New investment in clean energy technologies, companies, and projects held steady in the second quarter of 2010 at US$33.9 billion as a drop in investment in European projects was offset by a continuing boom in China and a bounce-back in the U.S., according to new estimates from research firm Bloomberg New Energy Finance. The quarterly total represented just a 1.5% slip from first quarter 2010, a 3.0% fall from Q2 2009, and came despite the Greek credit crisis, poorly performing public markets, and a sluggish U.S. economic recovery.

“On a global level, the new numbers suggest that despite continuing worries about the macro-economy, investors remain relatively optimistic about clean energy’s longer term prospects,” said Bloomberg New Energy Finance chief executive Michael Liebreich. “However, where investors are placing their bets is changing rapidly. China continues its extraordinary surge and Europe has suffered a setback according to our figures for asset finance in the second quarter.”

Bloomberg New Energy Finance tracks third party investment on a quarterly basis in three main categories: Asset Finance (funds provided for the construction of electricity- or biofuel-generating projects), Public Markets (funds raised over the stock exchanges via IPOs and other offerings), and Venture Capital/Private Equity. The company also takes other forms of clean energy investment into account in its annual figures.

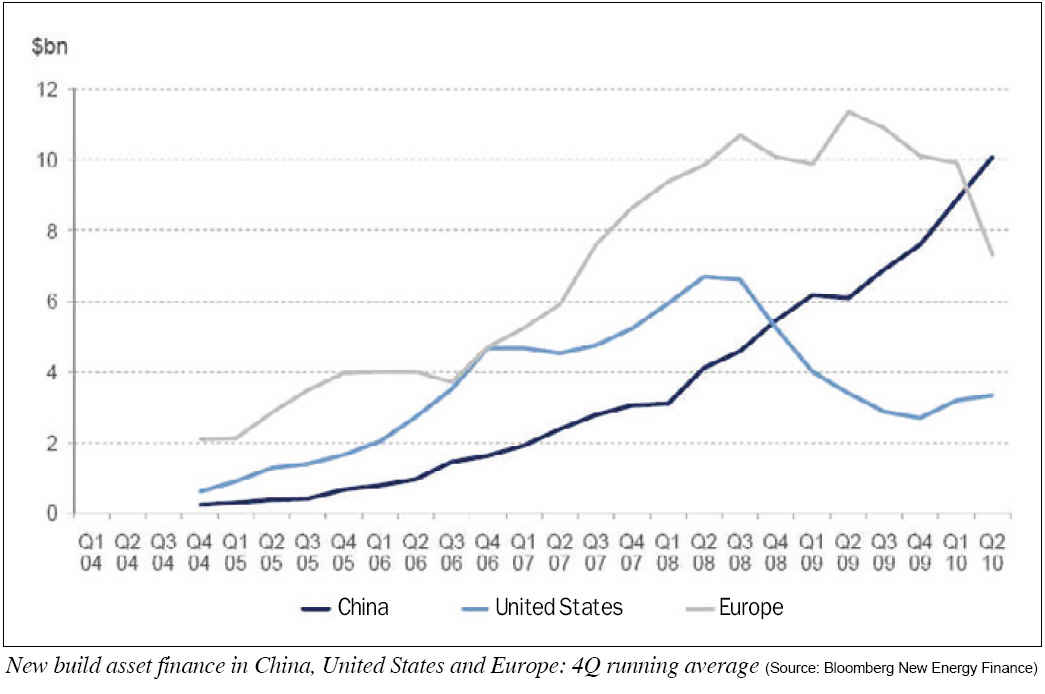

Asset financing accounted for US$28.9 billion of the US$33.9 billion in new funds invested in Q2 2010, but was down 2.1% from Q1 2010 and off 3.7% from Q2 2009. China appears to be continuing its massive build-out of new clean energy capacity. The country, which installed 14,000 MW of new wind last year, saw US$11.5 billion in new asset financing in Q2 2010. That represented a 9.6% rise over the prior quarter and a 72.1% jump from Q2 2009. U.S. asset financing also rose to US$4.9 billion, from US$3.5 billion in the prior quarter and from US$4.3 billion in Q2 2009.

The picture looked substantially different in Europe where asset financings totaled just US$4.5 billion, down from US$6.6 billion last quarter and far below the US$14.9 billion in new investment in Q2 2009. Europe was first to embrace clean energy technologies at substantial scale but now appears to be falling behind China. Over the past four quarters, China has attracted US$40.3 billion in asset financings, compared to US$29.3 billion in Europe and European project finance has fallen consecutively in each of the last four quarters.

Asset financing typically accounts for just under two thirds of all new funds invested in clean energy in a given year. Through the first six months of 2010, it has totaled US$58.4 billion, compared to US$48.1 billion in the same period in 2009, representing a 21.4% gain.

New capital raised via the public stock exchanges remained anemic at US$2.6 billion. While that represented a 29.2% jump from the US$2 billion raised in the prior quarter, it pales in comparison to the US$5.9 billion raised in Q4 2009. The industry had hoped to see key initial public offerings from U.S. cylindrical solar module maker Solyndra, U.S. project developer First Wind, and Italys Enel Green Power. Between them, the three firms had hoped to net approximately US$6 billion.

The markets did not cooperate, however. The S&P 500 Index fell 11.6% during the quarter as concerns grew over the credit situation in Greece. The WilderHill New Energy Global Innovation Index, or NEX, a composite of over 80 stocks selected by Bloomberg New Energy Finance to reflect the breadth and width of the clean energy sector, fell 19.5% in the period. Solyndra has pulled its IPO and instead raised funds privately. Enel now says it plans to IPO in October. First Wind has made no major new announcements about its planned offering.

One bright spot in public market activity was Tesla Motors’ US$202 million IPO in June on Nasdaq after pricing its shares above a previously announced price band. The company also collected US$50 million in a new strategic investment from Toyota. The largest IPO of the quarter was from Hangzhou-based battery maker Zhejiang Narada Power Source, which successfully completed a US$300 million float on the Shenzhen Stock Exchange.

Venture capital and private equity financings remain a bright spot for clean energy in 2010 compared to last year. VC/PE activity for the quarter totaled US$2.4 billion. While that is down from US$2.9 billion in Q1 of the year, the total VC/PE investment through the first half of 2010 of US$5.2 billion far surpasses the US$3.2 billion raised over the same six-month period in 2009. Virtually all of Q2 2010’s major VC/PE deals took place in the U.S. U.S. wind developer Pattern Energy raised US$400 million; solar thermal electricity generation project and technology developer BrightSource collected US$150 million; and electric vehicle maker Fisker Automotive brought in US$74 million.

Bloomberg New Energy Finance has forecasted 2010 total new clean energy investment at US$180-US$200 billion. The firm’s macro annual figure takes into account not just Asset Finance, Public Markets, and Venture Capital/Private Equity fundings but other forms of investment as well, such as spending on corporate research & development and the financing of small-scale projects. The latter of these should result in substantially more dollars invested this year as the photovoltaic industry expands rapidly through the installation of thousands of tiny residential and commercial systems worldwide.

Further Information: Bloomberg New Energy Finance (www.newenergyfinance.com)

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved.

|