Photovoltaics is already competitive with some non-renewables today and will become one of the lowest-cost options in less than 20 years, says a study by the European Photovoltaic Industry Association. No longer a luxury novelty for rich nations, it¡¯s a sensible, sustainable solution for the energy needs of ¡®Sunbelt¡® countries around the equator. Whether in regional grids, mini-grids or house-by-house, photovoltaics makes economic as well as environmental sense. The study says to expect the fastest growth in China and India, with vast potential in the Mediterranean, North Africa, Southeast Asia and Latin America. The challenge: persuade more policymakers and investors to embrace solar energy.

By Eleni Despotou

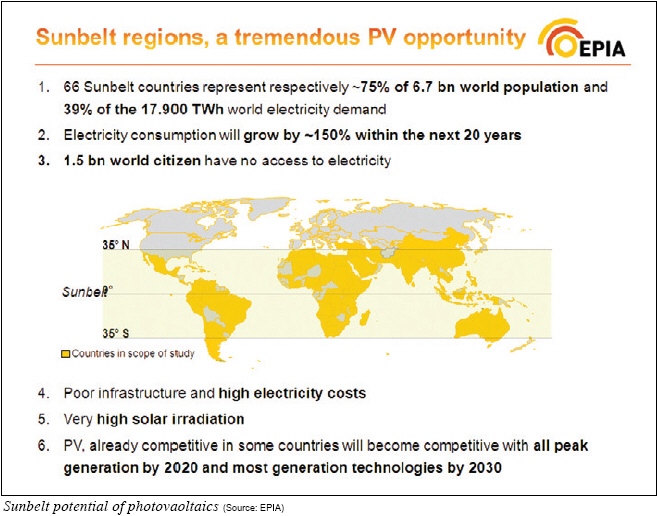

It¡¯s not just a sustainable idea. It makes business sense. Photovoltaics (PV) promises to become a leading source of energy in a low-carbon future, with major growth potential in so-called ¡®Sunbelt¡¯ regions around the equator, where 1.5 billion people live without power today. It¡¯s not just a sustainable idea. It makes business sense. Photovoltaics (PV) promises to become a leading source of energy in a low-carbon future, with major growth potential in so-called ¡®Sunbelt¡¯ regions around the equator, where 1.5 billion people live without power today.

Rising demand for electricity across the planet, coupled with falling PV prices, means photovoltaic energy is on the cusp of a massive boom, according to a study by the European Photovoltaic Industry Association (EPIA), the world¡¯s largest.

Unlock the Potential

The 53-page report, entitled ¡®Unlocking the Sunbelt Potential of Photovoltaics¡¯, looks at the existing PV landscape in the region and explores the conditions, political and economic, that are necessary to guarantee the deployment of photovoltaic energy. PV can compete today with diesel generators, and will be competitive with gas and oil by 2020 and with coal by 2030.

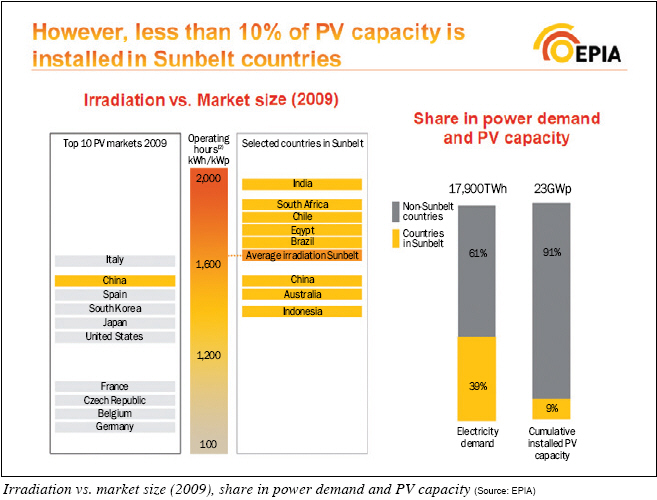

Falling photovoltaic systems prices are increasingly making PV an attractive investment in the Sunbelt countries those located within ¡¾35¡Æ around the equator, making up about 75% of the world¡¯s population. Despite the exceptional solar irradiation registered in these countries, at present they represent only 9% of the global installed PV capacity.

The study comes at a critical time as nations debate how much to invest in renewable energy and whether to build new coal-powered and nuclear plants. The billions, even trillions, about to be spent on conventional energy generation worldwide could be more sustainably spent on solar panels.

Thus the EPIA¡¯s bold push in a race against time with conventional energy sources--often subsidized--and so-called ¡®bridge technologies¡¯ to compete for investment and political support. The study says electricity demand in the Sunbelt is expected to grow 150% in the next 20 years. How that demand is met will have direct impact on efforts to control global warming and foster social development in the region.

The Persuasive Cost Factor

At the end of the day, cost is the name of the game, which the EPIA says photovoltaics is winning and will win decisively. The cost of a PV kilowatt hour has fallen drastically in the last decades. If the right policy and investing conditions are met in the Sunbelt region, it could fall to between 4 and 8 cents by 2030, making it one of the most cost-effective ways to produce electricity.

The immediate effect: for the 1.5 billion people who don¡¯t have electricity, PV can make it possible. As countries have invested in mobile phones to leapfrog fixed-line telephone grids, they can also leapfrog building regional power grids by installing solar power locally.

Driven by local and global demand, the Sunbelt could account for up to 60% of all PV installed capacity in the world. At the moment, 75% is installed in a less-sunny Europe. Expected electricity demand growth in the Sunbelt is much higher than in non-Sunbelt countries. According to the IEA World Energy Outlook, almost 80% of the expected global electricity demand growth will come from Sunbelt countries.

Necessary Conditions

The EPIA has no illusions either. PV faces a tough fight to overcome skeptical investors, policymakers and consumers around the world who lack the convincing data showing the vast potential of photovoltaics. Subsidies for other energy sources, such as diesel fuel, also make it hard for PV to compete and the absence or early stage of policy support schemes still represents a significant barrier.

In addition to providing a detailed economic analysis supporting the various deployment scenarios, EPIA¡¯s study also highlights a series of recommendations to enable the full realization of the potential of PV in the Sunbelt. There¡¯s a tight window of opportunity in terms of available investment and global warming. Here¡¯s what needs to be done:

-Policymaking: Governments and utilities need to include PV as an explicit part of their energy and investment planning as a means of job creation and economic stimulus.

-Pricing: Performance-based incentives, such as advanced and well-designed feed-in tariffs supported by public and/or private funding, must be implemented. Put in the context of national infrastructure development, energy regulatory frameworks and low carbon development strategies, such incentives are needed to jump-start local PV deployment and enable the build-up of a domestic industry.

-Financing: Development banks and private financial intermediaries need to actively address the finance gap that exists in many Sunbelt countries. Partnerships between local banks and international partners will speed up the financing of PV.

-Expertise: National and international PV associations must provide information and act as brokers and matchmakers between stakeholders in order to facilitate market opening.

Overcoming the Obstacles

In the Sunbelt, PV is still perceived as an expensive energy source mostly suitable for off-grid installations of small and medium size. However, the truth is that PV can already compete with other commonly used power generation technologies such as diesel generators.

Among the benefits of PV for the Sunbelt: It¡¯s an indigenous energy supply, and it generates power close to consumption, thus enabling mini-grids. It can stimulate economic activity while reducing import reliance. It has low operational costs, and it can enable the domestic industry to expand. What¡¯s more, it can shield a country from spikes in imported fuel prices.

Mini-grids can connect a mix of stand-alone electricity sources to private consumers and small businesses of a community, enabling more economic activity, education and improved medical care. They can be interconnected between communities, forming the nucleus for a more systematic electrification, especially in more densely populated rural areas.

A key factor is risk perception, which often depends on an observers personal background and experience. PV-experienced financial institutions often have a European market background. So there¡¯s a learning curve: They need to understand the specific conditions of Sunbelt countries where the regulatory engagement is likely not to offer the same level of certainty. Local banks operating in the Sunbelt, however, usually have no significant experience with financing PV. For that reason, Sunbelt PV financing options could multiply with partnerships between local banks and international partners, or in-house know-how transfers of large multinational banks with a presence in Sunbelt countries.

One recent development may strengthen the argument for more PV. In the United States, the Republicans¡¯ election victory that put them back in power in Congress caused President Obama to abandon efforts of so-called ¡®cap and trade¡¯ schemes to control CO2 and ensuing global warming. ¡°There is more than one way to skin a cat,¡± Obama said after the election. One way would be to build more PV instead of more coal plants.

Regional Differences

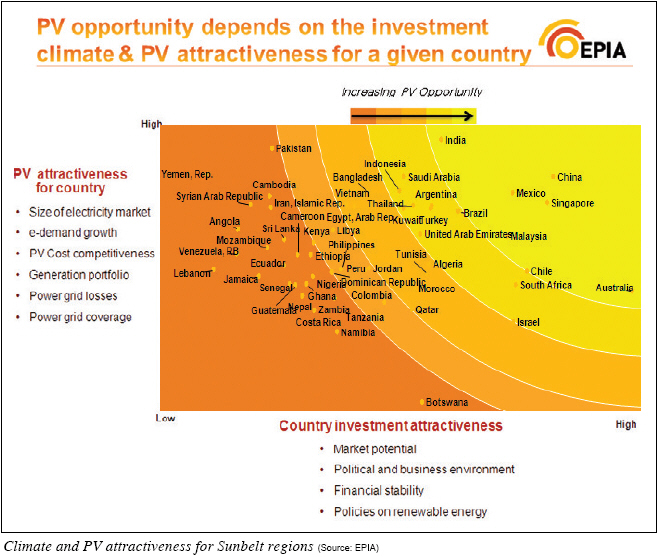

Within the Sunbelt, there are regional differences in receptiveness to PV. In the non-EU Mediterranean and North African countries is the dynamic economic development of countries such as Turkey, Egypt and Morocco, which face significant domestic supply challenges. The European Union intends to increase Mediterranean economic cooperation with programs such as the Mediterranean Solar Plan, one of the main initiatives of the Union for the Mediterranean. Also, the Industry-driven Desertec Industrial Initiative (DII) has broadly publicized the idea of an integrated EU/Northern African energy grid with strong solar energy components.

Southeast Asia has been growing more dynamically and its installed PV capacity amounts to over 60 MW, which constitutes around 7% of Sunbelt installed PV capacity. This compares to an electricity consumption of 515 TWh or about 7% of Sunbelt final electricity consumption, showing a slightly above-average penetration of PV. The PV growth is mostly driven by Thailand and Malaysia, where comprehensive support policies are emerging.

The Latin American region shows below-average penetration of PV compared to other regions. That¡¯s in part because the investment attractiveness in the region is scattered. Chile, Mexico and Brazil lead while Venezuela, Jamaica and Ecuador lag behind. That, in turn, is due to differing policy support.

While Venezuela, Jamaica and Colombia don¡¯t have any policy support reported, other countries in the region, such as Chile, have an explicit political target regarding renewable energy and require power generators to meet minimum quotas for it.

The Scenarios

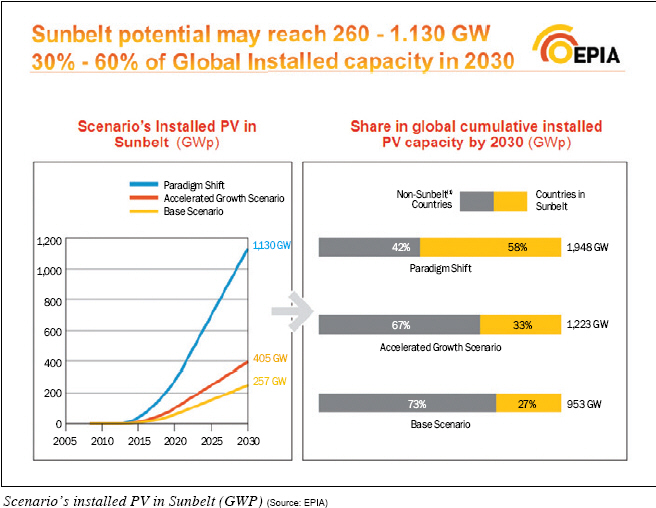

The EPIA study, using varied scenarios, aims to show the unlocked potential that could outshine conventional technologies. The most ambitious one, a ¡®paradigm shift¡¯, would make China the dominant PV market in the next 20 years, generating 12% of its power with PV. In combination with India, both countries could account for 69% of the overall Sunbelt potential.

The paradigm shift is seen as a visionary stretch scenario that would be feasible if a number of stakeholders worked closely and decisively to implement the recommendation previously outlined. It assumes that China will change course soon and decide to unleash the full potential of PV to reach a 4% share in power generation by 2020 and 12% by 2030, making it the world¡¯s leading PV market in the next 20 years. What could make that possible: The IEA forecasts a steep increase in Chinese electricity demand. Also, in China¡¯s 12th Five Year Plan, commenced in January (until end of 2015), the renewable energy sector has been earmarked as one of the Magic 7 emerging strategic industries. China views the green economy as ¡®the¡¯ growth engine of this century and the only way to bring China to prosper as a nation and tackle the key challenges of the 21st century.

India is the other main driver in the Sunbelt. PV can make a positive contribution to the fundamental economics of power supply in India where a share of 12% of oil-and gas-fired capacity is used for peak power supply. This is of high economic relevance as only 65% of Indian population is currently connected to an electricity grid. Due to a comparatively long PV tradition including several mid-sized manufacturing players, India¡¯s installed capacity of 130 MW is significant compared to most Sunbelt countries. This capacity is mostly off-grid capacity in rural regions, which reflects the perception most policy-makers and development banks had of the application of PV. However, this is about to change.

In its landmark National Solar Mission (announced in November 2009), India has set itself the solar energy installation targets of 22 GW by 2022 of which 20 GW, about 90%, is for on-grid purposes. The first phase (through 2013) has a target of 1.3 GW, roughly split 50/50 between PV and CSP technologies. Recently, it was announced that 37 companies have been selected to build solar power projects (for over 600 MW of supply). For PV Projects to be selected during 2010-11, it will be mandatory to use the cells and modules manufactured in India, leading to a rush of foreign firms into the market to help ramp up capacity.

PV to Become Competitive

The study shows that the PV potential of the Sunbelt countries could range, depending on the scenario (base, advanced and paradigm shift), from 60 to 250 GW by 2020, and from 260 to 1,100 GW in 2030, representing 27%~58 % of the forecasted global installed PV capacity by then. Prices of PV systems by 2030 are expected to decrease by up to 66% compared to their current levels.

Under an accelerated scenario, Sunbelt countries would reach an installed PV capacity of around 405 GW by 2030, which would provide sustainable electricity to about 300 million people and make up between 2.5% and 6% of the Sunbelt¡¯s overall power generation.

PV electricity, already competitive today with some peak generation technologies in a number of countries, would see its generation costs dropping to a range of 5 to 12 c / kWh by 2020, making it highly competitive with all peak generation technologies, and as low as 4 to 8c/kWh in 2030, making it also widely competitive with most mid-load generation technologies. PV will, therefore, represent a highly competitive alternative for new generation capacity as well as a replacement for existing ones.

The time to invest is now, to power our world sustainably. It makes business sense. It makes environmental sense.

Eleni Despotou is Secretary General of the European Photovoltaic Industry Association (EPIA). She majored in mechanical engineering with specialization in energy and political sciences and in international relations. She joined EPIA in 2002.

For more information, please send your e-mails to pved@infothe.com.

¨Ï2010 www.interpv.net All rights reserved. |