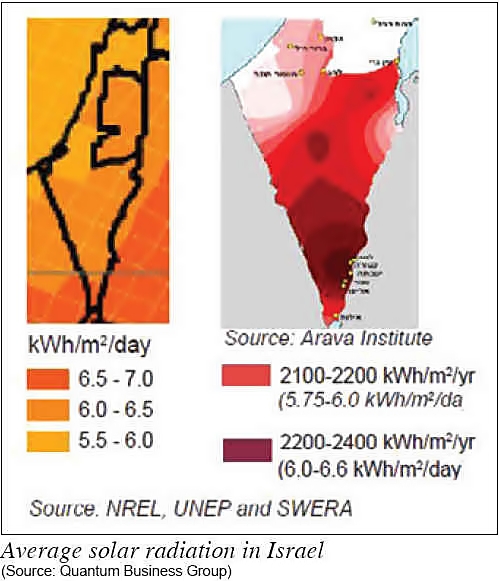

Taking into account 10-month long Israeli summer (in some areas, the sun shines all year long almost without any interference), well-developed infrastructure, different financial aspects like insurance, banking, loans, etc., we can understand that in some further months there will an ‘Israeli solar rush hour’ accompanied with huge amounts of capital.

For an average Israeli, the information above indicates the possibility of obtaining a stable income from fast-and-secure-investment. Simply saying, investing about 80,000 NIS (appx. 16,000) in an average 4 KW/p PV system (including installation and insurance), the consumer will receive annual profit of 15,000-16,000 NIS. This calculation brings us to 5 to 6 years ROI and overall income (20 years) of 300,000-320,000 NIS (app. 60,000-64,000)

For the PV manufacturer or distributor, the above information means that now is the real ‘money time’ for investing in business development, marketing and sales in this emerging market. In addition to the growth of the market, additional factor should be taken into account: all the needed equipment is imported either by local offices of foreign manufacturing companies, distributors or directly by the system integrators.

Solar Future is Here--in Israel

The Israeli market for solar energy is one of the most attractive in the world today. Being in constant growth since 2008, due to the careful attention of the state authorities and the current ‘green tariff’ with the introduction of the current quota, Israeli market automatically becomes even more attractive for investment. Now is precisely the time when companies can take the leading positions, investors get the maximum benefits, and consumers make their real estate to work for themselves.

Vladimir Budyansky is CEO of Quantum Business Group (www.qbizgroup.com). He has 7 years of experience in developing and managing of International Business Networks. Since 2006, Vladimir has been focused entirely on the Clean-Tech industry, especially on the Renewable Energy and Energy Efficiency segments. Serving as Senior Advisor for Legislation in the Knesset (Israeli Parliament) to MK Alex Miller and MK Lia Shemtov, he was also involved in MK Dr. Juri Shtern’s parliamentary think tank aimed at construction of a comprehensive policy for promotion and implementation of Photovoltaic technology-based power plants. The outcome of this initiative was the introduction, in July 2008, of the first 50 MW PV quota and feed-in tariff.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved. |