Global solar PV installations will reach 24 GW in 2011 according to a new report from IMS Research.

.jpg)

According to a new report from IMS Research, despite the relatively weak start to the year, installations will rise by 24% in 2011 to reach 24 GW, up from 19 GW in 2010. The research also revealed that European installations will rise by just 3% in 2011 year and that Italy will displace Germany as the world¡¯s largest market.

Installations Surge but Orders Don¡¯t

IMS Research¡¯s recently released Q4¡¯11 PV Demand Database shows that installations exceeded 8 GW in the first half of 2011 and will reach 15 GW in the second half confirming the market analyst firm¡¯s prediction earlier in the year that installations would soar in 2H. However, although installations have grown considerably, this has not necessarily translated into a surge in demand for PV components because of high inventory levels. ¡°Despite installations in the second half of the year being almost double those in the first half, most suppliers didn¡¯t see any considerable uptick in orders. This is simply as a result of the high inventory levels in the channel, with customers installing previously purchased modules and inverters,¡± explained Ash Sharma, Senior Research Director for Photovoltaics. Earlier in the year, IMS Research revealed how module inventory stood at a huge 10 GW, while inverter inventory was at an unusually high level of 6 GW.

Confusion over Italy

The new report also highlights that the true size of the market in 2011 is contentious, depending on what is considered the size of the Italian market in 2010. While IMS Research measures PV demand when a system is installed, other methods often consider connections, registrations or approvals leading to different market sizes. ¡°There is much confusion over the size of the Italian market in 2010 and 2011 due to various data points for installations under the various ¡®Conto Energias¡¯. IMS Research has analyzed module and inverter shipments to the country and cross-checked inventory levels at integrators and distributors to conclude that 4.5 GW of new capacity was installed in 2010¦¡despite a greatly higher number claiming the ¡®Secondo Conto Energia¡¯ which expired at the end of the year,¡± commented Sharma.

Italy the New Number 1, but Europe¡¯s Share Falls

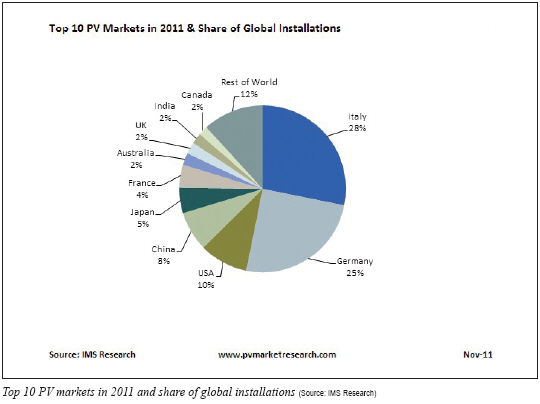

Despite a freeze and then cuts to its incentives earlier this year, Italy is forecast to become the world¡¯s largest market in 2011 for the first time; and install 6.8 GW of new capacity. Yet despite the strong performance of the Italian market, Europe is set for another underwhelming performance this year; with installations growing by just 3% because of falls in Germany and the Czech Republic and slow-downs elsewhere. ¡°The upswing in Italian installations won¡¯t be sufficient to counter falls from Germany and the Czech Republic and Europe¡¯s share of global installations will sharply fall from 82% in 2010 to 68% in 2011,¡± noted Sharma.

Growth from Americas & Asia

IMS Research found that though Europe is stagnating, the American and Asian markets are performing well; these two regions will generate 85% of the global growth in installations in 2011. Furthermore, the research found that this trend is forecast to continue into 2012, when Europe¡¯s share of new installations will fall to 50%. ¡°The PV market continues to diversify in 2011; this will create short-term pain for suppliers that can no longer solely rely on one market to fuel their growth, but creates long-term stability for the industry by helping to balance the effects of a single country¡¯s incentive policy and reduce large swings in supply and demand. This diversification is clearly continuing to happen and we have identified 20 markets that will install more than 100 MW in 2011, up from just 14 last year,¡± commented Sharma.

Top 10 Markets in 2011

The report¡¯s updated rankings also reveal that while the research firm maintains its earlier prediction that only four of the top 10 markets in 2011 will be European, it now forecasts that the U.K. will be one of those. ¡°Despite installing just 45 MW last year, the U.K. is set to install more than 500 MW in 2011 and become the 8th largest PV market. The attractive incentive levels helped kick-start the market, but the changes to the tariff during the year to prevent large-scale projects and the sudden cuts proposed for December have created a surge in demand,¡± explained Sharma. The research firm predicts that the U.S.A. will become the third largest market this year, while China will be the fourth largest. ¡°Installation rates in China have rocketed since the introduction of provincial and the national FiTs; as China¡¯s Government seeks to provide domestic demand for its huge manufacturing base while Europe falters. Installations in China could reach as much as 2.5 GW this year, with IMS Research predicting a level of around 1.9 GW to be most likely,¡± concluded Sharma.

Further Information: IMS Research (www.pvmarketresearch.com)

For more information, please send your e-mails to pved@infothe.com.

¨Ï2011 www.interpv.net All rights reserved.

|