It’s messy. It’s inefficient. It’s working.

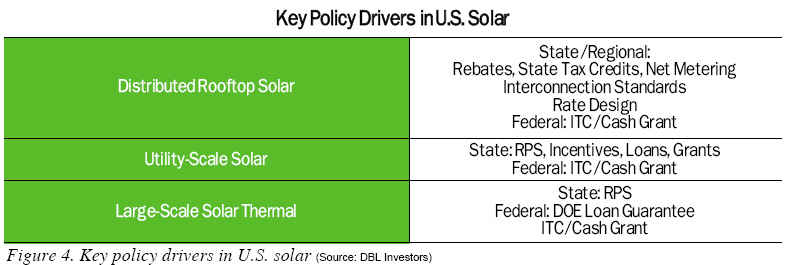

The United States is forecast to be the second-largest global market for solar in 20121) despite the absence of a broad-based national climate change policy. Efforts in the U.S. to put a price on carbon and establish national mandates for renewable energy as a percentage of total energy produced have fallen victim to partisan politics and the 2010 election cycle, and it is highly unlikely that significant climate change legislation will pass this year. And yet, solar adoption continues to climb, with some estimating that the U.S. solar industry will grow at an average rate of 30% a year through 2014.2) This seeming paradox is explained by a patchwork of government actions that fill the void left by national inaction: led by state renewable portfolio standards and joined by regional and local solar initiatives including rebates and grants, federal tax incentives and stimulus-related programs, and U.S. Department of Energy loans and loan guarantees. The net impact of this patchwork quilt of policies has brought new signs of life to the financing of U.S. solar, a field that has been nearly moribund for the last two years. While the lack of action in the U.S. Congress may disappoint parts of the American body politic, a growing array of policymakers and industry participants are busy flexing their solar muscles. This momentum, in turn, is expanding into commercial solar finance.

By Nancy E. Pfund, Sarah M. Ham

State, Regional & Local Policy Drivers

Renewable Portfolio Standards

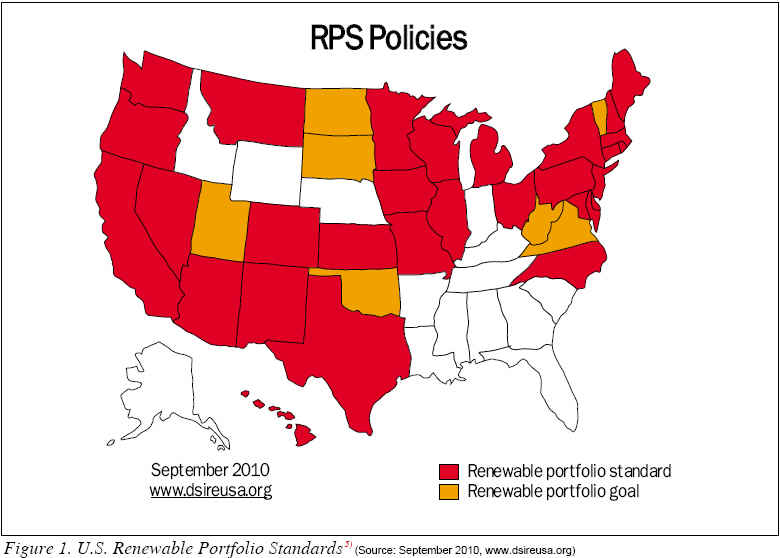

Renewable Portfolio Standards (RPS) are government mandates that require utilities, both public and private, to derive a certain percentage of their power from renewable sources by a specified date. For instance, California has an RPS that mandates that electric utilities must generate 20% of their electricity from renewable resources by 2010;3) this is set to increase to 33% by 2020 through a recent vote by the California Air Resources. Currently, 29 states and the District of Columbia4) have renewable portfolio standards; including four of the country’s five most populous states, California, Texas, New York and Illinois (see Figure 1). While renewable mandates can be met with a variety of energy sources--including wind, geothermal and biofuels--solar’s ability to scale, meet a variety of energy demand needs, and potential for distributed rooftop installations make it a popular choice in many regions. RPS mandates play a critical role in growing solar adoption because they catalyze utility involvement in solar as a way of meeting RPS requirements. This involvement not only leads to larger-scale deployments and the ability to develop long-term, financially-attractive contracts, but also gives utilities a vested interest in solar’s success. In addition to the scale and legitimacy that growing utility participation brings to the U.S. solar market, utility involvement also pushes the industry to step up to the plate on reliability, cost, power generation and intermittency. Meeting the often exacting requirements of utilities is working to position the U.S. solar industry for its next phase of growth.

Solar Rebates and Other Ratepayer Adjustments

While the national Investment Tax Credit (ITC) for solar installations constitutes an important incentive for homeowners and commercial building owners to install solar, many state, regional and local governments have recognized that an extra refund in addition to the ITC speeds adoption. The most extensive state program is the California Solar Initiative (CSI), launched in January 2007.6) The program initially offered a US$2.50/W rebate using a model in which rebate levels dropped as certain volume targets were achieved. Today, the rebate level has fallen to as low as US$0.65/W, and the market continues to grow. In part as a result of CSI, California leads U.S. states in solar adoption with 690 MW installed and 68,465 solar projects.7) Other states and municipalities that have initiated rebate programs include Oregon, New Jersey, and the City and County of San Francisco. In all, 38 states and the District of Columbia have some type of solar rebate, ranging from a single solar water heater rebate to the nearly fifty subsidies offered by different municipalities within California.8) Solar companies need to be wary of the ephemeral nature of rebate programs. For instance, in Arizona, it appears that as soon as rebate programs developed momentum and grew the installation base, government leaders reduced their size or eliminated them entirely, likely in the belief that they were no longer necessary. Moreover, the chances of a pullback usually go up in difficult economic times. While they can be reinstated, the stop and start aspect of rebates requires careful management and solar integrators should work with regulators to provide as much visibility for rebate programs as possible.

State-level rebates often work hand-in-hand with other actions by state legislatures or the state commissions that govern public utilities aimed at increasing the overall value of solar to the homeowner or commercial property owner. For example, 20 states offer state tax credits for solar. In addition, several states, led by New Jersey and including Pennsylvania, Maryland, Massachusetts and Virginia, are developing Solar Renewable Energy Credits (SRECs) to reduce the cost of solar to the customer. SREC programs provide a financial value apart from the electricity generated by the solar system and can often be used over time to help pay off a the loan used to buy the system. The utility PSE&G in New Jersey currently has such a program for over 50 MW of residential and commercial installations. Other policies that complement rebates include the development of interconnection standards (to avoid daunting solar-specific hoops to jump through) and net metering, which allows customers with solar power to receive a credit on their electric bill for energy they send back to the utility. Finally, rate design, which is driven by state or municipal policies, can have a significant impact on solar adoption, especially in the case of tiered pricing, in which heavy users pay more expensive rates on their surplus use, along with the elimination of fixed charges and other targeted approaches. Rising electricity rates across the board, of course, also make solar more attractive, and U.S. electricity rates on average have been rising 5% per year for the past 30 years.

Feed-in Tariffs

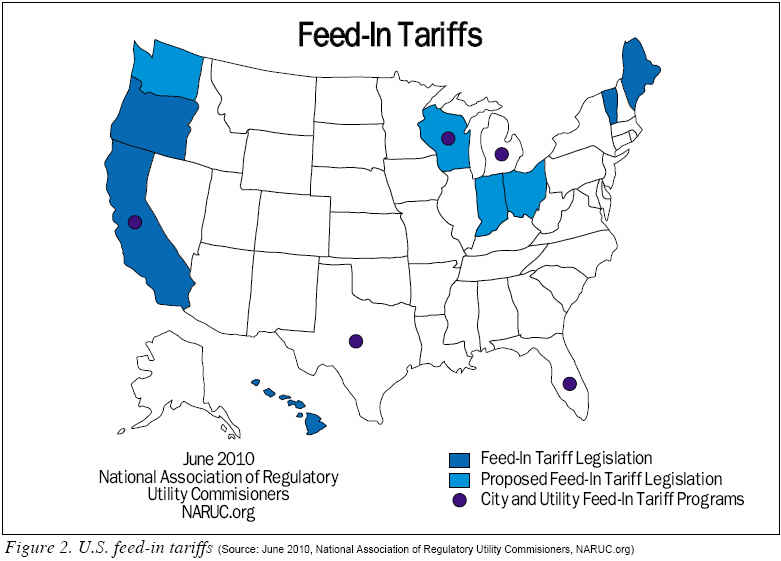

While the use of feed-in-tariffs (FiTs) is well established in Europe, it has not been the solar policy of choice in the United States, and no federal FiT exists today. As Figure 2 demonstrates, various states, including Hawaii and Vermont, have FiT programs in place, and Maine, Oregon, Indiana, Ohio, Washington and Wisconsin have pilot programs or current and recent proposed legislation.9) In some cases, the nature of FiT pricing and structure has limited its adoption, and the Federal Energy Regulatory Commission (FERC) has not always supported these programs. In California, for example, efforts to establish a FiT are now shifting to a proposed reverse auction structure. To the north, the Canadian province of Ontario has instituted a popular FiT through its Green Energy and Green Economy Act of 2009 which also mandates increased use of locally sourced equipment. (This local sourcing language is another trend to watch: many are studying the Ontario local-content requirements to see how they influence regional solar manufacturing growth and cost.) Cities throughout the U.S. that have instituted FiT programs include Gainesville, Florida; Madison, Wisconsin; San Antonio, Texas; and Sacramento, California.10) The City and County of Los Angeles, through its municipal utility, Los Angeles Department of Water and Power, is currently reviewing a FIT to promote solar growth by 600 MW over 10 years. A decision is expected later in 2010.

Manufacturing Loans/Grants

For many years, several state-funded loan and grant programs have catalyzed the development of alternative energy. One of the best known programs, the Public Interest Energy Research (PIER) program at the California Energy Commission (CEC), has provided hundreds of millions of dollars to promote alternative energy and energy efficiency. One of the first U.S. solar integrators, PowerLight (sold to SunPower in 2007) received PIER grants that helped it establish its leadership position. Today, these programs, some assisted by federal stimulus dollars, have expanded to include a variety of financial incentives aimed at bringing solar companies and the jobs that accompany them to regions across the country. Grants, low-interest loans, targeted green economic zones, tax credits, tax exemptions, workforce training grants, and attractive building and land lease rates are some of the tools used by states and counties. The State of Oregon, for example, recently approved Solexant, a thin-film company based in California, for a Business Energy Tax Credit of US$18.75 million and a State Energy Loan for US$25 million from the Oregon Department of Energy to establish a manufacturing site in Gresham, Oregon, an area targeted for economic improvement. Another solar company, Solaria, which makes CPV modules and is based in Fremont, California, received US$1.2 million from a CSI-funded program to create the country’s first tracker-based solar system at a state fair site in Hollister, California. Solaria is also benefitting from a recent round of CEC low-interest loans which deploy national stimulus funds focused on assisting solar manufacturers with next-generation expansion and product development. This recent round of CEC grants totaled US$28 million and was awarded to nine companies.

Solar manufacturing incentives vary greatly in structure and size from state to state. For instance, Kansas offers a solar manufacturing incentive of up to US$5 million in financing to a solar or wind manufacturing project. New Jersey offers a combination of a cash grant and a zero-interest, ten-year loan as part of the Edison Innovation Clean Energy Manufacturing Fund to support manufacturing of energy efficient and renewable energy products. Michigan offers a PV manufacturing tax credit for 25% of the capital costs for building a qualifying PV manufacturing facility (up to US$25 million for one certificate). Montana offers a 50% property tax abatement for new renewable energy production facilities, new renewable energy manufacturing facilities, and renewable energy research and development equip-ment.11) Federal stimulus funds disbursed by the U.S. Department of Energy (DOE) as part of the American Recovery and Reinvestment Act (ARRA) have also been a driver of solar manufacturing. In addition to the CEC/ARRA Solaria project, the Payments-In-Lieu-Of-Tax-Credits program within the ARRA has helped fund projects including the 25 MW DeSoto Solar Park in Florida. In addition, the Advanced Energy Manufacturing Tax Credits are helping to fund the expansion of a large manufacturing plant in Ohio.12) In an important foreshadowing of the transformational role that energy storage and electric vehicles will play in expanding solar demand, the CSI recently awarded a grant to Tesla Motors, SolarCity, and the University of California at Berkeley for the development of distributed battery storage solutions for solar and mobile applications.

Federal Policy Drivers: Federal Investment Tax Credits, Cash Grants and DOE Loan Guarantees

Investment Tax Credits and Cash Grants

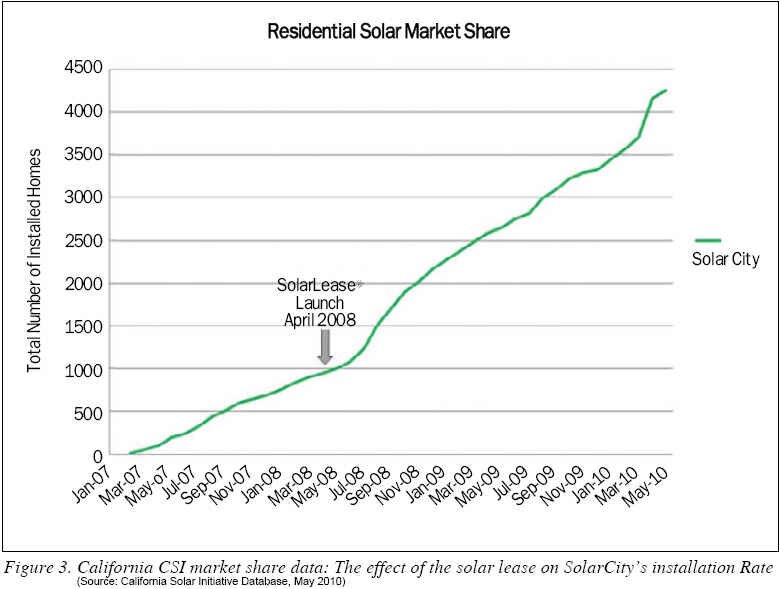

As mentioned above, the national Investment Tax Credit (ITC) for solar has been a critical ingredient in the growth of solar adoption in the U.S. Over the past three years, when economic conditions reduced the appetite for tax credits, the U.S. government instituted a 30% cash grant in lieu of a tax credit for commercial installations initiated by the end of 2010. (Legislative efforts are currently pending in Washington, D.C., to extend the cash grant program.) The ITC and cash grant have helped to create more cost effective financing products such as the solar lease (pioneered by SolarCity) and power purchase agreements (PPAs) that allow solar customers to avoid the large costs of installation by using tax equity funds to finance this upfront expense. Tax equity funds aggregate ITCs or cash grants, depreciation, rebates and the like into a package attractive to entities that use them to reduce their tax exposure and allow solar customers to pay much smaller monthly payments rather than most or all of their upfront costs. The solar lease has had a profound impact on residential solar adoption, so much so that over 20% of new California residential installations are financed through a lease, an option which only became available in the last three years. (Figure 3 demonstrates the impact of the solar lease on one company’s solar installation rate.) With the severe economic downturn over the past two years, the cash grant program has served as an important bridge while recession-weakened tax equity players did not participate. The grant program allowed solar integration companies to continue to create cost-competitive leasing and PPA options, in turn enabling customers to see immediate savings.

DOE Loan Guarantees

Another pivotal government initiative that signals transformational growth ahead for U.S. solar is the U.S. Department of Energy’s Loan Guarantee Program. In February 2010, BrightSource Energy of Oakland, California, received conditional approval for a US$1.37 billion loan guarantee for its future large-scale solar thermal plants in the environs of the Mojave Desert of California. Ground-breaking is expected to begin in the fourth quarter of 2010. When completed, the first plant, which will be built in three stages, will supply about 1 GW of power to California utility PG&E. This level of output doubles the total amount of solar installations in 2009 in the entire country. Other U.S. DOE loan guarantees include US$1.45 billion for Abengoa Solar for the construction and start up of a concentrating solar power generating facility that will add 250 MW of capacity to the electrical grid, US$535 million for Solyndra and US$400 million for Abound Solar, with several more applications in the approval process. It should be noted that for those projects that begin before the end of the year, the 30% cash grant described above will also kick in, enhancing the returns of those investments.

Commercial Impact of State and National Solar Programs on Solar Project and Tax Equity Finance

The extensive role played by state, regional and national programs to promote solar development has not been lost on private sector financing partners. After essentially freezing in late 2008 through most of 2009, project and tax equity financing partners are returning to the sector. Banks that are in the market or considering entry include US Bank, National Bank of Arizona, Wells Fargo, Rabobank, Citigroup, Goldman Sachs,13) and Union Bank of California,14) among others.

In an important development, U.S. utilities are also beginning to take the solar tax equity plunge, led by California utility PG&E in tax equity funds with SolarCity and SunRun. Project financing for large-scale solar installations is also showing signs of life--BrightSource is using its DOE loan guarantee to attract project finance for its PG&E plant, most likely by 2010. A combination of financial and strategic players is expected to lead this effort. In this way, government funding programs, whether national, state or regional, are playing a critical role in providing capital to solar companies and projects early in their lifecycles, supplementing the role that venture capital traditionally plays. The fact that the government has performed due diligence and has often helped to structure financing and performance milestones means these companies have gone a long way toward achieving the all-important ‘bankability’ which then allows major project and equity players to scale the development of the companies and their projects. As these early efforts gain in experience, the cost and availability of debt is expected to become more broadly accessible.

Acess to Capital Markets

Over the next one to two years, as a combination of government support and renewed commercial appetite for financing U.S. solar translates into continued growth in revenues and MW of U.S. installed or contracted solar, the opportunity to access public markets should become a distinct possibility for those companies in leadership positions. Solar companies possessing long-term PPAs with high grade utilities or annuity streams from solar lease or PPA products will represent attractive IPO candidates due to both their earnings visibility and the dynamic nature of their business models. If this happens successfully, more capital will become available to the sector, and the U.S. market will achieve a scale and breadth unrecognizable today. Thus, while a bolder national renewable energy policy would accelerate growth even further and would likely be more cost-effective, groundwork is laid today for the U.S. to be one of the fastest growing solar markets in the world. This potential for leadership is due in part to the fact that the U.S. has the rare combination of a large internal market, high quality sunlight in many of its most populated areas, and innovation leadership with a financial infrastructure capable of supporting new entrants and attracting international sources of capital. While the current hodgepodge of local and national programs, with its ups and downs and fits and starts, is far from ideal, it is sufficient to harness the first stage of the U.S. solar market’s growth and provide a basis for future, more unified policies. State and regional governments are not waiting for the federal government to act, but instead are incubating a variety of policy approaches that will contribute to eventual federal policy development while already working to get the U.S. solar industry to scale. With large internal markets, strong demand, and ample insolation, the United States solar market will inexorably go gigawatt in its own slightly chaotic way.

REFERENCES

1) GreenTech Media Research

2) “SolarBuzz- US Solar Market to Growth Tenfold by 2014” 26 July 2010 http://www.renewableenergyworld.com/rea/news/article/2010/07/solarbuzz-us-solar-market-to-grow-tenfold-by-2014 from the Solarbuzz United States PV Market 2010 Report

3) The California Energy Commission http://www.energy.ca.gov/renewables/ index.html [Accessed 30 August 2010]

4) www.dsireusa.org

5) The Database of State Incentives for Renewables & Efficiency (DSIRE) is a comprehensive source of information on state, local, utility, and federal incentives and policies that promote renewable energy and energy efficiency. Established in 1995 and funded by the U.S. Department of Energy, DSIRE is an ongoing project of the N.C. Solar Center and the Interstate Renewable Energy Council

6) Go Solar California “The History of Solar Rebates in California” http://www.gosolarcalifornia.ca.gov/solar_basics/rebate_history.php [Accessed 5 September 2010]

7) Go Solar California Webpage http://www.gosolarcalifornia.ca.gov/ Updated 9.01.10 [Accessed 5 September 2010]

8) DSIRE http://www.dsireusa.org/incentives/index.cfm?EE=1&RE=1&SPV=0&ST=0&searchtype=Rebate&technology=all_solar&sh=1

9) The National Association of Regulatory Utility Commisions “Feed in Tariff FAQ” June 2010 http://www.naruc.org/Publications/NARUC%20Feed%20in%20Tariff%20FAQ.pdf [Accessed 6 September 2010]

10) ibid

11) Database of State Incentives for Renewables & Efficiency- Financial Incentives by State http://www.dsireusa.org/incentives/index.cfm?EE=0&RE= 1&SPV=0&ST=0&implementingsector=S&technology=all_solar&sh=1 [Accessed 8 September 2010]

12) Office of the Vice President of the United States --The Recovery Act: Transforming the American Economy through Innovation--August 2010 p.4

13) Pulled from 29 June 2009 Issue of Institutional Investor newsletter p.1 http://www.iipower.com/pdf/PFR062909.pdf

14) SunEdison Press Release 3 March 2009 http://www.sunedison.com/ press_releases.php?id=60

Nancy E. Pfund is a Managing Partner at DBL Investors (www.dblinvestors.com) in San Francisco, California. DBL Investors is a venture capital firm that specializes in pursuing both strong financial and social returns and has a heavy emphasis on cleantech investments, including Powerlight, Tesla Motors, BrightSource Energy, SolarCity, Solaria and Solexant. Pfund is also a board member of CalCEF (the California Clean Energy Fund).

Sarah M. Ham is currently completing the second year of her MBA program at the Yale School of Management and was recently a Summer Associate at DBL Investors.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved.

|