PV module shipments increased for the fifth consecutive quarter in Q2?0 to 3.7 GW, generating US$7.1 billion in revenues according to IMS Research.

The first half of 2010 saw high demand from major PV markets, particularly Germany where proposed feed-in tariff cuts drove demand to new levels. Solar module shipments are forecast to increase once again in Q3’10 to reach 4.3 GW.

“In contrast to the first half of 2009, when declining module prices and poor economic conditions stalled the market, current market conditions have led to a huge surge with PV module shipments in Q3’10 increasing by over 60% compared to the same quarter of the previous year,“ commented IMS Research Analyst, Sam Wilkinson. ”PV module suppliers are undoubtedly enjoying this surge in demand and results have improved significantly. We predict that average gross margins will reach over 30% this quarter,“ continued Wilkinson.

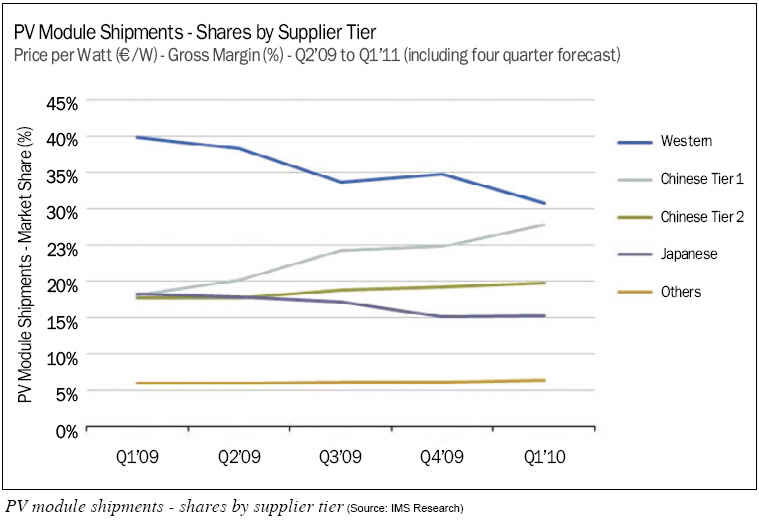

First Solar, which currently enjoys some of the highest gross margins of PV module manufacturers, remained the largest supplier in Q1‘10. However, its share of module shipments decreased for the fifth consecutive quarter and the gap between it and its crystalline competitors closed further, a trend that is likely to continue throughout this year. While IMS Research predicts that total PV module shipments will grow by 60% in 2010, shipments of Cadmium Telluride (CdTe) modules (dominated by First Solar) are forecast to increase by just 20% due to limited capacity increases for the technology until 2011; these results will mean that CdTe‘s share of shipments will decrease from nearly 11% in 2009 to just over 8% in 2010.

In contrast, the five largest Chinese module manufacturers (Suntech, Trina, Yingli, Canadian Solar and Solarfun), all suppliers of crystalline technology, continued to increase their command of the market and their combined share of global shipments reached 28% in the first quarter.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved.

|