While market conditions meant that all suppliers could grow their shipments, some suppliers were able to benefit more than others.

.jpg)

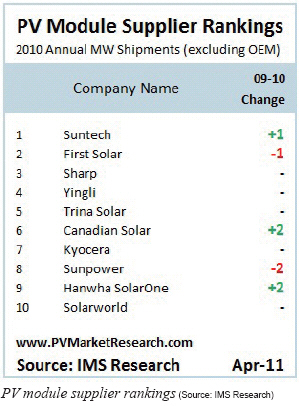

Suntech was the largest PV module supplier in 2010, growing its shipments by more than 130% over the previous year, to ship more MWs than any of its competitors. First Solar, which held the top spot in 2009, fell to second place, increasing its shipments by less than 50% although the total market more than doubled. Suntech was the largest PV module supplier in 2010, growing its shipments by more than 130% over the previous year, to ship more MWs than any of its competitors. First Solar, which held the top spot in 2009, fell to second place, increasing its shipments by less than 50% although the total market more than doubled.

IMS Research’s latest analysis of the global PV supply chain, based on shipment data from hundreds of suppliers, reveals that while market conditions meant that all suppliers could grow their shipments, some suppliers were able to benefit more than others: Chinese Tier-1 suppliers Canadian Solar and Hanwha SolarOne (formerly Solarfun) both gained two places in the rankings; in fact, all the suppliers in the top ten gaining rank were Chinese. Conversely, both the suppliers losing rank were Western, headquartered in the U.S. One Western supplier bucking this trend was REC, which moved quickly up the rankings to become the eleventh largest supplier of PV modules in 2010.

“2010 was an outstanding year for everyone in the PV industry. Module suppliers were able to benefit from the strong demand, which lasted all year, and make great increases in their shipments; five of the top ten suppliers more than doubled them, some even increased them by more than 150%,” says Sam Wilkinson, PV Market Analyst at IMS Research.

Another clear winner in 2010 was JA Solar, another large Chinese supplier, which increased its production by nearly 180%, becoming the largest producer of PV cells, having been only the fifth largest producer in 2009.

IMS Research predicts a slowdown in growth for the PV module market in 2012, as many major European markets cool following amendments to incentive schemes.

Further Information: IMS Research (http://www.pvmarketresearch.com/)

For more information, please send your e-mails to pved@infothe.com.

ⓒ2011 www.interpv.net All rights reserved.

|